Panoramic/Zuma

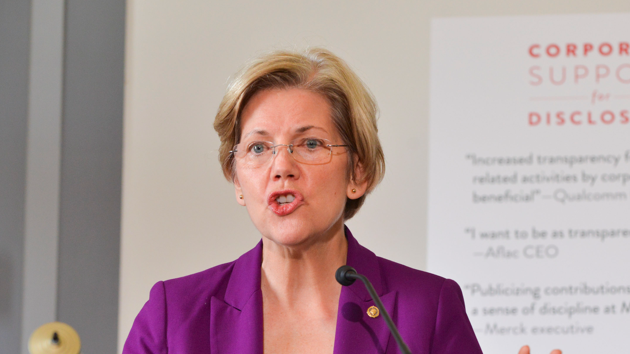

If you put out a complaint box for customers of US banks and financial firms, you will get hundreds of thousands of complaints. That’s what the Consumer Financial Protection Bureau—which was set up by Elizabeth Warren before she became a US senator—has discovered. And the bank that has drawn the most complaints is Bank of America. Wells Fargo, JPMorgan Chase, and Citibank were other top targets of consumer wrath.

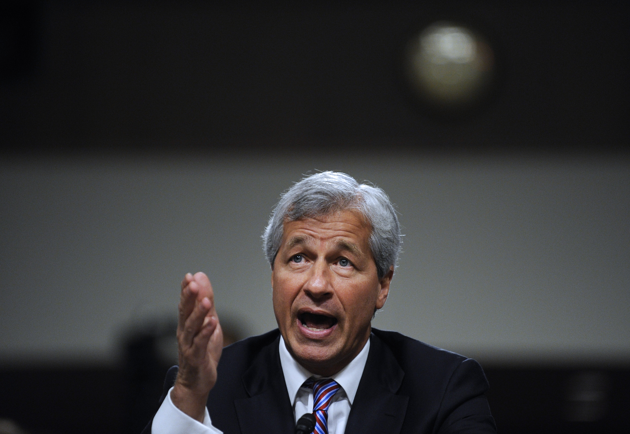

In June 2012, the CFPB launched a consumer help center where Americans can lodge complaints against banks and financial institutions they believe are ripping them off. The information in the center’s data base is public. So you can tell which Wall Street entities provoke the most gripes. Ranked by number of complaints, the top five most reviled institutions are Bank of America, Wells Fargo, Equifax, which is a credit-reporting agency, JPMorgan Chase, and Citibank. Debt collectors, mortgage servicers, and student loan servicing companies also fall within the top 20. As of this weekend, consumers had filed over 265,000 complaints. Bank of America earned 38,833 complaints, Wells Fargo drew 26,055, and JPMorgan Chase was the subject of 20,057. Check it out:

These numbers show that bigger is not necessarily better. The number of complaints largely corresponds with the size of the bank. JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo are the largest four US banks by assets. All other banks on the list above are among the 20 largest.

The majority of complaints targeting Bank of America—over 27,500 of them—concern mortgage practices, including foreclosure processing. In 2012, Bank of America, Citi, Chase, Wells Fargo, and Ally Bank—the nation’s five largest mortgage servicers—entered into a $25 billion settlement with 49 states and the federal government over the banks’ use of faulty foreclosure documents. (Bank of America recently agreed to pay a fine of $16.6 million to the Treasury Department to settle allegations that it processed nearly $100,000 in transactions for drug traffickers between 2005 and 2009.)

Out of the 26,055 complaints filed against Wells Fargo—which is accused of directing minority borrowers into subprime loans in the lead-up to the financial crisis—close to 6,000 concerned issues consumers had with their checking or savings accounts, including complaints over fees and charges. In 2010, Wells was ordered to pay hundreds of millions of dollars to customers for manipulating debit card transactions in order to rack up overdraft fees.

About 5,100 of the consumer complaints about Citibank concerned mortgages and foreclosures. Earlier this month, the Department of Justice slapped a record penalty on Citi for violations on the investor side of the bank’s mortgage business. The DOJ fined Citi $7 billion for telling investors that the toxic mortgage-backed securities it sold in the mid-2000s were high-quality.

Over 3,700 of the complaints against JPMorgan Chase concerned problems with consumer bank accounts, including disputed fees. Last September, the Consumer Financial Protection Bureau ordered Chase to fork over $309 million to 2.1 million customers for charging them for services such as identity theft protection and fraud monitoring without obtaining consent.

Americans filed over 5,000 complaints with the consumer agency regarding debt collection, more than 27,000 over mortgage servicing practices, and north of 5,500 concerning student loan servicing.