Mother Jones; Samuel Corum/Getty (3)

This story was originally published on Judd Legum’s Substack, Popular Information, to which you can subscribe here.

As president, Donald Trump’s tax policy heavily favored corporations and the wealthy. Trump’s signature tax legislation, the Tax Cuts and Jobs Act, overwhelmingly benefited those groups.

But as a presidential candidate, Trump campaigns as a populist. In his 2024 campaign, he’s touting a proposal to end federal taxation on tips. He made the announcement last month in Nevada, a key battleground state with a large service industry that relies on tips.

“For those hotel workers and people that get tips, you’re going to be very happy, because when I get to office, we are going to not charge taxes on tips,” Trump said. “We’re going to do that right away first thing in office because it’s been a point of contention for years and years and years, and you do a great job of service.”

This week, Trump’s proposal to end taxes on tips was one of 20 “promises” included in the official 2024 Republican Party platform: “LARGE TAX CUTS FOR WORKERS, AND NO TAX ON TIPS!”

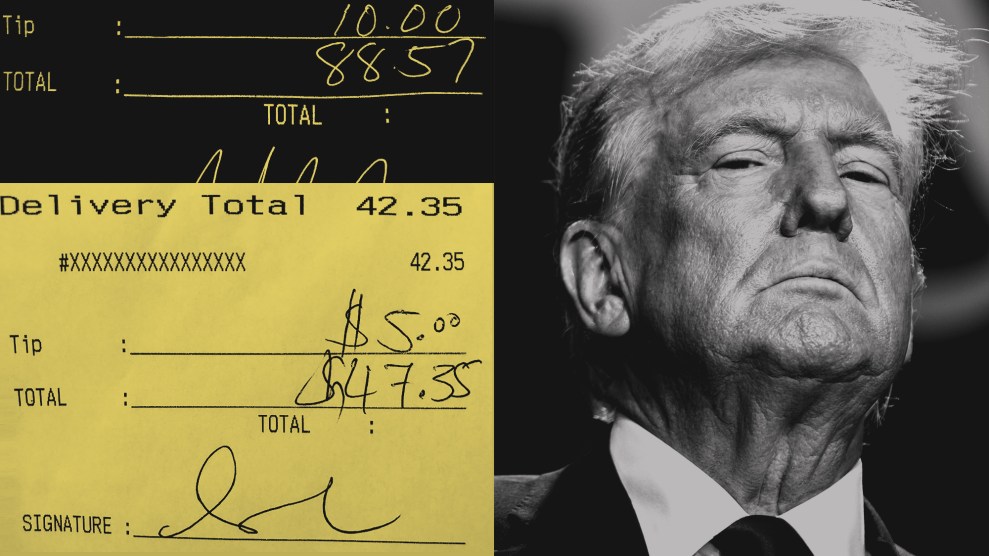

Trump’s plan to end taxes on tips may help him politically with service industry workers. His campaign is urging people to write “Vote for Trump for NO TAX ON TIPS!” on their restaurant receipts.

Republicans in Congress have already introduced legislation to implement Trump’s plan and end federal taxation of tips. Notably, the bill would only exempt tips from income taxes, and not payroll taxes, which represents the majority of federal taxes owed by low-income workers.

Only the best-paid workers would benefit, but why should a waiter who earns $60,000 a year pay less taxes than someone making the same amount in a grocery store?

But the proposal, if it were ever implemented, could have a detrimental effect on most tipped workers. The primary beneficiaries would be people who own and operate hotels, restaurants, and other businesses that employ tipped workers—in other words, people like Trump.

First, many people who rely on tips earn so little money that they already pay no federal income taxes. For example, half of all servers earn $32,000 or less. A server with a family who earns $32,000 does not owe any federal income tax and, therefore, would not benefit at all from Trump’s proposal.

The bigger issue is that the federal minimum wage for tipped workers is $2.13 an hour. The tipped minimum wage has not increased since 1991. Combined with tips, these workers are supposed to earn a minimum of $7.25 an hour. That is not close to a living wage in the United States in 2024.

As a result, seven states (Alaska, California, Minnesota, Montana, Nevada, Oregon, and Washington) have eliminated the tipped minimum wage and require all employers to pay their employees the same minimum wage regardless of whether they receive tips. The Biden Administration requires “federal contractors to pay tipped workers the same minimum wages as others.” Major cities like New York and Chicago have recently implemented similar policies. Numerous other cities and states are considering following suit.

The hotel and restaurant industry has been desperate to halt the momentum of state initiatives to raise the minimum wage. The National Restaurant Association, which represents restaurant owners, has endorsed Trump’s proposal.

Historically, “many restaurants and rail operators embraced tipping because it allowed them to ‘hire’ newly freed slaves without having to pay them.”

Eliminating taxation on tips could sap support from efforts both to eliminate the tipped minimum wage and raise the minimum wage overall. While most service industry workers would receive little or no benefit from eliminating income taxes on tips, many would benefit from increasing their minimum wage to $15 an hour or higher. The Tax Policy Center notes that this tradeoff would be particularly brutal for “‘back of the house’ staff such as dishwashers, who often receive only a small share of tips, enough to qualify as tipped workers but not enough to live on, or to pay taxes.”

That’s why the Restaurant Workers United, a labor union that represents many of the industry’s workers, opposes Trump’s plan. “The call to end taxes on tips is just a misguided way of trying to fix a problem of uplifting the lower class,” Elyanna Calle, a bartender and RWU organizer in Austin, said. Saru Jayaraman, president of the labor advocacy group One Fair Wage, calls Trump’s proposal “not just the wrong solution, but a fake solution.”

There are some tipped employees—including the 10 percent of servers that earn $60,000 or more—who would significantly benefit from ending income taxes on tips. But why should these higher-paid tipped workers get a special tax benefit while those making the same income in industries without tips are excluded? Why should a waiter who earns $60,000 a year pay less taxes than someone making the same amount in a warehouse or a grocery store?

There is no clear answer to these questions, other than the proposal to end taxes on tips may have political benefits for Trump.

Ending federal taxation of tips could prompt more industries to shift from paying wages to soliciting tips. In addition to potential tax benefits for employees, it would transfer some of the responsibility for paying workers from the business to its customers. For example, the Wall Street Journal notes that “[a]n auto-body shop could restrain its prices and wages and strongly encourage tipping as a way to get untaxed income to workers.”

If there is a significant shift to tipping over wages, it would also increase the cost of the proposal. The Committee for a Responsible Federal Budget estimates that incentivizing more tipping by ending federal taxation could cost the federal government up to $500 billion over 10 years.

According to the Leadership Conference on Civil and Human Rights, “tipping in the United States is rooted in a racist system which was designed to keep African Americans in an economically and socially subordinate position following the end of slavery.”

Prior to the Civil War, notes a conference fact sheet, “tipping was frowned upon: it was viewed by many as an aristocratic, European practice that was incompatible with American democracy.” But after the elimination of slavery, “many restaurants and rail operators embraced tipping because it allowed them to ‘hire’ newly freed slaves without having to pay them—they would be forced to work for tips alone.” The practice was designed “to keep African Americans in an economically and socially subordinate position.”

Even today, it continues, “40 percent of people who work for tips are people of color.” Further, studies show that “customers discriminate against African-American servers, consistently tipping them less than White servers regardless of the quality of service.”

The movement to end the tipped minimum wage to create a single fair wage for all workers is about recognizing the dignity and worth of all workers. Trump’s proposal would push the United States in the opposite direction, making millions of Americans even more dependent on wealthy patrons.