Mother Jones; Getty

Are you better off now than you were when Donald Trump was president? That’s a dumb question for Republicans to pose, because the answer by most measures would be, “Oh, heck yes!” But plenty of people feel otherwise, either because they are down a right-wing rabbit hole or because the poorer half of the population wasn’t doing great before the pandemic and they’re still really not doing so well.

You know who is? Billionaires.

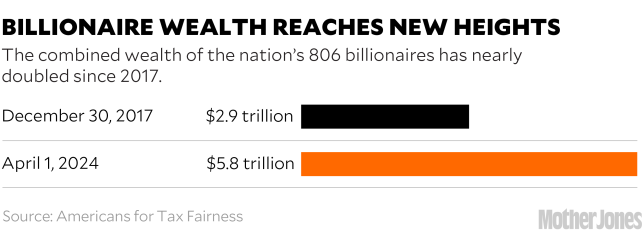

As of April 1, according to the latest analysis of Forbes data by the nonprofit Americans for Tax Fairness (ATF), the combined wealth of the nation’s 806 billionaires—their population rises and falls with the markets—had reached a record $5.8 trillion. That’s more than $7 billion a head and nearly double their total holdings in late 2017, when congressional Republicans unilaterally rammed through a package of widely unpopular tax “reforms” skewed in favor of America’s most affluent.

Even after adjusting for the high inflation that has plagued us these past few years, billionaires have seen a 57 percent gain in their collective wealth since the so-called Trump tax cuts took effect. That legislation was a feeding frenzy for corporate lobbyists. Here’s an updated passage from Jackpot, my 2021 book on the harms of excessive wealth in America:

According to an analysis by Public Citizen, as Republican lawmakers unilaterally hammered out cuts that would add an estimated $2 trillion to the national debt—a brigade of 7,088 lobbyists descended upon Capitol Hill, mainly to pursue the interests of corporations, industry groups, and wealthy business owners. That’s about 13 lobbyists per lawmaker. The securities and investment industry deployed 497. Insurance sent 648. Real estate, 301. Commercial banks, 227.

Virtually every industry was represented, along with a who’s who of blue-chip companies: Amazon, Anheuser-Busch InBev, Comcast, Verizon, General Electric, Microsoft, Novartis, etc. “My donors are basically saying, ‘Get it done or don’t ever call me again,’” New York representative Chris Collins told reporters that November.

Not only did Collins and his Republican colleagues deliver, trimming the top individual income tax rate to 37 percent and slashing the top corporate rate from 35 percent to 21 percent, and passing a generous new deduction for pass-through businesses, they retained other breaks and deductions whose removal might have helped pay for the cuts. The very next year, according to an analysis by the Institute on Taxation and Economic Policy, nearly 400 of America’s largest corporations paid an average income tax of 11 percent—the lowest effective rate the nonprofit had seen in four decades of number crunching. Ninety-one firms, including Amazon, Chevron, Halliburton, and IBM, paid zero or less.

If your household income, too, has increased since late 2017 owing to raises or better-paying jobs, I commend you. But you’ll be paying taxes on that increase. The thing about billionaires (and hundred-millionaires, for that matter) is that nearly all of their gains are unrealized—locked up in investments that have soared in value but remain unsold. Under current law, the IRS cannot tax unrealized profits.

That’s convenient for dynastic families, because when a super-wealthy parent dies and leaves unsold investments (stock, fine art, jewels, buildings, racehorses, whatever) to their children, the “cost basis” for those assets—the price the parents originally paid, and upon which taxes are calculated—resets to the assets’ current market value. Which means the heirs don’t owe a penny of capital gains tax. This is just one of many unfair perks for the affluent that the Biden administration and progressive lawmakers have tried to kill, but Congress won’t play ball.

It is precisely our failure to tax unrealized earnings that turbocharges the wealth gap and makes it easy for billionaires (and wannabes) to avoid income tax almost entirely. This isn’t rocket science. Instead of selling off high-value assets to fund a lavish lifestyle—triggering a tax of about 24 percent on the gains—the clever billionaire simply borrows. Even if they’re paying 10 percent interest (and they aren’t) they’ll save a bundle.

The upshot is that America’s billionaires have raked in $2.9 trillion since the Trump tax cuts took effect, almost all tax-free. Just 806 individuals now control more wealth—57 percent more, in fact—than the 65 million households comprising the poorer half of the population.

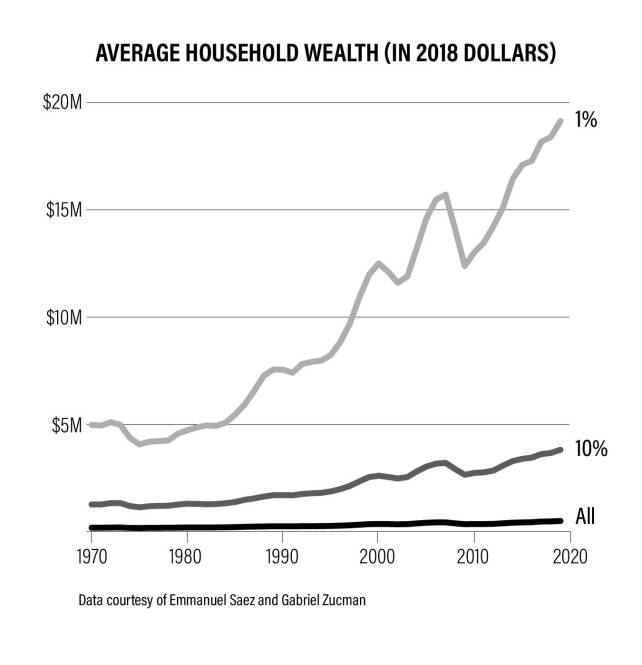

This chart from my book shows how a series of Republican tax cuts that began in the early 1980s under President Ronald Reagan have expanded the wealth gap. The top line shows the wealthiest 1 percent of US households, followed by the wealthiest 10 percent, and, lastly, all Americans.

Washington is now gearing up for a huge fight over provisions of the 2017 tax cuts set to expire at the end of 2025. Republican leaders used the expiration dates to reduce the bill’s official cost estimates so they could claim it would pay for itself—it hasn’t. Extending the sunsetting provisions for another 10 years will cost taxpayers $3.3 trillion, according to the nonpartisan Committee for a Responsible Federal Budget.

Many of the same Republicans who have cited our growing national debt as a rationale for cutting Social Security and Medicare will seek to make the Trump cuts permanent. We’re likely to hear a lot more about that from President Joe Biden, who teamed up with Sen. Bernie Sanders (D-VT) last week to attack Trump for telling rich donors he’ll cut their taxes.

We’re also certain to see another lobbying frenzy on Capitol Hill like the one in 2017. The outcome will depend on which party holds power after the election—although not entirely. Wealth is its own political affiliation, after all, and the billionaire class is resilient. Congress may commit to small steps, but if America’s oligarchs have a say in the matter (and they always do), the tax code will stay sufficiently generous to help them fulfill the ultimate billionaire dream: that one day they might blossom into trillionaires.