Mother Jones; Getty

Consider the billionaire. Yes, that is a David Foster Wallace reference. I spotted his book of essays, Consider the Lobster, yesterday morning in one of those little libraries people of a certain demographic put up in front of their houses. My morning walk takes me up into the Oakland-Berkeley Hills, and past the homes of two billionaires. That’s rare; most billionaires choose to live far from us mere mortals. My family lives a little further down toward the flats, in a neighborhood that was once middle-class, but where a well-maintained two-plus-bedroom, one-bath house now sells for north of $1 million. We bought in at the right time.

I remember when being a millionaire meant you were crazy rich. My brother and I used to watch reruns of Gilligan’s Island on a static-y little black-and-white TV set with a coat-hanger antenna. This 1960s sitcom follows a group of misfits shipwrecked on a desert island. The motley crew included Thurston Howell III and Eunice Wentworth “Lovey” Howell—sing it: “the millionaaaaaire…and his wife”—spoiled socialites who griped about minor inconveniences and said “dah-ling” instead of “darling.” The Howells were caricatures, lazy aristocrats who rarely lifted a finger to help the others.

These days, a million bucks won’t even get you into the wealthiest 10 percent of US households. Researchers from the Federal Reserve Bank of St. Louis calculated, based on data from 2010 through 2013, that if you were college educated, middle-aged, and white or Asian, your odds of being a millionaire were greater than 1 in 5—though only about 1 in 15 if you were Black or Latino.

To broach America’s wealthiest 10 percent, as of 2019, you needed $1.2 million in net assets—the total value of your home, investments, and savings (including college and retirement funds) minus your debts. This tier included 12.6 million families, most of whom, while better off than most, aren’t what we normally think of as “rich.” Most of their net worth is tied up in their house. A prolonged unemployment, a catastrophic accident, divorce, natural disaster, a parent or kid requiring expensive care—any one of those things could decimate a mere millionaire household. Yeah, I know, cry me a river.

Billionaires are a different breed. I know more about them than most, having recently written a book about excessive wealth in America—or rather, about what excessive wealth is doing to America. One billion is an arbitrary number—a psychological marker, like the way we treat birthdays and anniversaries ending in a 0 or 5 as something special. And we do treat our billionaires as special. They are, after all, a source of endless cultural intrigue. We envy them, revere them, and loathe them. We put them on lists and read (and write!) magazine profiles about them and binge reality shows and TV dramas based on them.

Forbes even has a “real time billionaires” list that lets you track “today’s winners and losers.” You’ll be happy to know that Elon Musk lost $6.3 billion the Monday before last and Jeff Bezos was down $2.5 billion, but Warren Buffett—one of the “good” billionaires—was $1 billion richer than he was on the previous Friday. Crazy, isn’t it, how these rarified humans—mostly white, mostly dudes—can gain or lose more money in one day than you and all your friends and family combined can ever hope to possess?

Take Musk, Twitter’s chief executive narcissist and, for now, still its CEO. Here is a boss who fires thousands of people by email, who offers severance pay to thousands more and then backpedals. A supposed free speech zealot who spews misinformation, cancels mainstream journalists, and fires off churlish tweets like, “My pronouns are Prosecute/Fauci.” Just how rich is this manchild? I recently calculated that if you converted Musk’s known assets into cash, you’d have enough $100 bills to cover 3,864 football fields—including the end zones. (His Tesla holdings have since taken a beating.)

According to Wealth-X, a firm that collects data on ultra-high-net-worth people and trends around the world, the United States now has 121,465 individuals with at least $30 million in assets and an average net worth of roughly $110 million. These are the stereotypically rich, people who hoard public and private and political resources so far beyond their needs that, should they will it, their kids and grandkids (and potentially their descendants in all perpetuity) could live—sponge—off the proceeds.

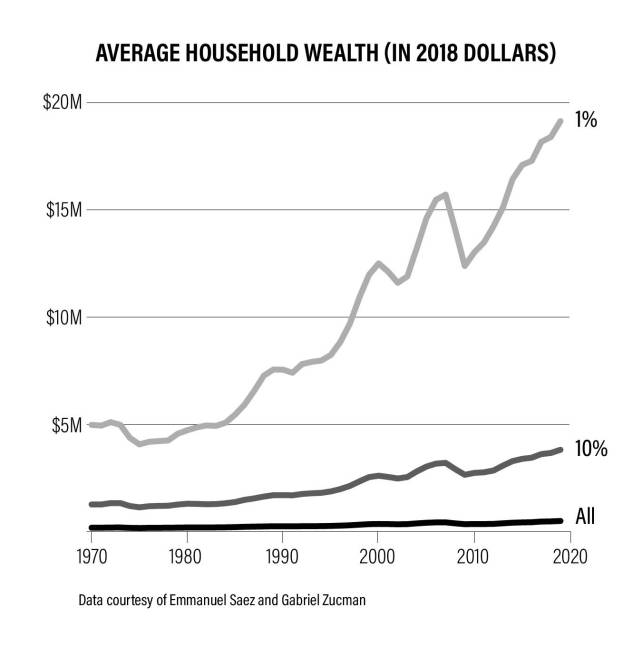

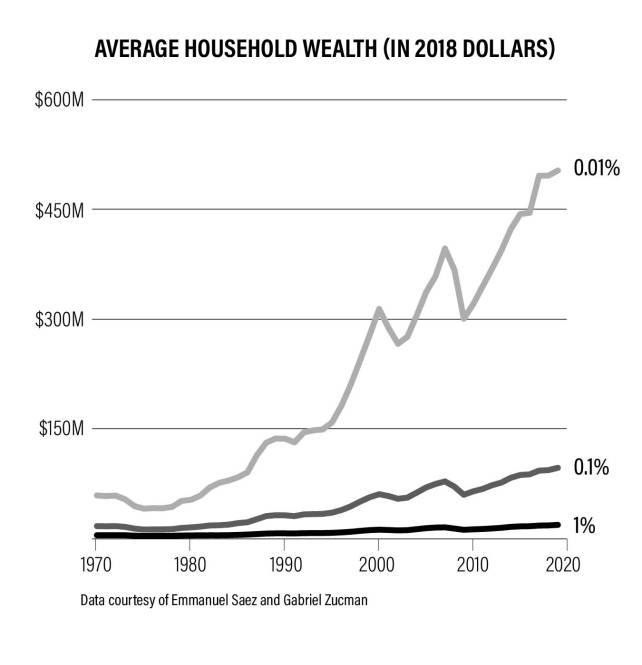

The biggest hoarders—spongers—of all are the billionaires. I find it perversely amusing that wealth inequality within the 1 percent (see charts below) closely resembles wealth inequality within the broader US population.

Pity the merely rich! According to Altrata’s Billionaire Census 2022, based on Wealth-X’s data, billionaires comprise less than 1 percent of the global ultra-high-net-worth population but own 27 percent of its cumulative wealth. “I think the public impression of the 1 percent is really the 0.001 percent,” one very successful former CEO told me. “I mean, they’re seeing Kochs and Buffetts and Gates. They’re seeing them as the 1 percent and they’re really not. The gap between me and them is probably larger in a lot of ways than between—I don’t know about you—but most people and me.”

And don’t they know it: “If you have only millions, you are not a B person. You don’t get invited to the billionaire parties,” attorney Richard Watts, a consigliere for some of America’s wealthiest families, told me when I interviewed him for my book. “There are events all around the world where the wealthiest of the wealthy connect, and if you don’t have a great big yacht, I mean a big yacht, you’re just not there. You’re kind of segregated from the group.”

To wit, one of Watts’ clients, now deceased, had planned just such an affair. “He was a capital B billionaire—multiple,” Watts recalled. “And he basically said, ‘We’re having this party. There are going to be 100 people there, US senators, all that stuff.’ And he says, ‘Everyone other than if you’re a political big guy has got to have a B.’”

They’re a pretty small social pool, the Bs, but the United States mints more of them than any other nation—way more. Wealth-X counts 975 American billionaires in 2021, almost two-and-a-half times as many as runner-up China, which has more than four times as many people. The US number represented a 5.2 percent increase over 2020 and a 20 percent gain in cumulative wealth, which brought them up to a total of $4.5 trillion—during a pandemic!

The United States, with just over 4 percent of the world’s population, has, according to Altrata, 29 percent of its billionaires—and those billionaires own 38 percent of the world’s total billionaire wealth. Which means our billionaires are richer than yours. According to the Billionaire Census, San Francisco has the second highest billionaire density on the planet next to Kuwait City. New York is sixth. Las Vegas 12th. Los Angeles 14th. And in 15th place—because grift and robber barons pair so nicely—is Washington, DC.

What else can we say of billionaires, apart from that they have way too much money. Well, their median age is 66, and only 10.5 percent are under 50. But there are more telling statistics. For instance, women make up more than half the US population, but account for only about 12 percent of our billionaires—not surprising, given that only 9 percent of American CEOs are women.

America’s Black population, likewise, is about 13.6 percent. Given equal opportunities for all, we should have 132 Black billionaires. Instead, we have six. Four—consistent with the limited paths to financial success for Black Americans—made their money in sports and entertainment: Michael Jordan, Tyler Perry, Jay-Z, and Oprah Winfrey. (Kanye West, a.k.a. Ye, was recently ejected from the three-comma club thanks to his irrepressible anti-semitism.) The others two are David Steward, founder of a St. Louis firm called World Wide Technology, and investor Robert Smith, the richest Black person in America, who confessed to participating in an epic tax-evasion scheme but stayed out of prison by informing on an even bigger tax cheat.

Should billionaires exist? I got asked that question a lot during publicity interviews for my book. I usually said something like, “Well, if the United States actually guaranteed its citizens equal rights, protections, and opportunities—and if our tax code wasn’t more or less a system of subsidies for the affluent—then I guess billionaires would be okay.”

But lately I’m thinking that was too charitable. Billionaires are typically billionaires because they built or staked a successful company, or invented something remarkable, speculated in real estate, or figured out how to game the markets. But their journeys almost always entail, directly or indirectly, some combination of lowballing workers (foreign and domestic), screwing over tenants, despoiling the environment, busting unions, avoiding taxes, siphoning off public money, and fighting proposals that guarantee people a living wage and safe and dignified working conditions. When you have that much, some portion of it is invariably blood money. And even if it weren’t, possessing so much wealth while half the nation lives paycheck to paycheck is enough to buy you a luxury penthouse in Hell.

What about Warren Buffett? He’s a good guy! I hear that refrain a lot, too: There are good and bad billionaires. Generous and stingy ones. Some, like Buffett, even acknowledge the system is rigged in their favor and say we should kill handouts like carried interest and tax the super-rich more. Buffet has famously pointed out that he pays a lower tax rate than anyone at Berkshire Hathaway, including his secretary. But that’s actually an understatement.

From 2014 to 2018, Buffet’s investments grew in value by more than $24 billion and he had $125 million in actual income, ProPublica reported, but he paid less than $24 million in taxes. Even if you ignore his epic asset gains, that’s an average income tax rate of 19 percent. If you include them, it’s a true tax rate of about 0.1 percent. By the same calculation, Jeff Bezos paid less than 1 percent. Michael Bloomberg paid 1.3 percent. And Elon Musk paid 3.3 percent.

Lobbyists for the investor class have convinced Congress—nonsensically—that it’s okay to favor the gains of wealthy investors over the paychecks of people who work for a living. And that the IRS should only tax investors’ profits when they sell the asset in question—and that, when they do, any profit should be taxed at a far lower rate (20 percent) than the maximum rate on wages (37 percent).

Despite his supposed misgivings, Buffett benefits immensely from this setup. He also holds stakes in countless companies that aren’t as humble and folksy and pro-taxation as he purportedly is. Take Clayton Homes, a mobile home conglomerate owed by Berkshire Hathaway, which has come under scrutiny for allegedly “preying” on the poor. And Berkshire has so much money invested in polluting industries that, in 2020, Bloomberg labeled Buffett “one of the richest fossil-fuel billionaires.”

As an investor, Buffett also gained untold riches when Congress, in 2017, slashed corporate income tax rates from 35 percent to 21 percent. And don’t think Berkshire and the companies it holds didn’t help make that happen. As I wrote in the book, the Trump tax cuts were “emblematic of the power America’s jackpot winners wield in the nation’s capital…

According to an analysis by Public Citizen, during the first three-quarters of 2017— as Republican lawmakers unilaterally hammered out cuts that would add an estimated $2.3 trillion to the national debt—a brigade of 6,243 lobbyists descended upon Capitol Hill, mainly to pursue the interests of corporations, industry groups, and wealthy business owners. That’s more than eleven lobbyists per lawmaker. The securities and investment industry deployed 435. Insurance sent 600. Real estate, 251. Commercial banks, 182. Virtually every industry was represented, along with a who’s who of blue-chip companies: Amazon, Anheuser-Busch InBev, Comcast, Verizon, General Electric, Microsoft, Novartis, etc. “My donors are basically saying, ‘Get it done or don’t ever call me again,’” New York representative Chris Collins told reporters that November.

The individual federal income tax is progressive, which is why rich folks often cite it when arguing that they pay their fair share. But other taxes, like sales and property taxes, are regressive. That means the poor expend a larger share of their income on those taxes than higher earners do. For instance, households in the lowest-earning 10 percent pay a dime per dollar earned in sales tax, but the highest-earning 1 percenters pay only a penny or two. Throw in the favorable tax treatment of investment profits and the alphabet soup of corporate tax breaks Congress offers, and the result is exceedingly billionaire-friendly.

The economists Emmanuel Saez and Gabriel Zucman have calculated that, when you tally up everyone’s federal, state, and local taxes, you basically end up with a flat tax across income brackets, averaging 28 percent. People at the bottom pay about 25 percent, and those in the top 0.1 and top 0.01 percent pay a somewhat higher overall rate. But billionaires, as represented by the nation’s 400 highest earners, pay only 23 percent—less than everyone else, even America’s poorest households.

Don’t hate the player, hate the game, the billionaires say. And if you hate the game, then change the game. But good luck with that. Studies I cite in my book show that the very wealthy are not only far more likely than the average citizen to reach out to their elected officials (because it works for them), they are also far more likely to see their own interests reflected in actual policy. When a billionaire calls their senator, rest assured they’ll get a callback. Billionaires have also been known to flex their power against the little guy, deploying lawyers and lawsuits in an attempt to, delay, intimidate, and silence their critics.

Some billionaires, of course, got to be billionaires by contributing nothing to the world—like the Walton offspring. They simply inherited their parents’ fortune via complex trusts that circumvent inheritance taxes. Of those 121,465 ultrawealthy Americans cited above, almost half of the women and 17.5 percent of the men inherited all or part of their fortunes. (Hello, Javanka.)

How is this possible in a nation founded in opposition to hereditary aristocracy? As I noted in an earlier story, our economic aristocracy has made it so.

In 2015, Public Citizen identified nine billionaire families lobbying actively for estate tax repeal. From 2012 through early 2015, the nonprofit reported, the Mars (candy) and Wegman (grocery) dynasties, together worth more than $137 billion combined, had spent more than $3.5 million on repeal. Other dynasties (Bass, Cox, DeVos and Van Andel, Hall, Schwab, and Taylor) spent a total of $7 million lobbying on this and other issues. The US Chamber of Commerce, according to public disclosures, also lobbies regularly for repeal of the “death tax.”

The chamber is the nation’s largest business organization and its highest-spending lobbyist. It fights, according to its website, “for business growth and America’s success,” adding that, “for all of the people across the businesses we represent, the US Chamber of Commerce is a trusted advocate, partner, and network, helping them improve society and people’s lives.”

They should consider changing that to “some” people’s lives. Indeed, the group mostly seems concerned with the lives and success of wealthy business owners and investors. Why else would a business organization lobby to repeal inheritance taxes? As of 2022, a wealthy couple can legally gift their children up to $24,120,000 without paying a dime in tax. If that’s not enough, they can use a type of trust known as a Walton GRAT that Congress enabled by accident in 1990 and was never able to repeal—because rich beneficiaries and the wealth industry lobbied to keep it.

These trusts allow would-be dynasties to avoid estate taxes almost entirely. The late GOP megadonor Sheldon Adelson used GRATs to pass along nearly $8 billion to his heirs, saving billions in taxes. Mark Zuckerberg and Sheryl Sandberg use them too—as do more than half of the 100 richest families in America, per ProPublica.

At the bottom end of the wealth and income ladder, the chamber actively opposes raising the federal minimum wage, which has been stalled since 2009 at $7.25 an hour. This is a wage so paltry that it forces full-time workers to go on the dole to cover their rent—a public subsidy for predatory landlords and stingy employers, many of whom are billionaires and/or ultrawealthy private equity partners. Legislators in seven states—Alabama, Georgia, Louisiana, Mississippi, South Carolina, Tennessee, and Wyoming—have yet to enact a higher state minimum wage.

Also among the nation’s top-spending lobbyists is the Business Roundtable, which represents the CEOs of America’s largest corporations. In August 2019, the group released a statement signed by 181 public company CEOs declaring that there’s more to capitalism than shareholder value—that companies should be committed to “all stakeholders,” treat workers with respect, contribute to their communities, and take care of the environment.

That seemed nice, but when the Biden administration sought to pay for some of those things by raising the corporate income tax rate to 28 percent—still seven points less than it was when Trump took office—the Business Roundtable went on the offensive and decried “the harmful corporate tax increases on America’s job creators proposed in the Build Back Better Framework.” (The bill died.)

The Roundtable also released a statement in support of a higher federal minimum wage, but the statement says Congress should consider “regional differences in average wages, as well as the impacts on small and medium-sized businesses.” That caveat could be a killer. The government defines a “small” business as one with up to 1,500 employees, and franchises qualify even if the corporate parent is, say, McDonalds. Regional considerations are already in effect: At the time of Joe Biden’s inauguration, workers in at least 30 states were guaranteed less than $10 an hour pretax. Raising the federal minimum by a few bucks won’t help those workers very much—but it would offer their billionaire exploiters more breathing room.

But billionaires give back! Whoa there. Don’t get me started on philanthropy. High-dollar giving is often something more like misanthropy—not a good deed, but rather a business or personal or political strategy. Jeffrey Epstein used his philanthropy as a cover for grooming and raping underage women. The Sacklers’ opioid empire used it to gain acceptance into high society and curry political favor. In her book Dark Money, investigative reporter Jane Mayer writes about how dynasties including the Kochs, the Scaifes, the Coorses, the Olins, and the DeVoses “weaponized” philanthropy to serve their ideological and business interests. For many megawealthy families, philanthropy serves as a “legitimation project,” says Rob Reich, a Stanford political science professor and author of the 2018 book Just Giving: Why Philanthropy is Failing Democracy and How We Can Do Better. “It’s a reputation-laundering exercise to construct an aura of altruistic do-gooding and distracting people from attending to the source of the moneymaking.”

In the days of Standard Oil’s John D. Rockefeller, the notion of some tycoon expending vast sums, purportedly for the public’s benefit but based entirely on one man’s interests and priorities, was viewed as profoundly undemocratic. When Rockefeller approached Congress seeking a federal charter for his foundation, Reich recalls in his book, he was roundly ridiculed and rebuffed. Attitudes have changed since then, but philanthropy is still profoundly undemocratic—even antidemocratic, funding groups that spread Donald Trump’s Big Lie and fought his electoral defeat, as Mayer wrote in the New Yorker.

Worse, billionaire giving is subsidized by ordinary taxpayers. Under current policy, only the roughly 10 percent of Americans who itemize deductions on their state and federal tax returns—as almost every wealthy family does—get to deduct charitable donations from their taxable income. So when a billionaire with a 20 percent effective tax rate gives $100 million to his own foundation, or makes a huge donation to Harvard—as Jared Kushner’s daddy did to help him get in—or bankrolls “charities” that spread hate and misinformation (because eligibility rules for tax-exempt nonprofits are shamefully lax), that donation costs the US Treasury $20 million.

Without all the perks and subsidies afforded to super-rich Americans, billionaires might never have emerged in the first place, or at least we’d have a great deal fewer of them. Kill those perks—the tax favoritism, the pay-to-play, the cheating, legacy admissions, self-interested philanthropy, retirement subsidies, the Walton GRATs and all the rest, and maybe those undeserving billionaires will one day fade away.

As usual, the staff of Mother Jones is rounding up the heroes and monsters of the past year. Find all of 2o22’s here.