From left: Sen. Bob Corker (net worth: $69.5 million), Jared Kushner and Ivanka Trump (at least $207 million), Donald Trump ($3.1 billion), Donald Trump Jr. ($150 million), Rep. Paul Ryan ($6.5 million), Betsy DeVos ($1 billion), Ben Carson ($22 million), Steven Mnuchin ($385 million)

André Carrilho

When he was selling the new tax law last fall, President Donald Trump insisted it “is going to cost me a fortune.” In fact, any way you count it, he and his cronies will undoubtedly save a bundle. The plan reduces income taxes for top earners, slashes the rate for corporations like his, and includes a generous cut for owners of pass-through companies—of which he has about 500.

Treasury Secretary Steven Mnuchin claimed “there will be no absolute tax cut for the upper class.” In fact, the top 5 percent of taxpayers get more than 40 percent of the benefits of this year’s income tax cuts. And the law slashes the corporate tax rate by 40 percent—a gift to the top 1 percent, who pay around a third of all corporate taxes.

Like his father-in-law, Jared Kushner is tied up in dozens of real estate pass-throughs. He stands to save at least $4 million annually. About 70 percent of pass-through income goes to the top 1 percent.

The pass-through cut also helps Ivanka Trump and Donald Trump Jr., Education Secretary Betsy DeVos (who could save at least $2 million), and wealthy members of Congress such as tax-bill waffler Sen. Bob Corker (R-Tenn.).

Housing Secretary Ben Carson offered a prayer at a Cabinet meeting thanking God for the tax bill’s passage. The plan undercuts tax credits for building affordable housing—which could mean more than 200,000 fewer units over the next decade.

The tax cuts will add at least $1 trillion to the federal deficit by 2027. Just before Trump signed them into law, House Speaker Paul Ryan (R-Wis.) started talking up the urgent need for “entitlement reform, which is how you tackle the debt and the deficit.”

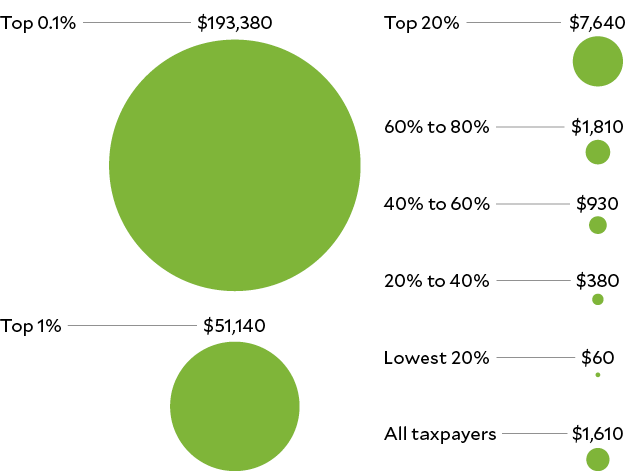

WHAT A BRACKET

“Tax reform will protect low-income and middle-income households, not the wealthy and well-connected,” Trump said. Yet his tax plan’s $1.2 trillion in income tax cuts are heavily weighted toward the wealthy. And only the corporate tax cuts are permanent. In 2027, 70 percent of middle-income taxpayers will get a tax hike—but just 8 percent of those making more than $5 million will.

Average tax cuts in 2018 by income percentile

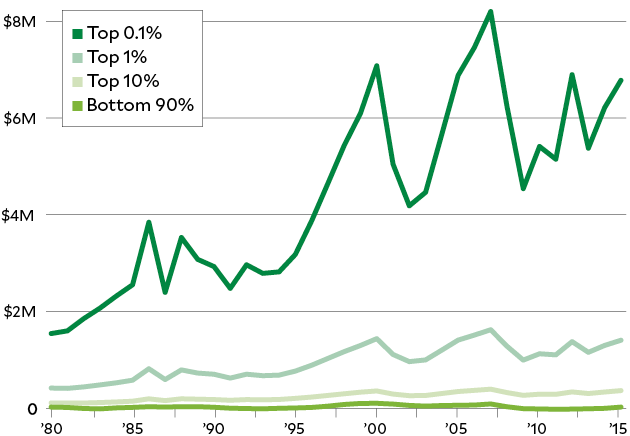

WHO’S ON TOP

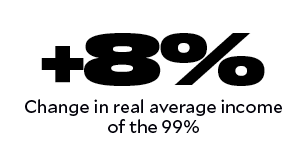

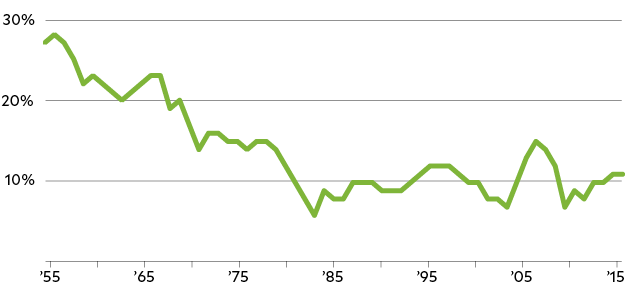

Since the 1980s, the richest 1 percent of taxpayers has taken an increasingly outsize share of all income, while many Americans’ incomes have stagnated. Yet the lion’s share of the new tax plan’s benefits go to top earners.

Average real income 1980–2015

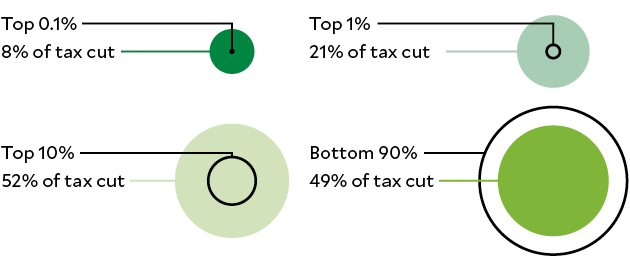

Share of benefits from income tax cut in 2018

UNHAPPY RETURNS

BONUS ROUND

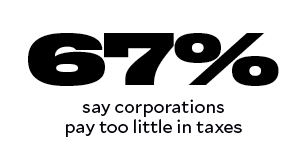

The tax plan gives more than $1.3 trillion in cuts to corporations, whose tax rate will drop from 35 to 21 percent. “The most excited group out there are big CEOs about our tax plan,” former White House economic adviser Gary Cohn said in November. Yet a recent survey of 150 CEOs found that most didn’t plan on hiring more people in the first half of 2018. While dozens of companies have announced one-time $1,000 bonuses for employees, Walmart, Comcast, and AT&T laid off hundreds even as they publicized their trickle-down generosity.

In total, S&P 500 companies gave out $3.7 billion in one-time bonuses. (In comparison, Wall Street handed out more than $31 billion in bonuses last year.) The bonuses are eclipsed by more than $200 billion in tax-cut-driven corporate share buybacks, which hit their highest level ever in the first quarter of 2018. Buybacks don’t create jobs or boost wages, but they do benefit shareholders—mostly the richest 10 percent of Americans who own more than 80 percent of all stocks.

How much is $1.3 trillion?

GROSSED OUT

Treasury Secretary Mnuchin declared that the tax cuts would pay for themselves by spurring the economy. (His source? A one-page handout.) Trump has predicted that he will supercharge the GDP growth rate—by as much as “even 6 percent.” Among 38 major economists surveyed, only one thought the tax cuts would substantially boost GDP. (“Aside from the redistribution of wealth, hard to see this changing much,” wrote Nobel Prize winner Richard Thaler.) Even Goldman Sachs, Mnuchin’s former employer, predicts GDP growth will increase by 0.3 points as a result.

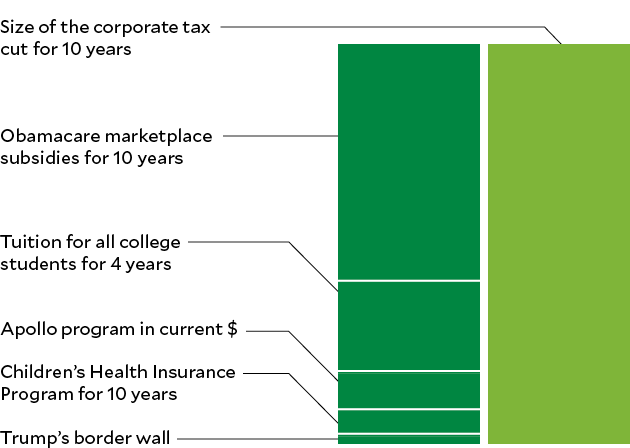

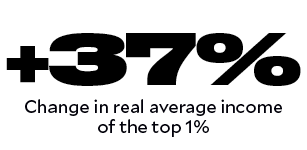

THE GREAT TRICKLE-UP

Since the recession officially ended in 2009:

SLASH FICTION

The tax law cuts the corporate rate of 35 percent to 21 percent—the lowest top rate since 1939. Yet even before the latest cut, corporations have footed a smaller share of the total tax bill—while their profits have surged.

Corporate taxes as a share of federal revenue

Corporate profits after tax (in billions of 2016 dollars)

TAX CUT WINNERS

Rich (but not too rich) heirs: Don’t have to pay estate taxes on inheritances under $11.2 million.

Alcohol-makers: Get a two-year reduction in excise taxes. (One expert estimates cheaper booze will cause up to 1,550 additional deaths annually.)

Wall streeters: Trump railed against loopholes that help hedge fund managers and high-finance types, but they’re mostly intact.

Private jet owners: Now officially exempt from an excise tax they long flew under. (Mnuchin, DeVos, and two other Cabinet members have private jets.)

TAX CUT LOSERS

Blue states: To fund the tax cuts, the plan caps deductions of state and local taxes, disproportionately affecting taxpayers in high-tax, heavily Democratic states.

People without private insurance: The Congressional Budget Office predicts that killing the Obamacare mandate will cause up to 13 million people to lose health insurance and that marketplace premiums will jump 10 percent.

Puerto Rico: A new tax on manufacturing will hit the island as it’s trying to rebuild.

Polar bears: To win over Sen. Lisa Murkowski (R-Alaska), a last-minute provision opened part of the Arctic National Wildlife Refuge to oil drilling.

Chart sources

Average tax cuts… (chart): Tax Policy Center (PDF)

Average real income… (chart): Emmanuel Saez (Excel)

Share of benefits… (chart): Tax Policy Center

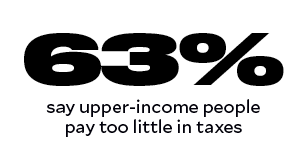

Unhappy returns (stats): Pew Research Center, CNN, Gallup

How much is $1.3 trillion? (chart): Joint Committee on Taxation (size of tax cut), Congressional Budget Office (Obamacare subsidies), National Center for Education Statistics (college tuition), NASA (Apollo program), Congressional Budget Office (CHIP), Reuters (border wall)

Corporate taxes… (chart): Chairman of the Council of Economic Advisers (PDF)

Corporate profits after tax (chart): Federal Reserve Bank of St. Louis

Since the recession officially ended… (stats): Emmanuel Saez (Excel), Economic Policy Institute

Art sources

Sad Obama face:

Credit: Jacquelyn Martin/AP

Mnuchin Currency:

Credit: Jacquelyn Martin/AP

Trump- looking-left-3:

Credit: Cheriss May/NurPhoto/ZUMA

Trump-looking-left-4

Credit: Cheriss May/NurPhoto/ZUMA

Trump- looking-right-2

Credit: Cheriss May/NurPhoto/ZUMA

Trump- looking-right-3

Credit: Cheriss May/NurPhoto/ZUMA

Trump- looking-right-4

Credit: Cheriss May/NurPhoto/ZUMA

(The other three Trump faces):

Credit: Shutterstock

Winners-Girl on horse:

Credit: alacatr/Getty

Winners-Liquor bottles:

Credit: traveler1116/Getty

Winners-Jet:

Credit: yoh4nn/Getty

Losers-Polar Bear:

Credit: UrmasPhotoCom/Getty

Losers-Puerto Rico Flag:

Credit: NatanaelGinting/Getty