House: Simple Icons/Noun Project.

The economic collapse of the late 2000s hurt most Americans—but not equally. In fact, according to a 2011 Pew study (visualized above), while median household wealth dropped by 16 percent for white Americans, it dropped a stunning 53 percent for African-Americans.

What accounts for this dramatic disparity? Traditional explanations tend to focus on structural economic factors, such as the fact that African American families had a higher proportion of their total wealth tied up in the vulnerable housing market, and that they were targeted by predatory lenders. But according to a new paper just out in Proceedings of the National Academy of Sciences, that may not be the full explanation. It looks as though a more subtle form of racial bias may have played a role as well—thanks to psychological factors that, in a recession, tend to make those biases worse.

The new study is by Amy Krosch and David Amodio of New York University. Amodio in particular has extensively studied what are called “implicit” racial biases: Uncontrolled prejudices that manifest themselves in our split-second reactions to images or in other cognitive tests. According to one estimate, for instance, 75 percent of whites harbor these subtle, subconscious biases in favor of other whites, and against blacks.

The study adds a new twist to this large and well established literature on unconscious biases. It finds that when people are made to think about economic scarcity—as they inevitably are during a stressful recession—their subconscious perceptions of race change as well. In particular, they are more likely to internally visualize African American faces as being darker in color and more “stereotypically black”—perceptions related, in prior research, to the expression of higher levels of discrimination. The study even found that when asked to divvy up money between two people, white study participants allocated less money to an individual who was perceived as being more stereotypically black.

What might that mean in the real world? Racial biases, heightened by the downturn, might have filtered into “hiring or firing decisions, or decisions about home ownership loans, dealing with foreclosure, or other things that came out of the recession,” Amodio speculates.

The new study consists of four separate experiments, which bulwark this central conclusion using a variety of methodologies. In one of them, white study participants were asked to play a money allocation game. In some cases, they were told that it was possible to distribute up to $100 to a partner; in others, they were told that it was only possible to distribute up to $10. Either way, the participants were ultimately given the same amount of money—$10—to distribute. Thus, the scenario in which that $10 looked like only a small slice of the available pie (just 1/10 of the possible total) created perceptions of scarce resources. (The two scenarios were pretested on a different group of subjects to confirm that having only $10 out of a possible $100 to distribute made individuals feel that resources were scarce. It did.)

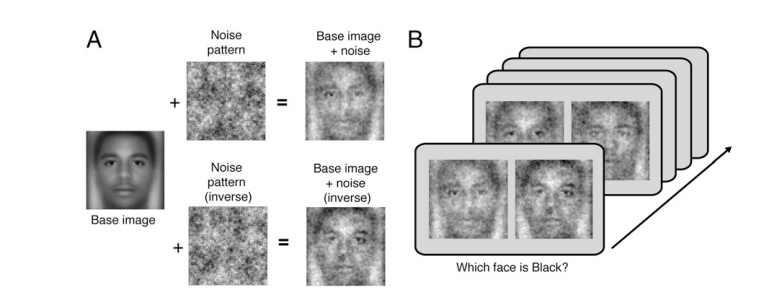

Afterwards, the research subjects were asked to looked at a series of images of paired faces. All of the images were actually based on the same original composite image, a mixed-race “morph” created from 100 black and 100 white faces, and then randomly degraded in quality by different patterns of visual noise. Here’s a helpful visualization, from the study, of how the process of creating the images worked:

Individuals were then asked to pick which version of the face was “black.”

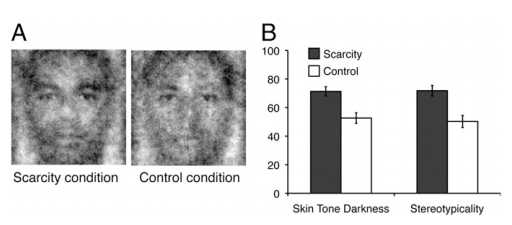

“We let them choose which faces most accurately matched the image of a black person in their minds, from a range of subtly different face images across hundreds of trials,” says Amodio. The subjects’ choices were then all combined together to make two new composite images: One of the research participants’ perceptions of a black person under conditions of scarcity, and one of their perceptions under control conditions. This was the result:

Sure enough, in the “scarcity” experimental scenario, research subjects collectively produced a very different picture of what they thought a black person looks like. Their version was judged, by independent observers, to be both darker in skin color, and also more “stereotypically black.”

“Together, our results provide strong converging evidence for the role of perceptual bias as a mechanism through which economic scarcity enhances discrimination and contributes to racial disparities,” the authors wrote.

That conclusion is underscored by the final experiment of the paper. In it, a new group of white research subjects were shown the two images above, and asked to divide $15 dollars between the fictional people pictured in them (in whole dollars; thus, giving each $7.50 was not a possible option). In this scenario, people generally tried to be relatively egalitarian, but they could not divide the money 100 percent evenly. At best, somebody had to get $8, and somebody had to get $7. Sure enough, the research subjects ultimately gave the person with the lighter colored, less “stereotypical” face more money.

We already knew, based on a large body of science, that subconscious racial biases filter into our behavior in innumerable ways. The new research presents striking evidence that in times when we’re all facing hardship, it can be even worse.

We recently interviewed David Amodio about the emerging science of prejudice on the Inquiring Minds podcast; you can stream below: