Center for Law and Social Policy

The federal government helps to make college affordable in a number of ways, from low-interest student loans to grants for low-income students. It also offers a host of lesser known subsidies for higher education through the tax code, by way of such things as 529 tax-free college savings plans and exemptions for loan interest and college expenses—expenditures that don’t show up as a budget line item the same way Pell Grants do. A new report from the Consortium of Higher Education Tax Reform suggests these tax credits aren’t doing much to increase the number of low-income families who send kids to college. Instead, they’re subsidies to the 20 percent of American households making more than $100,000 a year—people who would send their kids to college even without a 529 plan.

The nation spends $34 billion annually on Pell Grants, which allow lower-income kids to go to college and leave without owing major debt. Meanwhile, the US spends $35 billion on higher education tax breaks, most of which go to people who need them the least. Tax credits in general are poorly targeted at those most in need, but some are worse than others. Take the Exemption for Dependent Students, which allows families to reduce their taxable income by up to $3,900 if they have a dependent student between the ages of 19 and 23. More than half of all these exemptions go to people making over $100,000 a year. Also regressive: the deduction for tuition and fees, half of which goes every year to families making over $100,000. The median income of a family with a 529 college savings plan is $120,000.

One reason tax credits don’t benefit lower-income families as much as they should is the fact that they aren’t refundable, so the money generally isn’t available to families when the college bills are due, only when they file their taxes. The consortium also points out that federal tax breaks are still available to colleges and universities that are doing a poor job of enrolling and graduating low-income students, noting that more than 100 institutions getting federal tax breaks have graduation rates under 20 percent—a serious problem that can leave low-income kids both saddled with college debt and without a degree that might help them earn enough to repay it.

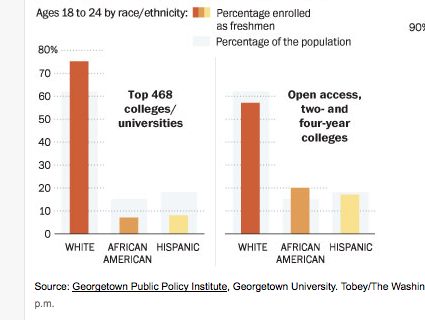

Research shows that financial aid can make a huge difference in whether a low-income kid decides to go to college. It has a miniscule impact on the college attendance rate of upper class kids, who are seven times more likely than low-income students to complete a bachelor’s degree by the age of 24. The consortium recommends some big cuts in higher ed tax breaks for the affluent and a shift in focus to directing aid to where it can do the most good. Among its proposals: ending taxation of Pell Grants; allowing people with drug convictions to access the American Opportunity Tax Credit, one of the few refundable higher ed tax credits; and imposing income limits on college savings plans. All of these things seem reasonable and something both parties ought to be able to get behind, but it’s hard to see middle-class families giving up all this aid without a huge fight.