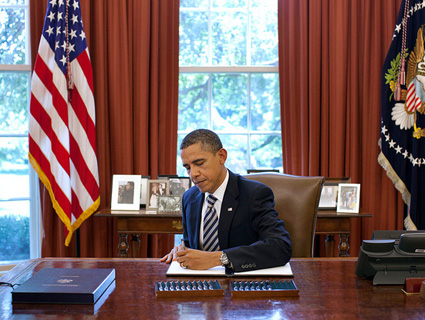

President Barack Obama signs the Budget Control Act of 2011.<a href="http://www.flickr.com/photos/whitehouse/6002624447/sizes/z/in/set-72157627217860727/">White House</a>/Flickr

Welcome to our debt ceiling explainer. As of August 3, this explainer is no longer being updated on a daily basis. You can read on for the basics of Congress’ debt ceiling fight and a blow-by-blow account of the action from late June to the day President Obama signed the Budget Control Act of 2011 into law, on August 2. In addition, you can read about the deep, painful cuts to public investment and safety exacted by the bill, Kevin Drum on why the bill sucks, David Corn on the White House’s strategy and Nancy Pelosi’s crucial role in sealing the deal, and why this fight was just one of many to come. Going forward, major developments will be noted on our main Political Mojo blog.

The Basics: On August 2 (or maybe a few weeks later), the US government will reach the point where it can no longer pay its bills. That’s because, earlier this spring, the federal government reached the legal limit on how much money it can borrow—a.k.a., the “debt ceiling.” It’s currently set at $14.3 trillion. The government borrows money to pay for everything from tax refunds to wars and veterans’ benefits, not to mention repaying our creditors, which include China, Japan, the United Kingdom, state and local governments, pension funds, and investors in America and around the world.

A debt ceiling has existed since 1917. Before that, Congress had to provide its stamp of approval each time the Treasury Department wanted to sell US debt to raise money. (Here’s a wonky history of the debt ceiling [PDF], courtesy of the Congressional Research Service.) Putting a borrowing limit in place gave the federal government more flexibility to fill its coffers without going to Congress over and over. Lawmakers in Congress have raised the debt ceiling on many occasions, including eight times in the past decade, and Treasury Secretary Tim Geithner has said that failing to raise it and allowing the US default “would shake the basic foundation of the entire global financial system.”

What Happens If Congress Doesn’t Raise the Debt Limit? In a word: Catastrophe.

At least that’s what Geithner told Congress in January. In an ominous letter, he wrote that a US default would wreak havoc on the domestic economy and essentially result in a hefty tax on all Americans.

That’s economics 101. If you default on, say, your mortgage or car payment, creditors consider you a bigger risk and as a result, it’ll cost more for you to take out loans in the future. The same idea applies here, too, except that everyone—consumers, cities, states, corporations, and the government—will pay higher borrowing costs if the federal government defaults, Geithner says. Not to mention that the government would run out of cash to pay the salaries of federal employees and members of the military, veterans benefits, Social Security and Medicare, unemployment benefits to states, individual and corporate tax refunds, Medicaid payments, and on and on.

What’s Happening Now? Congressional Republicans are refusing to raise the debt ceiling without drastic spending cuts. They see the federal government as a reckless spendthrift, running up out-of-control deficits and undermining the integrity of the country. “We are in a debt crisis,” said House Majority Leader Eric Cantor (R-Va.). “The American people are expecting us to deliver on our commitment that we are going to change the spending crisis in Washington.” With a majority in the House, Republicans can block a debt ceiling vote until they get what they want—which is a deficit reduction deal heavy on cuts to government spending and light on everything else.

Democrats see the GOP’s obstruction as political grandstanding, a dangerous game of chicken that could lead to the US defaulting on its obligations. For months, a bipartisan group of lawmakers and Obama administration officials, led by Vice President Joe Biden, have been working on a deal to shrink the federal deficit, now at roughly $930 billion, in exchange for Republican support to increase the debt ceiling. But those talks broke down in late June over a key element of the negotiations: tax increases. Democrats want new revenue of some kind in the deal, and have floated slashing oil corporation subsidies, worth $21 billion, over ten years; Republicans won’t consider any tax increases at all. On June 23, Cantor and Sen. Jon Kyl (R-Ariz.), the number two GOPer in the Senate, abandoned the negotiations because Democrats hadn’t taken tax increases off the table.

As a result, the debt ceiling negotiations fell into the lap of President Obama. On June 27, Obama invited Senate Majority Leader Harry Reid (D-Nev.) and Minority Leader Mitch McConnell (R-Ky.) to the White House to work on a debt ceiling deal.

How Do I Follow the Action in Real Time? With the August 2 deadline looming large, we’ll be tracking the fight in Washington on a daily basis. You can find the latest developments below. (The first four updates were written in advance and published on the evening of June 28.)

*********

UPDATE 1, Monday, June 27, 12:30 p.m. EST (Andy Kroll): For some analysis on Rep. Eric Cantor and Sen. Jon Kyl’s decision to walk away from the Biden-led bipartisan talks, intended to reach a deficit reduction deal in exchange for Republican votes to increase the debt ceiling, check me (Andy Kroll) out on “Countdown” with Keith Olbermann, on Current TV:

UPDATE 2, Monday, June 27, 2:45 p.m. EST (Andy Kroll): After meeting this morning with Senate Majority Leader Harry Reid and Minority Leader Mitch McConnell, President Obama said he was confident a deal could be reached to prevent the US from defaulting on its debts. White House press secretary Jay Carney said at Monday’s briefing that Obama would insist on a deficit-cutting deal that included both spending cuts and tax increases, including ending oil subsidies and tax breaks for “millionaires and billionaires.”

Vice President Biden previewed Obama’s position over the weekend at a dinner held by the Ohio Democratic Party. The GOP’s insistence that tax breaks for the wealthy remain intact “borders on being immoral,” Biden said, adding, “we’re never going to solve our debt problem if we ask only those who are struggling in this economy to bear the burden and let the most fortunate among us off the hook.”

UPDATE 3, Tuesday, June 28, 7:25 p.m. EST (Nick Baumann): Politico‘s David Rogers reports that Obama and Reid “appear to be” willing to make significant cuts to Medicare and are offering to help Boehner “neutralize” the Medicare issue for the 2010 elections. (The Medicare issue is that Republicans voted for Rep. Paul Ryan’s plan to make vast changes to the program, essentially ending it in its current form and transitioning to a voucher-based system.) Here’s Rogers:

For their part, Obama and Reid appear prepared to reach much higher, putting substantial Medicare savings on the table if Republicans would accept added revenues. With the House GOP leadership in New York, all of Monday’s White House maneuvering was Senate-centric. But Obama’s hope is that Speaker John Boehner (R-Ohio), with whom he met privately last week, will be intrigued by a bolder package that might also help neutralize the Medicare issue now hurting the GOP among elderly voters.

If Rogers is right, this is big news. Nancy Pelosi and the Democratic Congressional Campaign Committee, along with Senate Democrats who are running for reelection in 2012 (Reid is not) very much want to keep the Medicare issue on the table. If Obama and Reid somehow work with Boehner to “neutralize” the issue (I’m skeptical about what would), they’d be selling out their Democratic colleagues. The President will hold a press conference Wednesday morning at 11:30, so we’ll likely know more then.

UPDATE 4, Tuesday, June 28, 8:35 p.m. EST (Nick Baumann): Huffington Post‘s Ryan Grim reports that some members of the Senate Democratic caucus believe that the debt ceiling itself is unconstitutional. Having the White House declare the debt limit unconstitutional is “going to get a pretty strong second look as a way of saying, ‘Is there some way to save us from ourselves?'” Sen. Chris Coons (D-Del.) told Grim. The constitutional argument stems from a phrase in the 14th Amendment: “The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned.” Columnist Bruce Bartlett has a good explainer for how this might work in practice.

UPDATE 5, Wednesday, June 29, 10:11 a.m. EST (Andy Kroll): In an interview with Fox News’ Sean Hannity on Tuesday night, House Speaker John Boehner (R-Ohio) downplayed the importance of the Aug. 2 deadline to cut a deal on raising the debt ceiling. Treasury Secretary Tim Geithner said last month that the Treasury could keep the US current on its obligations until that day, but on Tuesday Boehner didn’t seem too worried about Geithner’s predictions. “Nobody believes the United States is going to walk away from its obligations,” he said. “Dealing with this debt problem and this deficit problem is far more important than meeting some artificial date created by the Treasury secretary.”

In response, a Treasury official told MSNBC that Geithner’s deadline wasn’t arbitrary at all but instead “is purely a function of the government’s cash flows. We will provide an update on the debt ceiling outlook at the beginning of July, as we have done at the beginning of each month this year, but it is unlikely that the date will move by more than a day or two—if at all.”

UPDATE 6, Wednesday, June 29, 11:39 a.m. EST (Andy Kroll): In a June 28 letter Treasury Secretary Tim Geithner rejected Sen. Jim DeMint’s claim that the federal government doesn’t need to raise the $14.3-trillion debt ceiling and that it could “prioritize” paying interest on the federal debt. Geithner described DeMint’s plan, laid out in a May letter co-signed by 16 Republican senators, as “radical and deeply irresponsible,” “unwise,” and “untested and unacceptably risky,” and reinforced his own position that the debt ceiling must be raised by early August at the latest.

UPDATE 7, Wednesday, June 29, 12:08 p.m. EST (Andy Kroll): President Obama told reporters today at the White House that he believes any deficit reduction deal, needed to win Republicans’ support on increasing the debt ceiling, must include tax increases of some kind as well as massive spending cuts. “You can’t reduce the deficit to levels it needs to be reduced to without having some revenue in the mix,” Obama said.

Obama chided top Republicans in Congress for refusing to consider new revenue as part of a deficit deal, saying, “I don’t think that’s a sustainable position.” He said Democrats had agreed to cut programs popular with their base, and that GOPers needed to do the same. “If everybody else is willing to take on their sacred cows and do tough things to achieve the goal of deficit reduction, I think it would be hard for Republicans to stand there and say the tax breaks for corporate jets” are a deal-breaker.

Asked about the debt talks endgame, Obama said he believed Republicans would eventually strike a deal with new revenues. “My expectation is that they’ll do the responsible thing,” he said.”

UPDATE 8, Wednesday, June 29, 1:45 p.m. EST (Nick Baumann): Political Wire‘s Taegan Goddard says “it’s pretty telling” that, during this morning’s press conference, President Obama “never answered whether he thought the debt ceiling was constitutional.” It looks like the president wants to maintain declaring the ceiling unconstitutional as an option. That’s strategically smart.

UPDATE 9, Wednesday, June 29, 1:52 p.m. EST (Asawin Suebsaeng): Mother Jones‘ David Corn reacts to President Obama’s press conference today and his statements regarding raising the debt ceiling and cutting a deficit reduction deal:

Obama is dealing with radical hostage-takers who do not share his sense of responsibility. So when he asks these questions—Will the GOP truly prevent young adults from getting college loans so mega-profit-making oil companies can keep their special tax breaks? Will they really push the nation into a financial crisis to score an ideological point about supposedly out-of-control spending?—is Obama underestimating the opposition? Or is he posing rhetorical queries designed to position himself (especially in the eyes of independent voters) as the reasonable fellow in this dust-up?

To read the rest, click here.

UPDATE 10, Wednesday, June 29, 5:57 p.m. EST (Siddhartha Mahanta): Standard & Poor—one of the three major credit-rating agencies—will knock the US’ current “AAA” rating down to a “D,” or “selective default,” reports Reuters. What does that mean? Come August 4, some $30 billion in short-term US Treasury bond are set to mature. If the government fails to honor them, they will be slapped with the lower rating, said John Chambers, S&P’s managing director and chairman of its sovereign ratings committee. But he noted, though, that S&P still considers the odds of a default to be “extremely low.”

UPDATE 11, Thursday, June 30, 9:37 a.m. EST (Andy Kroll): How often is it that 235 economists—among them six Nobel Prize winners—can all agree on the same thing?

On Tuesday, that many economists signed a letter urging Congress to raise the government’s $14.3 trillion debt limit without deep cuts to federal spending. “Not doing so promptly could have a substantial negative impact on economic growth at a time when the economy looks a bit shaky,” they wrote. “In a worst case, it could push the United States back into recession.” The letter was organized by the left-leaning Economic Policy Institute, a think tank in Washington, DC.

Among the co-signers (PDF) was Laura Dyson, a top economic aide in the Clinton White House; Alan Blinder, a former vice chair at the Federal Reserve; the University of California-Berkeley’s Emmanuel Saez; and Nobel laureate Robert Solow of MIT.

Here’s the full letter:

Dear Members of Congress:

We, the undersigned economists, urge Congress to raise the federal debt limit immediately and without attaching drastic and potentially dangerous reductions in federal spending. Not doing so promptly could have a substantial negative impact on economic growth at a time when the economy looks a bit shaky. In a worst case, it could push the United States back into recession.

The U.S. economy looks fragile at present. Economic growth has been too weak to generate sufficient new job creation. Reaching the limit on total outstanding debt could force a dramatic and sudden cut in federal spending that would destroy jobs and threaten the recovery. To remove spending from the economy at such a pivotal moment would be irresponsible.

Failure to increase the debt limit sufficiently to accommodate existing U.S. laws and obligations also could undermine trust in the full faith and credit of the United States government, with potentially grave long-term consequences. This loss of trust could translate into higher interest rates not only for the federal government, but also for U.S. businesses and consumers, causing all to pay higher prices for credit. Economic growth and jobs would suffer as a result.

UPDATE 12, Thursday, June 30, 10:56 a.m. EST (Siddhartha Mahanta): In his press conference yesterday, President Obama lashed out at Congress for planning to leave Washington for the July 4th recess next week, without finalizing a deficit reduction deal and a plan to raise the debt ceiling. Republicans remain intransigent, insisting that any agreement include massive spending cuts and refusing to seriously consider revenue increases. Looks like Harry Reid got the message.

“Mr. President, it is often said that with liberty comes responsibility,” [Reid] said. “We should take that responsibility seriously. I’m confident we do. That’s why the Senate will reconvene on Tuesday, the day after the Fourth. We’ll do that because we have work to do. We’ll be in session that week – that’s next week – with our first vote on July 5.”

UPDATE 13, Thursday, June 30, 12:45 p.m. EST (Siddhartha Mahanta): Senate Minority Leader Mitch McConnell invited President Obama today to meet with Senate Republicans and discuss the debt ceiling negotiations.

“I’d like to invite the president to come to today to meet with Senate Republicans—anytime this afternoon…[t]hat way he can hear directly…why what he is proposing will not pass,” McConnell said. He stressed that any proposal that includes tax hikes is a non-starter. McConnell said Obama needs to come to grips with the reality in Congress. “All of us know that Congress isn’t going to approve hundreds of billions of dollars in tax hikes—it’s simply not going to happen,” he said. “We’ve known that for six months—and we’ve been saying it all along. The President does not seem to get it.”

Another Senate Republican, Rand Paul of Kentucky, said he would vote down any debt deal that does not include a balanced budget amendment.

“We will never surmount our fiscal problems until we amend the Constitution,” he said. All 47 GOP senators favor a balanced budget amendment, which would limit government spending to 18% of the gross domestic product. But only 12—including Paul—have signed a pledge not to vote to raise the debt ceiling without one.

UPDATE 14, Thursday, June 30, 2:30 p.m. EST (Nick Baumann): Timothy Geithner, the Secretary of the Treasury, has dramatically embraced the “constitutional option” theory of the debt ceiling, Huffington Post‘s Ryan Grim and Sam Haas report. Here’s the video of Geithner whipping out his pocket constitution and reading the section of the 14th amendment that says the “public debt of the United States… shall not be questioned”:

This is yet another sign that the Obama administration and congressional Democrats are taking the “constitutional option” seriously—or at least a sign that they want people to think they are.

UPDATE 15, Thursday, June 30, 3:40 p.m. EST (Siddhartha Mahanta): President Obama rejected Sen. McConnell’s invitation to meet with Republican senators to talk about cutting the deficit (see Update 13). “What the senator invited the president to do was to hear Senate Republicans restate their maximalist position. We know what that position is,” said White House spokesman Jay Carney.

Treasury Secretary Timothy F. Geithner. Pete Souza/White House

Treasury Secretary Timothy F. Geithner. Pete Souza/White House

UPDATE 16, Friday, July 1, 9:40 a.m. EST (Andy Kroll): August 2: It’s the day on which the US could potentially default on its debt, according to the Treasury Department. And for weeks, it’s been the do-or-die point on the calendar, looming large over the bipartisan negotiations in Washington to cut the deficit and raise the $14.3 debt ceiling.

Now, the White House has a new date: July 22. The Wall Street Journal reports that Obama administration officials say July 22 is in fact when a deal needs to be done, so that a bill can be written and passed through Congress without the nation missing a payment. That’s 11 days earlier than the target date everyone had been using until now, and it will no doubt up the stakes for the White House and Congress to cut a deal, and fast.

The newer date also appears to be a way for the Obama administration to turn up the heat on top Democrats and Republicans in Congress to quit bickering and reach a deficit-reduction agreement. Right now, however, those talks are all but dead. House Majority Leader Eric Cantor (R-Va.) and Sen. Jon Kyl (R-Ariz.) walked away from the talks two weeks ago over the issue of tax increases, and this week President Obama refused to meet with Senate Republicans on a deficit deal. “We know what that position is,” White House press secretary Jay Carney said.

UPDATE 17, Friday, July 1, 1:30 p.m. EST (Andy Kroll): Senate Majority Leader Harry Reid (D-Nev.) introduced a measure today insisting that any deal to reduce the federal deficit include tax increases on Americans earning more than $1 million a year. Reid’s offering (PDF) is what’s called a “Sense of the Senate” measure, a pledge of sorts which members of Senate would vote yes on if they supported Reid’s call for higher taxes on the rich.

The measure is unlikely to earn any Republican support, considering that GOPers refuse to support any new tax increases in a deficit deal in exchange for raising the nation’s $14.3-trillion debt ceiling. A few weeks ago, House Majority Leader Eric Cantor (R-Va.) and Sen. Jon Kyl (R-Ariz.) both walked away from bipartisan deficit negotiations, led by Vice President Joe Biden, because Democrats refused to rule out any new tax increases. Those proposed increases include cutting subsidies for oil companies, worth $21 billion over ten years, and raising taxes by a few percentage points on the wealthy. Thus Reid’s proposal, which simply calls for higher taxes on the wealthy, is DOA with Republicans.

UPDATE 18, Monday, July 4, 3:30 p.m. EST (Asawin Suebsaeng): Senator Rand Paul (R-Ky.) said Sunday he intends to filibuster the Senate’s upcoming business week in an effort to force more discussion on the debt ceiling. During an interview on C-SPAN’s Newsmakers, Paul, the Senate Tea Party Caucus founder, stated that he and like-minded conservative senators “will vote in favor of raising the debt ceiling if we can, but it will be contingent on passing a balanced budget amendment to the Constitution.”

Senator John McCain (R-Ariz.)Louie Palu/Zuma

UPDATE 19, Monday, July 4, 3:50 p.m. EST (Asawin Suebsaeng and Andy Kroll): Two top Republican lawmakers, including Sen. John McCain (R-Ariz.), have hinted that while they are maintaining staunch opposition to tax increases, they may consider unspecified “revenue-raisers” and tax reform plans as part of a deficit-reduction deal that could open the door to raising the nation’s $14.3-trillion debt ceiling.

Here was McCain on CNN’s “State of the Union” on Sunday:

“[Arizona senator] Jon Kyl was in negotiations with the vice president and he said there were certain revenue-raisers in other areas that perhaps we could work on, but to somehow say we’re going to raise Americans taxes, anybody’s taxes, I think…it’s a principle we promised the American people last November and that we have to stick to.”

Sen. John Cornyn (R-Texas) suggested the GOP might support eliminating tax loopholes on Fox News Sunday, but didn’t overtly mention the issue of raising revenue:

Do we believe that tax reform is necessary? I would say absolutely. There’s not enough time to get it this done between now and August 2nd. But it ought to be the first thing we turn to, try to make our tax code more rational. We could bring down rates [and] eliminate…a lot of tax expenditures or loopholes.

UPDATE 20, Tuesday, July 5, 12:12 p.m. EST (Siddhartha Mahanta): If Congress fails to increase the nation’s $14.3-trillion debt ceiling, countries who hold America’s debt could seriously question the US’ ability to make good on its debts while economists predict the US could slip back into recession. But how will we know if financial markets think that crisis is imminent? The Washington Post’s Neil Irwin breaks down five tell-tale signs. Among them:

- Discontinuities in the Treasury bill market. If the prices of bonds maturing around the Aug. 2 debt limit deadline begins to fall, that means investors are demanding higher interest rates for holding on to them. Right now, the rate for bills maturing on August 4 is .01 percent, which is the same as those maturing on August 18th or 25th. “Get nervous if that changes,” Irwin writes.

- Spikes in the credit default swaps market. If the price of credit default swaps—insurance against the US government debt—begins to rise, look out. “US swaps imply only a 4.6 percent chance of a default within five years. This is the indicator that is flashing warning signs — it is up substantially since early April,” says Irwin.

- A narrower spread between Treasurys and near substitutes. If US government bonds become a riskier bet, investors could look elsewhere. Like Canada, or other credit-worthy countries like Switzerland or Germany.

Irwin also points to a narrowing gap between the interest rates on Treasury bills and other forms of short-term credit, as well as higher volatility on the rates on government bonds.

Zhang Jun/ZumaUPDATE 21, Tuesday, July 5, 3:18 p.m. EST (Siddhartha Mahanta): If a deficit-reduction deal in exchange for raising the debt ceiling isn’t reached soon, top Republicans appear ready to move on a short-term debt limit hike—an idea first floated by Bill Clinton last Saturday—that would involve a temporary increase in exchange for spending cuts already agreed to by Democrats and Republicans.

Zhang Jun/ZumaUPDATE 21, Tuesday, July 5, 3:18 p.m. EST (Siddhartha Mahanta): If a deficit-reduction deal in exchange for raising the debt ceiling isn’t reached soon, top Republicans appear ready to move on a short-term debt limit hike—an idea first floated by Bill Clinton last Saturday—that would involve a temporary increase in exchange for spending cuts already agreed to by Democrats and Republicans.

A short-term increase “is more likely than not at this point because we’re basically running out of time,” said Senator John Cornyn (R-Texas) on a local Dallas radio show. “[T]he House has to pass it as well as the Senate and really we’re coming up against an Aug. 2 deadline, so it may be we’ll get sort of a mini-deal.” But Cornyn emphasized that short term fixes aren’t the answer. “[W]e need to deal with the problem as a whole and that means not just kicking the can down the road which is what a mini-deal would be.”

While one top Republican suggested that the GOP might consider “revenue-raisers” as part of a deficit deal, any such deal appears a long way off. Democrats insist that any agreement must include new revenues and possibly tax increases of some kind. Republicans, however, refuse to consider any new tax increases.

UPDATE 22, Tuesday, July 5, 5:49 p.m. EST (Siddhartha Mahanta): In remarks delivered Tuesday, President Obama invited senior Republican and Democratic leaders to the White House on Thursday for more talks on raising the debt ceiling in exchange for spending cuts. The president also appeared to brush aside any possibility of a short term deal.

Afterwards, White House spokesman Jay Carney said that the president has yet to discuss the “constitutional option” with White House lawyers. The idea—invoking the 14th amendment to render the debt ceiling itself unconstitutional—was first floated by Treasury Secretary Tim Geithner as a possible strategy for bringing a quick end to negotiations.

UPDATE 23, Wednesday, July 6, 12:34 p.m. EST (Siddhartha Mahanta): CNN reports that President Obama met with House Speaker John Boehner over the weekend as part of the negotiations over raising the debt ceiling, according to a Republican official.

Rep. Ron Paul (R-Texas). flapa blog/FlickrUPDATE 24, Wednesday, July 6, 12:55 p.m. EST (Nick Baumann): That Rep. Ron Paul (R-Texas), perhaps the Federal Reserve’s most dedicated critic (and a supporter of heterodox, Austrian economics) has an idea for dealing with the debt ceiling is not a shock. But that at least one liberal economist is backing Paul’s idea is a bit surprising. Dean Baker of the Center for Economic and Policy Research says that Paul’s idea—namely that the Federal Reserve should tear up the $1.6 trillion in government bonds it now holds—is “surprisingly lucid”:

Rep. Ron Paul (R-Texas). flapa blog/FlickrUPDATE 24, Wednesday, July 6, 12:55 p.m. EST (Nick Baumann): That Rep. Ron Paul (R-Texas), perhaps the Federal Reserve’s most dedicated critic (and a supporter of heterodox, Austrian economics) has an idea for dealing with the debt ceiling is not a shock. But that at least one liberal economist is backing Paul’s idea is a bit surprising. Dean Baker of the Center for Economic and Policy Research says that Paul’s idea—namely that the Federal Reserve should tear up the $1.6 trillion in government bonds it now holds—is “surprisingly lucid”:

The basic story is that the Fed has bought roughly $1.6 trillion in government bonds through its various quantitative easing programs over the last two and a half years. This money is part of the $14.3 trillion debt that is subject to the debt ceiling. However, the Fed is an agency of the government. Its assets are in fact assets of the government…. [T]he bonds held by the Fed are literally money that the government owes to itself.

Unlike the debt held by Social Security, the debt held by the Fed is not tied to any specific obligations… [T]here is no direct loss of income to anyone associated with the Fed’s destruction of its bonds. This means that if Congress told the Fed to burn the bonds, it would in effect just be destroying a liability that the government had to itself, but it would still reduce the debt subject to the debt ceiling by $1.6 trillion. This would buy the country considerable breathing room before the debt ceiling had to be raised again. President Obama and the Republican congressional leadership could have close to two years to talk about potential spending cuts or tax increases. Maybe they could even talk a little about jobs.

In addition, Baker says, Paul’s plan would reduce the government’s interest burden over the coming decades. (He explains that here.) “This is a proposal that deserves serious consideration, even from people who may not like its source,” Baker writes. So far, though, there’s been little sign that anyone on Capitol Hill other than Paul is thinking seriously about this idea.

President Obama. Zhang Jun/ZumaUPDATE 25, Wednesday, July 6, 3:46 p.m. EST (Siddhartha Mahanta): President Obama continued to make his case for a balanced approach to the budget negotiations during the White House’s first-ever Twitter town hall on Wednesday,

President Obama. Zhang Jun/ZumaUPDATE 25, Wednesday, July 6, 3:46 p.m. EST (Siddhartha Mahanta): President Obama continued to make his case for a balanced approach to the budget negotiations during the White House’s first-ever Twitter town hall on Wednesday,

“Never in our history has the US defaulted on its debt,” he reminded the audience. “The debt ceiling should not be something that is used as a gun against the heads of the American people to extract tax breaks for corporate jet owners, or oil and gas companies that are making millions of dollars.”

Americans, Obama insisted, are on his side, and favor a “balanced” approach to fixing the deficit: closing corporate tax loopholes, decreasing discretionary spending to curb inefficiencies, and ramping down defense spending. Social insurance programs like Medicare, Medicaid, and Social Security are also part of that equation. And Obama still hopes that Republican and Democratic lawmakers can abandon their “sacred cows” in the budget and reduce the deficit while investing in infrastructure and research.

On taxes, Obama stated unequivocally that the Bush tax cuts for the rich should be made permanent for low and moderate income earners, who haven’t seen their wages rise over the past decade while the costs of health care, education, gas, and food, have risen.

Government revenue, the president stressed, should come from those who can afford it. “If all we do is go back to pre-Bush tax rates for top income brackets…that would raise hundreds of millions dollars… [it] could solve the deficit, debt problems [and it’s] not something that requires radical solutions,” he said. Obama reminded his audience that the rich did very well during the Clinton years, when tax levels were higher than those he has proposed. “If the wealthiest among us are willing to give up a little bit more, then we can solve this problem. It does not take a lot.”

Obama also pushed back against his conservative critics, arguing that a modest increase for the wealthiest won’t stymie job creation. “It’s not like we haven’t tried what these other folks are pitching,” he said, referring to the Bush tax cuts of 2001 and 2003. “It didn’t work. And we should go with what works.”

UPDATE 26, Thursday, July 7, 10:41 a.m. EST (Andy Kroll): President Obama has reportedly put Social Security and Medicare, two of the nation’s biggest entitlement programs, on the negotiating table as he and top Democrats try to hammer out a deficit-reduction deal with Congressional Republicans, the Washington Post reports. However, the White House has strongly pushed back against the Post‘s story, telling the Huffington Post and MSNBC First Read that there’s no massive entitlements deal under discussion. The White House added that the president has always been open to “reasonable changes” to Social Security and Medicare.

Here’s the Post‘s story:

At a meeting with top House and Senate leaders set for Thursday morning, Obama plans to argue that a rare consensus has emerged about the size and scope of the nation’s budget problems and that policymakers should seize the moment to take dramatic action.

As part of his pitch, Obama is proposing significant reductions in Medicare spending and for the first time is offering to tackle the rising cost of Social Security, according to people in both parties with knowledge of the proposal. The move marks a major shift for the White House and could present a direct challenge to Democratic lawmakers who have vowed to protect health and retirement benefits from the assault on government spending.

“Obviously, there will be some Democrats who don’t believe we need to do entitlement reform. But there seems to be some hunger to do something of some significance,” said a Democratic official familiar with the administration’s thinking. “These moments come along at most once a decade. And it would be a real mistake if we let it pass us by.”

A willingness to consider Social Security or Medicare cuts would signal a reversal in the president’s position, as entitlements had previously been off the table.

The possibility of entitlement cuts comes as Obama is pushing for a much more comprehensive deal in the deficit negotiations. The president, the New York Times reports, doesn’t want to accept a short-term agreement that would cut spending and potentially increase taxes or cut tax subsidies. Instead Obama is eyeing as much as $4 trillion in cuts, with a mix of tax revenues and spending cuts.

Cuts to Social Security and Medicare would be deeply unpopular with the American public. A new Pew Research Center poll found that 60 percent of respondents said it was important to keep the Social Security and Medicare programs as they are, while only 32 percent placed more importance on reducing the federal budget deficit. Broken down by party affiliations, Democrats overwhelming favored preserving Social Security and Medicare over deficit reduction, 72 percent to 21 percent; 50 percent of Republicans backed protecting entitlements and 42 percent backed deficit reduction; and among independents, the percentages were 53 percent and 38 percent, respectively.

UPDATE 27, Thursday, July 7, 11:08 a.m. EST (Siddhartha Mahanta): In a Wall Street Journal op-ed today, Republican Senators Jim DeMint of South Carolina and Olympia Snowe of Maine excoriate President Obama for demanding Congress raise the debt ceiling and potentially “hijacking the promise of American prosperity.”

“If Congress increases our national debt ceiling next month without permanent, structural budget reforms, we will signal to taxpayers and bond markets alike that Washington is still in denial,” they write. “[T]he only way to compel lawmakers to maintain their responsibility forever is a balanced budget amendment to the Constitution.” In particular, what they’re referring to is a measure that would limit government spending to 18 percent of the nation’s gross domestic product—that is, the overall value of all goods and services in the US, which is $14.1 trillion. A balanced budget amendment has received the support of 47 senators, all Republicans.

DeMint and Snowe remind readers that when Senate last took up a balanced budget amendment in 1997—when the overall national debt stood at $5.36 trillion—it failed to pass by a single vote. Today, they note, that figure is $14.3 trillion, implying that a balanced budget amendment would have controlled the debt.

Why will this plan work where all others have failed?:

For one single reason: As senators and representatives, we take an oath to uphold the Constitution. By amending the Constitution, Congress will be forever bound to match our nation’s expenditures with our revenues. Toothless resolutions and statutory speed bumps have proven easy to evade or ignore. Indeed, the reason many lawmakers don’t want a balanced budget amendment is the exact reason why we need it: It would permanently end the types of legislative trickery that have now brought our country to the fiscal brink.

The senators also raise the alarm over the interest the US owes on its existing debt, an annual amount projected to reach $1 trillion by 2021. “At that rate, China would surpass the U.S. economy in size even before 2016, the year recently forecast by the International Monetary Fund,” they write.

UPDATE 28, Thursday, July 7, 12:19 p.m. EST (Siddhartha Mahanta): On Thursday, House Majority Leader Eric Cantor (R-Va.) told Fox News’ Gretchen Carlson that any deal on the debt ceiling cannot close tax loopholes without tax cuts that offset those reforms. Cantor has said in the past that he would be open to cleaning up the tax code by eliminating costly corporate exemptions, but claims that President Obama’s plan to curb loopholes will hurt small businesses and stifle job creation.

Here he is on Fox News:

UPDATE 29, Thursday, July 7, 12:40 p.m. EST (Andy Kroll): Rep. Chris Van Hollen (D-Md.), the ranking member of the House budget committee, said in an interview with CNN today that Democrats in Congress would not accept major cuts to entitlements such as Social Security and Medicare as part of a deficit-reduction deal. Van Hollen added that he didn’t know if reports were true that President Obama had put entitlements on the chopping block (the White House has denied doing so in a big way), but said the administration would find no support among Democrats if that were the case.

“What we have said is that if the president wants to adopt a separate track—just as [former Democratic House speaker] Tip O’Neill and Ronald Reagan did in the 1980s—to strengthen social security, that’s one thing. But to try and balance the budget on the backs of Social Security beneficiaries would be unacceptable,” Van Hollen told CNN’s Ali Velshi. “I’m pretty confident that’s not what the president is referring to.”

The Maryland Democrat reiterated that he supports a balanced compromise that includes tax increases such as closing corporate tax loopholes. He also said he supported lifting the cap on the payroll tax and deeper cuts to Pentagon spending.

Van Hollen said the biggest question right now with the deficit negotiations is whether Congressional Republicans will budge on accepting tax increases and new revenues as part of a deal—something GOP leaders such as House Majority Leader Eric Cantor (R-Va.) and the House rank-and-file refuse to do. “Until the Republican Party is more worried about the deficit than they are about [Americans for Tax Reform president] Grover Norquist and that whole part of their coalition, then we’re going to have a real problem.”

UPDATE 30, Thursday, July 7, 1:25 p.m. EST (Andy Kroll): After a “very constructive meeting” this morning with top Democrats and Republicans in Congress, President Obama said at today’s White House press conference that all parties would continue working through the weekend to reach a deficit-reduction deal in exchange for Republican support on increasing the $14.3-trillion debt ceiling. The president said leaders from both parties will reconvene on Sunday at which point he wants both sides to have agreed to the broad outlines of a deal. The specifics of a deal can be hammered out afterward, the president said.

Obama stuck by his position that any agreement will require concessions from both parties, even as he acknowledged that Democrats and Republicans “are still far apart on a range of issues.” He added, “There’s going to be pain involved politically on all sides.”

UPDATE 31, Thursday, July 7, 1:57 p.m. EST (Siddhartha Mahanta): Reuters reports that a “small team” of Treasury officials is working behind the scenes to find ways to sidestep a financial catastrophe if the debt ceiling is not raised by the August 2 deadline.

Among the menu of options, the team is considering whether the administration can stall its payments. Postponement, though, comes with some serious technical problems: “If Treasury were to decide to delay payments, it would need to re-program government computers that generate automatic payments as they fall due—a massive and difficult undertaking. Treasury makes about 3 million payments each day,” reports Reuters.

Treasury is also exploring whether a 1985 finding by the Government Accountability Office would allow the government to prioritize its payments—a popular strategy among some conservative Republicans. This would let the government decide, in effect, whether to pay soldiers or Medicare recipients first. The team is also deliberating whether the New York Federal Reserve Bank could function as Treasury’s broker in the markets in the event that a deal is not struck.

Keith Hennessey, former chair of the National Economic Council under George W. Bush, said a backup plan is essential. “You have to have a backup plan. If you are relying on Congress to avoid the possibility of an Armageddon, you can’t just bet on that.”

The White House has yet to comment on the talks, and is actively pooh-poohing any discussion of the “constitutional option”—the idea that the debt ceiling itself is unconstitutional. The White House wants to keep lawmakers focused on the impending August 2 deadline. Administration officials worry that “even a hint of a ‘Plan B’ could lessen the urgency to strike a deal by then,” according to Reuters.

UPDATE 32, Thursday, July 7, 4:07 p.m. EST (Siddhartha Mahanta): Speaking from the Senate floor on Thursday, Sen. Carl Levin (D-Mich.) re-introduced a bill that would close the corporate stock option tax loophole.

When corporations grant their top executives large stock option packages, they are expected to report the cost of those options on their books. But when it comes time to file their taxes, current law allows them to claim a much higher expense that qualifies them for a significant tax benefit. Closing this loophole would shrink the deficit by about $25 billion over 10 years, Levin said, citing figures from the Joint Committee on Taxation.

Stock options, Levin said, are the only type of compensation in the tax code where a corporation can deduct more than the expenses shown on their books. “It is an exception we can no longer afford,” he added.

From his floor statement:

[T]he IRS found that for the first full year in which data was available, U.S. companies claimed an excess of $61 billion in stock option tax deductions compared to their book expenses. Since then, IRS data shows that the stock option tax gap has persisted for five years, from 2005 to 2009, the latest year for which data is available, with the size of the excess tax deductions varying from $11 billion to $52 billion per year.

This loophole, Levin argues, fuels excessive executive salaries and allows companies to avoid paying their full share of the tax burden. His bill address the problem

by requiring the corporate stock option tax deduction to equal the stock option expense shown on the corporate books. It would not affect the taxes paid by individuals who receive the stock options. It would not affect so-called Incentive Stock Options which receive favored tax treatment under Section 422 of the tax code and are often used by start-up companies.

. . . the excessive corporate tax deduction for stock option pay widens the deficit while increasing the tax burden on ordinary taxpayers. By closing this tax gap, by ending the illogical treatment of corporate stock options in current law, we can reduce the budget deficit and bring much-needed fairness to the tax code.

UPDATE 33, Thursday, July 7, 5:17 p.m. EST (Asawin Suebsaeng): The “I” word has officially been dropped.

Rep. Tim Scott (R-S.C.) said Tuesday that he would consider it an impeachable offense if President Obama were to invoke the 14th Amendment in order to ignore the debt ceiling. Scott made the comments during a town hall sponsored by LowCountry 9.12 Project, a tea party affiliate in Summerville, South Carolina. The Huffington Post has the story:

This president is looking to usurp congressional oversight to find a way to get it done without us. My position is that is an impeachable act from my perspective…This jeopardizes the credibility of our nation if one man can usurp the entire system set up by our Founding Fathers over something this significant.

Scott isn’t alone. Rep. Pete Olson (R-Texas) mentioned during an interview with Think Progress that Scott is not merely an outlier, and that there has been “a little bit” of discussion among Republican lawmakers behind closed doors about the possibility of kick-starting an impeachment process if the president declares the debt limit unconstitutional:

[Rep. Scott is] not a lonely voice. All of us out there, we’re getting closer to a place where we’ve never gone in our country’s history. So we’re all sort of learning as we go. We’ve never gotten to the point where we’ve defaulted, potentially, on our debt. So we’re looking at other options out there because this is new ground for all of us.

UPDATE 34, Thursday, July 7, 7:46 p.m. EST (Siddhartha Mahanta): The Huffington Post reports that the first Republican has conceded that the “constitutional option”—invoking the 14th Amendment to render the debt ceiling itself unconstitutional—could be a legitimate way to end the negotiations. Sen. Chuck Grassley (R-Iowa) told The Huffington Post that “[I]n the 14th Amendment, there’s something that says something about the debt of the United States government shall be honored…The 14th Amendment includes a public debt clause that insists the obligations of the government ‘shall not be questioned.'”

Grassley said that he supports the spending discipline the debt ceiling imposes on Congress, but recognizes that “[t]he Constitution trumps the law, obviously.”

UPDATE 35, Friday, July 8, 12:39 p.m. EST (Siddhartha Mahanta): President Obama will veto a short-term deficit deal, an option proposed by Senate Republicans to raise the debt ceiling for a few months to buy enough time to negotiate a more lasting agreement, Politico reports.

The president made the promise in a 90-minute meeting with congressional leaders on Thursday, going further than he had when speaking publicly about the option.

“By drawing a harder line,” Politico reports, “Obama aims to avoid revisiting the debt limit again until after the 2012 elections.

During the meeting, Obama discussed three options for resolving the negotiations: the short-term measure (which he opposes); a deal with about $2.5 trillion in cuts; and a plan that cuts spending by more than $4 trillion while raising $1 trillion in revenue.

Leaders of both parties favor the larger package. But Sen. Jon Kyl (R-Ariz.) and House Majority Leader Eric Cantor (R-Va.) raised questions about the nature of the revenue-raisers. For her part, House Minority Leader Nancy Pelosi (D-Calif.) refused to accept a deal that includes cuts to entitlement programs such as Medicaid and Social Security.

“Any discussion of Medicare or Social Security should be on its own tables,” warned Pelosi, emphasizing that the president will need House Democrats to pass any deal that emerges from negotiations. “Do not consider Social Security a piggy bank for giving tax cuts to the wealthiest people in our country. We are not going to balance the budget on the backs of America’s seniors, women or people with disabilities.”

UPDATE 36, Friday, July 8, 2:46 p.m. EST (Andy Kroll and Asawin Suebsaeng): In May, Treasury Secretary Tim Geithner pointed to the US Constitution’s 14th Amendment—which says that “the validity of the public debt of the United States, authorized by law…shall not be questioned”—and suggested the Obama administration could ignore the nation’s $14.3-trillion debt ceiling and simply keep paying its bills. Or at least that’s how it looked to some observers, including Harvard constitutional law professor Laurence Tribe.

In a New York Times op-ed published today, Tribe singled out Geithner for pointing to the the 14th Amendment as a silver bullet, and said such a strategy would not in fact pass muster. Not so fast, replied Treasury’s top attorney, George Madison.

In an e-mail to the Times, Madison, the Treasury’s general counsel, said Geithner had not suggested leaning on the 14th Amendment and emphasized the sole authority of Congress in raising the debt ceiling and avoiding default:

The Secretary has cited the 14th Amendment’s command that “[t]he validity of the public debt of the United States shall not be questioned” in support of his strong conviction that Congress has an obligation to ensure we are able to honor the obligations of the United States. Like every previous Secretary of the Treasury who has confronted the question, Secretary Geithner has always viewed the debt limit as a binding legal constraint that can only be raised by Congress.

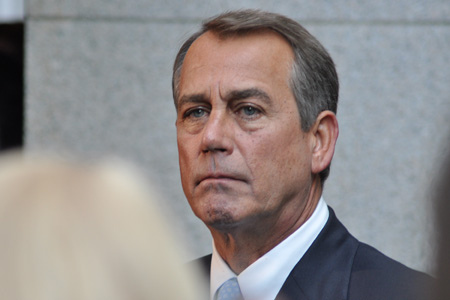

The White House/Wikimedia Commons.UPDATE 37, Saturday, July 9, 1:35 a.m. EST (Nick Baumann): Last weekend, President Barack Obama announced that he would seek a $4 trillion deficit-reduction deal as part of negotiations with Republicans to raise the federal debt ceiling. But this Saturday, Rep. John Boehner (R-Ohio), the Speaker of the House, announced that he isn’t on board with the president’s goal. The problem is just what you might expect: The White House wants to see some tax increases as part of any deal, and many, if not most, Republicans want the deal to be made up entirely of spending cuts.

The White House/Wikimedia Commons.UPDATE 37, Saturday, July 9, 1:35 a.m. EST (Nick Baumann): Last weekend, President Barack Obama announced that he would seek a $4 trillion deficit-reduction deal as part of negotiations with Republicans to raise the federal debt ceiling. But this Saturday, Rep. John Boehner (R-Ohio), the Speaker of the House, announced that he isn’t on board with the president’s goal. The problem is just what you might expect: The White House wants to see some tax increases as part of any deal, and many, if not most, Republicans want the deal to be made up entirely of spending cuts.

The GOP leadership will seek a smaller deficit-reduction plan in the neighborhood of $2 trillion as part of any deal to raise the debt ceiling, which the government is due to hit in early August. (The President has said a deal is needed by late July to prevent the government from defaulting on its debts.) Revenue increases are still going to be a hurdle, however, because Democrats want them to be part of any smaller deficit deal, too.

The White House issued a statement late Saturday evening saying that on Sunday, Obama would “make the case to congressional leaders that we must reject the politics of least resistance and take on this critical challenge.” In other words, the White House is still pushing for the larger deficit-reduction package. Any large deficit-reduction deal on the scale Obama seeks would likely involve changes to popular social insurance programs including Medicare, Medicaid, and Social Security. Given that, convincing those “congressional leaders” the White House statement refers to is probably going to entail not only convincing Republicans to raise taxes but also convincing Democrats to fiddle with Medicare and Social Security. Say what you will about Obama’s plan, but it is certainly ambitious.

UPDATE 38, Monday, July 11, 12:50 p.m. EST (Siddhartha Mahanta): President Obama announced at a press conference today that he still wants to hammer out an ambitious “grand bargain” in the ongoing debt talks with Speaker John Boehner (R-Ohio) and other Congressional leaders, eyeing trillions in spending cuts and new revenues. Obama rejected the idea of a smaller deal that buys lawmakers a few months’ time to craft a larger agreement. “We don’t manage our affairs in three-month increments,” he said. “We’re going to resolve this, and we’re going to resolve this for a reasonable period of time.”

Obama again emphasized the importance of a balanced deal, mixing cuts and tax increases—an idea Republicans have rebuffed. Obama said he wants an agreement that tackles the short-term deficit, stabilizes the economy, avoids default, and “proves to American people that we can actually get things done in this country and in this town.”

While a majority of Americans do not support raising the debt ceiling, the president argued that it is not their job to fully grasp the implications of failing to do so. That, he said, is Washington’s job. He also praised Boehner’s role in the negotiations, but he bashed members of both parties for refusing to accept unpopular measures, such as cuts to defense spending and entitlement programs and preserving tax cuts.

“Nobody has talked about increasing taxes now, nobody has talked about increasing taxes next year,” Obama insisted. Instead, current plans call for closing tax loopholes, including those for corporate jet owners and oil companies, starting in 2013. The president also stumped for extending the payroll tax cut passed last December and unemployment benefits to states.

Obama also hit on the importance of shared sacrifice among the wealthy and middle class. “If you don’t like that formulation, then I’m happy to work with you on tax reform that could potentially lower everyone’s rates and broaden the base,” he said. But to meet his demands, such a reform cannot balance the budget on the backs of the middle class and let the rich off the hook.

Looking past a debt deal, which must be signed before Aug. 2 after which the US government can no longer pay all its bills, Obama said lawmakers should double down on job creation through new trade deals, creating an infrastructure bank, and investing in medical research and development. “If the country as a whole sees Washington act responsibly…that that will help with businesses feeling more confident about aggressively investing in this country…[I]t can have a positive impact in overall growth and employment.” House Speaker John Boehner. Medill DC/Flickr

House Speaker John Boehner. Medill DC/Flickr

UPDATE 39, Monday, July 11, 2:30 p.m. EST (Andy Kroll): House Speaker John Boehner (R-Ohio) fired back at President Obama today by insisting, for the umpteenth time, that Republicans will not accept any tax hikes as part of a deficit-reduction deal. Just this morning, the president called for a balanced agreement that includes trillions in both spending cuts and new revenues, some potentially coming from tax increases. Boehner said it was important to cut a deal and raise the debt ceiling by August 2, but added that “the American people will not accept, and the House cannot pass, a bill that raises taxes on job creators.” (That’s half-true: More than a dozen polls show that a majority of Americans support or feel its necessary to raise taxes to tackle the deficit.)

Despite the impasse, Boehner described the deficit negotiations so far as “very sincere and honest.” The speaker also said he would consider new revenue in the form of overhauling the tax code so that tax rates were lowered but the tax base was expanded to include more people. But Boehner seemed to suggest Democrats and Republicans were no closer to a deal than they’d been in recent weeks. “This boils down to two things: The president continues to insist on raising taxes, and they’re just not serious about fundamental entitlement reforms to solve the problems for the near, immediate future.”

UPDATE 40, Monday, July 11, 5:40 p.m. EST (Siddhartha Mahanta): President Obama reportedly offered to increase the eligibility age for Medicare from 65 to 67 in exchange for an increase in tax revenues as part of the ongoing debt ceiling negotiations. According to the Huffington Post, the White House made the proposal as part of a potential “grand bargain” on raising the debt ceiling in exchange for steep spending cuts. It is unclear if it remains in play.

In addition to cuts to entitlement programs, the plan would have slashed $3 trillion in spending while raising some $800 billion to $1 trillion in revenue starting in 2013. But Republicans were also offered an alternative to the revenue increases: allowing the Bush-era tax cuts to expire for those people making above $250,000. Ultimately, the deal fell apart over the Democrats’ attempt to secure a firm commitment from Republicans over the de-coupling provision.

UPDATE 41, Tuesday, July 12, 4:10 p.m. EST (Siddhartha Mahanta): Senate Minority Leader Mitch McConnell (R-Ky.) offered a proposal that could bring an end to the prolonged negotiations between the White House and Congressional leaders—and that would blame President Obama and the Democrats for expanding the size of government, Politico reports.

McConnell’s plan would put the onus on President Obama to raise the debt ceiling through three incremental spending requests together adding up to $2.5 trillion, roughly the amount by which the White House wants to raise the debt ceiling. If Congress didn’t approve of the increase, it would need a two-thirds vote to reject it.

The plan takes a cue from the Congressional Review Act, which allows Congress to block or overturn an agency’s rules by adopting a joint resolution of disapproval, which the president could go on to veto.

McConnell’s plan would place all responsibility for increasing the debt limit on Democrats, and give Republicans three separate chances to call them out for increasing government spending. And it would leave Republicans free to vote against an increase without risking a default.

“The development confirms suspicions that the GOP was unwilling to truly use the looming debt ceiling as leverage to force conservative-friendly changes to popular entitlement programs, but suggests strongly that Republicans plan to continue politicking on fiscal issues through the 2012 elections,” TPM reports.

UPDATE 42, Wednesday, July 13, 10:33 a.m. EST (Siddhartha Mahanta): Senator Lindsey Graham (R-S.C.) said on Tuesday that Republicans should accept a deal that both cuts Social Security and Medicare and increases revenues by closing tax loopholes in exchange for raising the debt ceiling. “You’re giving money away to a few people at the expense of many, and I think it’s time to reevaluate that,” Graham told ABC News. “If you did away with all deductions and exemptions except charitable giving and the mortgage interest, that’s $1.2 trillion that’s spent every year.”

Graham, however, said he remained pessimistic that President Obama would be able to strike a deal with top Republicans by the August 2 deadline. “If I were a betting man, I’d bet no [deal],” Graham said.

UPDATE 43, Wednesday, July 13, 3:31 p.m. EST (Siddhartha Mahanta): On Wednesday, 247 national progressive and good-government organizations, including the AFL-CIO, Democracy 21, National Coalition for LGBT Health, and OMB Watch, cosigned a letter opposing House Judiciary Committee Resolution 1, better known as the balanced budget amendment. Both the House and Senate are expected to vote on the measure next week.

The bill would cap government spending at 18 percent of gross domestic product. That would slash spending much deeper than Rep. Paul Ryan’s (R-Wis.) Medicare-privatizing, Medicaid-gutting, rich-people-coddling budget plan, which holds spending between 20 and 21 percent of GDP over most of the next two decades (currently, spending is around 24 percent of GDP).

The proposal also makes it exceedingly difficult for Congress to undo the budget damage inflicted by the cap: It requires a two-thirds majority vote in both houses to break the cap, increase the debt limit, raise taxes, or close loopholes, strangling the government’s ability to increase spending on social programs, health care, or unemployment benefits.

UPDATE 44, Wednesday, July 13, 6:15 p.m. EST (Siddhartha Mahanta): Moody’s Investors Services, one of the “big three” credit rating agencies, has placed the United States’ AAA bond rating on review for possible downgrade. The agency cited rising worries that the debt limit will not be raised in time for the government to avoid a default on its debt obligations and said that it still considers the odds of a default “to be low but no longer to be de minimis.”

Even a short-term default would change Moody’s outlook on the US’ ability to meet future payments, resulting in a lower rating somewhere in the AA range. This would, in turn, result in higher borrowing costs for American families and businesses, and make US investments a risky proposition for multinational companies. For the US to regain a AAA rating, Moody’s says, it would likely have to change its process for raising the debt limit, among other things.

Moody’s has also placed the AAA ratings of Fannie Mae, Freddie Mac, the Federal Home Loan Banks, and the Federal Farm Credit Banks—all financial institutions directly linked to the US government—on review for possible downgrade, along with some municipal and housing bonds supported or guaranteed by the US government.

UPDATE 45, Wednesday, July 13, 9:25 p.m. EST (Nick Baumann): Both sides in the debt talks are pushing their versions of an alleged breakdown in negotiations on Wednesday evening. Rep. Eric Cantor (R-Va.), the second-ranking Republican in the House, claims that President Obama “abruptly” and “angrily” walked out of the room as talks broke down. Cantor “suggested that all progress in the debt talks has been erased,” according to Taegan Goddard. Cantor also said Obama said, “Eric, don’t call my bluff. I’m going to take this to the American people,” which doesn’t make much sense because if you were bluffing, you wouldn’t encourage someone to call your bluff. Something must have been lost in translation there. A Dem source tells TPM’s Brian Beutler that Cantor’s account is “overblown,” and that Cantor interrupted the president three times about a temporary debt ceiling hike while Obama was wrapping up, and then Obama “shut him down.”

When different people in a private meeting are telling different stories, it’s nearly impossible to ascertain what really happened. In this case, that’s not a huge problem. All of this pyschodrama will probably lead the morning news shows and most stories in the non-financial media. It involves personalities rather than policy, so people find it more interesting. But it doesn’t really matter. The most important debt ceiling news today was 1) Moody’s potential downgrade of the United States’ bond rating and 2) the fact that everyone will be back at the negotiating table tomorrow. Almost everything else is window dressing.

UPDATE 46, Thursday, July 14, 2:50 p.m. EST (Andy Kroll): Not only do Democrats and Republicans vehemently disagree on what to include in a deficit reduction package, they’re not even close to consensus on what will happen if the nation’s $14.3 trillion debt ceiling isn’t raised and the country fails to pay all its bills on time.

A new Congressional Insiders Poll from National Journal reveals a wide gulf between Dems and GOPers on the severity of failing to raise the debt ceiling. Sixty-one percent of Democrats said the consequences would be “catastrophic,” but only 15 percent of Republicans agreed. Meanwhile, 44 percent of GOPers said the fallout would be “major” and 29 percent said it’d be “minor.”

UPDATE 47, Thursday, July 14, 3:47 p.m. EST (Siddhartha Mahanta): Sens. Harry Reid (D-Nev.) and Mitch McConnell of (R-Ky.) are working on a “hybrid” deficit deal in exchange for raising the debt ceiling before the Aug. 2 deadline, The Huffington Post reports. The plan, combining elements of an earlier framework hashed out in negotiations led Vice President Joe Biden and the compromise hatched by McConnell this week, includes $1.5 trillion in spending cuts over the next ten years and no revenue increases. It would allow President Obama to raise the debt ceiling in three separate installments over the coming months and into next year. But Obama will also be required to offer up additional spending cuts to go along with each increase. In this case, the total spending cuts would exceed the initial $1.5 trillion.

“The president…will be able to move the debt ceiling debate into 2013, albeit while having to hold a largely pre-determined vote for a second [debt ceiling] extension (once the $1.5 trillion in cuts run out) before the election,” HuffPo‘s Sam Stein reports.

The deal also creates a new commission of lawmakers charged with finding additional areas in the budget to cut costs. The commission’s recommendations would automatically be given amendment-free votes in both the House and Senate.

Republican and Democratic sources both told HuffPo that the hybrid plan is far from a done deal, as details over the final amount of cuts and the make up of the commission have yet to be negotiated. But that didn’t stop Sen. Chuck Schumer (D-N.Y.) from voicing support for it.

UPDATE 48, Friday, July 15, 1:10 p.m. EST (Siddhartha Mahanta): At a press conference on Friday, President Obama urged Republicans in Congress reluctant to agree to a debt deal to use the ongoing bipartisan negotiations as an opportunity to solve the nation’s long-term debt and deficit problems. Obama again made his case for ending tax cuts for the wealthy, cutting defense spending, reforming entitlements, and ending the ideological polarization that has stymied any progress on a deal.

“What is important is that even as we raise the debt ceiling, we also solve the problem of underlying debt and deficits,” he said, rebuffing recent talk of a plan hatched by Sens. Harry Reid (D-Nev.) and Mitch McConnell (R-Ky.) to raise the debt ceiling without directly addressing the deficit. “The American people expect more than that…[and that] we get our fiscal house in order.”

Obama, less scolding and combative than in past press conferences, said he hoped the negotiations with GOP leaders would soon deliver a “serious plan” that includes revenue increases and modest cuts to entitlements programs—largely through additional means testing in Medicare—that could save trillions of dollars. But he stopped short of committing to raising the retirement age and defended the sanctity of programs like Social Security and Medicare.

The president also took time out to remind Americans how the US arrived at the doorstep of potential fiscal disaster. “We cut taxes without paying for them over the past decade, [introduced a] prescription drug program that was not paid for, fought two wars, did not pay for them…had a bad recession that required a recovery act,” and introduced state aid programs, he said, all while interest on the debt continued to accumulate. “To unwind that, what’s required is that we roll back those tax cuts on the wealthiest individuals, clean up our tax code [and] cut programs that we don’t need, and…invest in those things that are going to help us grow.”

For the general public, Obama said, “this is not some abstract issue. These are obligations that the United States has taken on in the past. Congress has run up the credit card, and we now have an obligation to pay our bills.”

Obama also went out of his way to address his negotiating partners on the other side of the aisle. Recent polls, he said, show that Democratic and Republican voters alike support a balanced deficit reduction package. “A clear majority of Republican voters think that any deficit reduction package should…include revenues,” he said. Republican voters agree that “we should not be asking sacrifices from middle class folks who are working hard everyday.”

By way of solutions, Obama reiterated his support for an extension on the payroll tax cut included in last December’s tax deal as well as extended unemployment insurance benefits. Addressing specific cuts that have been part of ongoing discussions, Obama cited defense spending and curbing the growing cost of Medicare.

But cutting $2.4 trillion in discretionary spending—a number that has emerged in recent talks with Republicans—without increasing taxes on the rich effectively guts much-needed domestic spending, he said.

Obama brushed off reports that negotiations with Republicans earlier this week turned ugly, referring to a Wednesday meeting that included House Majority Leader Eric Cantor (R-Va.). Such reports, he said, “may be good for chatter in this town, [but they’re] not something folks in the country are obsessing about.”

Obama criticized the upcoming vote on the balanced budget amendment, which would freeze government spending and cap it at 18 percent of gross domestic product. “What you’re looking at is cuts of half a trillion dollars below the Ryan budget in any given year,” he said, referring to the budget proposal offered up by Rep. Paul Ryan (R-Wis.) in April. “We don’t need a constitutional amendment…we need to do our jobs.”

Ultimately, Obama argued, an ambitious spending package should be a political win for Democrats and Republicans alike. “If you care about making investments in our kids and making investments in our infrastructure and making investments in scientific research, then you should want our fiscal house in order.” That equally applied to his liberal base, Obama added: “If you are a progressive, you should be concerned about debt and deficits just as much as if you’re a conservative.”

UPDATE 49, Monday, July 18, 9:30 a.m. EST (Andy Kroll): Congressional Republicans may claim that their demand for trillions in spending cuts and refusal to consider tax increases is for the benefit of the country, but the American people simply do not agree.

According to a new CBS News poll, 71 percent of Americans disapprove of Congressional Republicans’ handling of the contentious deficit reduction negotiations with President Obama and top Democrats in Congress. What’s more, 51 percent of Republican respondents disapproved of their party’s position in the talks, while only 21 percent supported the strategies of House Speaker John Boehner, Senate Minority Leader Mitch McConnell, and House Majority Leader Eric Cantor. GOPers have demanded steep spending cuts to government programs, including Social Security and Medicare, in exchange for raising the US’ $14.3-trillion debt ceiling, the legal limit on how much the country can borrow at one time to pay its obligations.

Democrats earn somewhat higher marks from Americans for their party’s handling of the debt talks. Forty-three percent approve of the job President Obama has done, while 48 percent disapprove. Among Democrats respondents, 32 percent approve of Obama’s work, and 31 percent approve of the job Democrats have done.

It’s only one poll, but CBS News’ findings give Democrats new ammo to fight for a “balanced” deal—mixing spending cuts, tax increases, and closing tax loopholes. As for Republicans, it’s increasingly clear that they stand alone in demanding spending cuts and nothing else.

UPDATE 50, Tuesday, July 19, 9:05 a.m. EST (Andy Kroll): With President Obama and leaders in Congress at loggerheads over a deal to shrink the federal deficit and raise the nation’s $14.3 trillion debt ceiling, it’s looking likely that Senate Minority Leader Mitch McConnell’s last-ditch debt plan could move into the pole position in the heated negotiations here in Washington.

The Hill today quotes several Senate aides as saying that, while GOP leaders will continue to negotiate with Obama, they’re also looking to McConnell’s contingency plan as a compromise between Democrats and Republicans. McConnell’s plan would cut $1.5 trillion over 10 years and give Obama the authority to raise the debt through next year’s election.

The political calculus behind McConnell’s plan is clear: By making Obama send requests to Congress to increase the debt ceiling, the plan makes the president look like the big spender while giving Congress—which normally votes to increase the ceiling itself—the chance to disapprove of Obama’s request. If that happened, Obama could then veto Congress and still be able to raise the debt ceiling. McConnell is trying to have his cake and eat it too—that is, to avoid political damage and avert default.

Despite opposition from the far left and right, McConnell’s plan was accepted by leaders as a last-ditch option for Congress. Except now it’s looking more like the only option. Here’s the Hill:

But GOP aides say the leaders are already looking past those votes to a potential deal with Democrats to raise the debt limit before an Aug. 2 deadline and spare Republican lawmakers from a political backlash.

“McConnell is going to let cut, cap, and balance have its vote and then immediately move to plan B,” said a GOP aide in reference to the fallback debt plan McConnell is negotiating with Senate Majority Leader Harry Reid (D-Nev.).

Another Republican aide said McConnell’s contingency plan “has become plan A.”

Those aides join a growing chorus of lawmakers and Washington insiders who say a final deal will look like McConnell’s. When asked on Fox News Sunday about a final deal, John Podesta, who runs the liberal Center for American Progress think tank, said, “I don’t like it, but I think it is probably some version of McConnell, which is cut the deficit now by $1.3 or $1.4 trillion.” And on Monday, Sen. Dianne Feinstein (D-Calif.) said on MSNBC, “I see the Reid-McConnell bill as the only practical way forward.”

UPDATE 51, Tuesday, July 19, 2:24 p.m. EST (Andy Kroll): President Barack Obama said at today’s White House press briefing that a group of senators had offered a deficit reduction plan that he described as “very significant” and “broadly consistent” with the White House’s framework. The plan from the Gang of Seven, as Obama dubbed them, calls for reducing discretionary spending, trimming the defense budget, curbing entitlement programs such as Social Security and Medicare, and raising revenues. “For us to see Democratic senators acknowledge that we’ve got to deal with our long-term debt problem that arises out of our entitlement problems, and Republican senators to acknowledge that revenues will have to be part of a balanced package that makes sure nobody is disproportionately hurt by us making progress…is a very significant step,” the president said.

Obama said the White House had just received the Gang of Seven’s plan, adding that it “wouldn’t match perfectly” with the White House’s demands. But the president seemed to suggest the senators’ plan was a crucial development in the negotiations.

For the umpteenth time, Obama demanded that any deficit deal in exchange for raising the debt ceiling include both spending cuts and new revenues, possibly from closing tax loopholes or raising tax rates. Obama emphasized that time was running out for Congressional leaders to reach a deal, and said that Senate Minority Leader Mitch McConnell’s plan to allow the president to raise the debt ceiling remained a last-ditch option. “Our attitude is [the McConnell plan] continues to be a necessary approach to put forward in the event that we don’t get an agreement,” Obama said. “But we continue to believe that we can achieve more.”

The Gang of Seven’s plan calls for cutting the federal deficit by nearly $4 trillion over the next decade, including an immediate $500 billion “down payment” on deficit reduction. The plan would also slash defense and non-defense spending, “reform” the US tax code to save $1.5 trillion, and tackle Social Security reform on “a separate track” from deficit reduction. For the most part, though, the Gang’s plan is short on details, stipulating that the government “spend health care dollars more efficiently,” “change the debate about taxes in America,” and “reform” Social Security. We’ll share more details about the plan when we get them.

Here’s an outline of the Gang of Seven’s plan:

UPDATE 52, Thursday, July 21, 11:35 a.m. EST (Andy Kroll): It’s getting awfully lonely on Capitol Hill for House Republicans, who oppose raising the nation’s $14.3 trillion debt ceiling and so welcome the economic blowback that will ensue.

Here’s the state of play. Senate Democrats and Republicans are eyeing a compromise deal, whether it’s the Gang of Seven’s plan to cut $3.7 trillion from the deficit in 10 years or Minority Leader Mitch McConnell’s Plan B letting President Obama raise the debt ceiling in exchange for political cover heading into an election year. The White House, meanwhile, wants a deficit deal mixing spending cuts and new revenue. That leaves hard-right House GOPers on a lonely island of their own, refusing to compromise and increasing the prospect that the US might default on some its debts.

Those Republicans say voters’ mandate in 2010 was to shrink government and that their intransigence is really fulfilling that mandate. In reality, the opposite is true. Recent polls show that a majority of Americans want Washington politicians to cut a compromise deal in the deficit debate. Americans also strongly disapprove of the GOP’s handling of the debate, while rating Obama and Democrats’ handling significantly better. But, as the Los Angeles Times reports, the public sentiment has yet to sway to House GOPers:

The new class of freshman and their conservative allies in the House are not as responsive to party leadership as earlier generations of lawmakers. They openly profess more allegiance to each other.

“I’m fired up more than I’ve ever been that we truly are going to change the way business is done,” said Rep. Jason Chaffetz (R-Utah), a rising star of the conservative flank, as the House passed the debt ceiling package he sponsored.

The party’s enthusiasm for budget cuts over compromise may leave Republicans with less than they could have otherwise achieved. Obama had proposed a 3-to-1 ratio of spending cuts to tax increases, even carving into Medicare and Social Security while drawing opposition from within his own ranks.