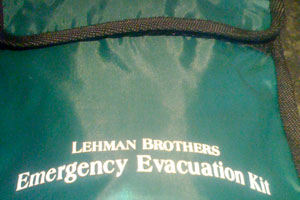

John Kasich, a former GOP congressman and onetime Lehman Brothers managing director, is running for governor of Ohio against incumbent Democrat Ted Strickland. He wants you to know he was just “one of 700” managing directors at the failed investment bank:

The fact that Kasich feels obligated to address his work at Lehman means that Strickland’s “He’s an outsider” attacks must be working. Eric Kleefeld says Kasich “clearly…wants to change the subject back to the bad economy.” The problem, of course, is that Lehman Brothers and the bad economy are inextricably linked in most people’s minds. So it’s going to be hard for Kasich to talk jobs without talking about his old one.

Clearly there’s plenty of blame to go around for the financial crisis. But the idea (promoted by Kasich here) that you had to actually be running Lehman to bear some responsibility for its behavior is madness. I know it really hurts bankers‘ feelings when people suggest that Wall Street might have, you know, played a role in its own near-collapse. But it’s true! And let’s be honest about what Kasich was doing when he was working for Lehman in Columbus, Ohio. While he spent most of his time working with the private sector, he clearly did some work trying to convince state pension funds to trust Lehman with their money.

It’s not even clear to me why state pension funds should be playing the stock market in the first place. Stocks clearly aren’t a safe bet (Ohio funds later invested at least $100 million with Lehman in unrelated deals), and people’s retirements are at stake. But state pension funds have a ton of money, and Wall Street banks like Lehman have a huge incentive to try to get the fees that come from investing that kind of money.

So a lot of the interactions between pension funds and Wall Street (or Wall Street’s middlemen) look kind of sleazy. The Wall Street firms (or their middlemen) hire former politicians or officials to talk up their old buddies (like they did with Kasich). Alternatively, they just go ahead and give big campaign donations to the politicians who oversee the funds—a move that even the SEC thinks looks a lot like pay-to-play.

Meanwhile, it’s abundantly clear that Kasich worries about Ohio voters knowing the full extent of the state’s Lehman losses. In June, the Associated Press obtained an email sent by a Kasich campaign employee in which the employee asked an Ohio pension fund executive to be sure to explain that “not all the money it lost was a result of the Lehman bankruptcy.” Lehman is Kasich’s albatross, and it’s not going away with one ad.