On Tax Day, Citizens for Tax Justice has released a report (PDF) rebutting a top conservative talking point: almost half of Americans pay no taxes, and the rich pay far more taxes than the rest of the country. They make this case for an obvious reason: to beat back calls for raising taxes for the well-to-do. But guess what? Their fundamental premise is not an accurate reflection of reality. Here’s how CTJ explains it:

Conservative pundits and media outlets have seized upon an estimate that 47 percent of taxpayers owe no federal income tax for 2009. This statistic has morphed into the claim by conservatives that “47 percent of all Americans don’t pay any taxes.” The conservative pundits are wrong. It’s true that many taxpayers don’t pay federal income taxes, but they still pay federal payroll taxes (and some federal excise taxes) and also pay state and local taxes. Most of these other taxes are regressive, meaning they take a larger share of a poor or middle-class family’s income than they take from a rich family. This largely offsets the progressivity of the federal income tax.

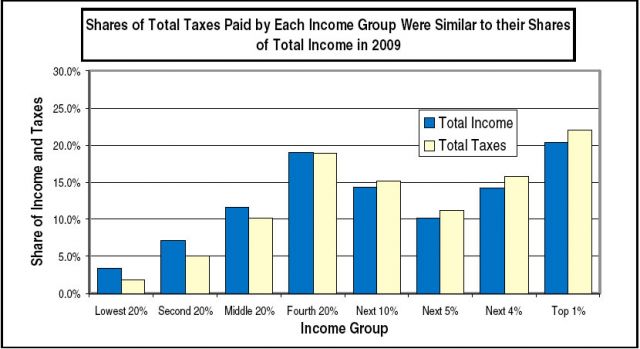

CTJ estimates that the share of total taxes (federal state and local taxes) paid by taxpayers in each income group is quite similar to the share of total income received by each income group in 2009. For example, the share of total taxes paid by the richest one percent (22.1 percent) is not dramatically different from the share of total income received by this group (20.4 percent).

Everyone in America pays some sort of taxes, which may take the form of income, sales or property taxes imposed by state and local governments, in addition to federal income, payroll and excise taxes.

For those of you whose eyes glaze over whenever someone talks tax rate policy, CTJ has whipped up a chart makes the case plainly:

You’ll note that folks across the spectrum carry a tax burden close to their share of total income. How fair. Measured this way, the rich do pay a slight bit more in taxes—a percentage point or two. But isn’t that patriotic of them? Let’s thank them and buy them an imported beer today.

You’ll note that folks across the spectrum carry a tax burden close to their share of total income. How fair. Measured this way, the rich do pay a slight bit more in taxes—a percentage point or two. But isn’t that patriotic of them? Let’s thank them and buy them an imported beer today.