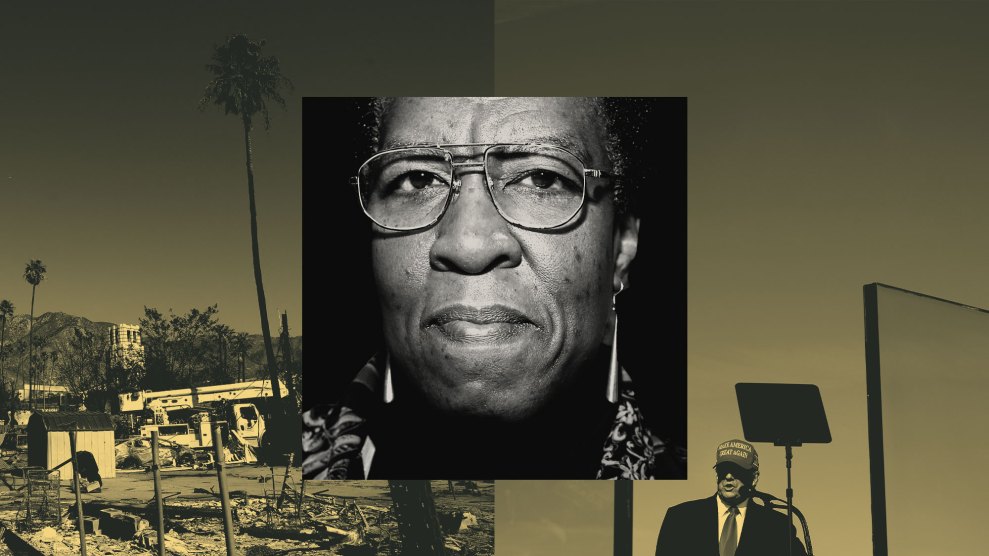

Photo: Mark Mahaney

I began needing drugs to stay alive one day in the early 1990s, though I did not realize it at the time. I was still a decade away from officially becoming an old person by US government standards, although I’d already started getting my mailings from aarp. I had spent the afternoon in the Plaza Hotel bar in New York City, meeting with an actor who’d said he wanted to make a film from a book I’d written. (To no one’s surprise, it never happened.) I’d had a few bourbons without eating anything, and afterward I stopped off at a falafel place. Then I began to vomit blood.

I went to the doctor. He gave me the first of what was to become a series of yearly tests, snaking a fiber-optic device down my throat to look at my upper digestive tract. He announced that I had Barrett’s syndrome, a dangerous precancerous condition in the cells of the lower esophagus, caused by years of acid reflux. But fortunately for me, the doctor said, there was a pill, still relatively new at the time, that could save me from a terrible fate—a little purple pill. With that, I became one of the millions of people who take Prilosec and a crop of other prescription drugs for acid reflux, stomach ulcers, and heartburn.

This was when I learned what it means to get old. You’re no longer like the average young person, who needs a course of antibiotics to cure a sinus infection, or painkillers for a sprained ankle. You have more in common with people who have life-threatening diseases like aids or cancer: Your access to the drugs you need may determine whether you will live another day, or another 10 years. Or it may determine whether you can see, or whether you can walk across a room. You will take pills until you die.

With that in mind, the question of what the government does to ensure America’s elders get their drugs takes on a significance of Darwinian proportions. And so, it was with more than professional interest that I followed President Bush’s push for a Medicare prescription drug plan in 2003—his signature health care initiative, and to date his only successful one. Congress passed the plan in a dramatic, clock-stopping session that November amid much media fanfare; two years later, I got a chance to try it out when I joined the 25 million people receiving benefits under what’s now known as Medicare Part D.

Part D offers a disturbing window on the future of health care. For conservatives, it represents the sharp end of the stake they hope to drive into Medicare at large, destroying the largest and best single-payer health care program this nation has ever known. For progressives, it demonstrates the vast shortcomings of any health program—no matter how “universal”—that fails to defy Big Pharma and the insurance companies. For myself, perhaps the key lesson from dealing with Part D has been that the new plan doesn’t have that much to do with ensuring drug access for seniors, but a great deal with securing the vested interests of the stakeholders—from the Bush administration and the pharma industry, all the way to groups like aarp.

prilosec was just the beginning of my life in pills. A few years after my esophageal cancer scare, a doctor encouraged me to consider antidepressants, and I grudgingly went to see the psychiatrist he recommended. A genial, heavyset man, he greeted me from a leather armchair that was tilted back into a reclining position so he could comfortably view his patient. Then he launched into a series of rapid-fire questions: Do you have trouble sleeping? Wake up feeling blue? Think bad thoughts during the day? Ever think of committing suicide? At the end of the interrogation he smiled broadly and said, “You’ve got 7 out of 10.” Turning on the electric motor in his chair, he winched himself upright and opened the door to a cupboard, revealing shelf after shelf of pill samples. He pulled out a package and said, “Here, see how this works.”

Like many people, I went through a string of antidepressants before settling on one with side effects I could endure—in my case, Wellbutrin. And like many people, I kept on taking it. The cdc reports that in 2005, antidepressants were the most prescribed class of drugs in the country, with nearly 118 million prescriptions written that year alone. US sales of antidepressants in 2006 topped $13 billion.

The elderly, unsurprisingly, make up an important segment of the antidepressant market. For some people, I suppose, getting old may be the glorious adventure that’s depicted in commercials for retirement investments. But for most of us, it’s actually pretty dispiriting: You feel lousy, your friends are sick or dead, and you worry about dying too—or running out of money before you do. In the United States, an estimated 5 million or more seniors—about 1 in 7—suffer from depression, and the elderly have a higher suicide rate than the general population as well. When it comes to treatment, of course, antidepressants tend to win out over costly psychotherapy sessions where we might find some relief talking about how rotten it is to get old. Between 1995 and 2004, according to a Department of Health and Human Services study, the number of antidepressant scrips written annually for patients over 65 more than doubled.

By the time I officially became a senior citizen, I was already taking two of the most prescribed classes of drugs in the United States. Then, while visiting France a few years ago, I suddenly felt a numbing in my left arm. I told the concierge at my hotel in Dijon, who swiftly called a doctor to my room. (She apologized profusely that because I was a foreigner, a house call would cost all of $50—on a Sunday.) The doctor said I was all right, but insisted that I go to the hospital nonetheless. I was quickly picked up by a miniambulance, admitted through the emergency room, checked out by doctors and specialists, and run through a CT scan and mri before being released six hours later with a bill for a little more than $200.

Back in the United States, my doctor agreed with the French hospital’s assessment that I’d probably had something called a transient ischemic attack—a tiny, passing stroke that leaves no permanent damage, but is a powerful warning sign of worse things to come. I must keep my blood pressure and bad cholesterol way down, he said, so I started taking Diovan for the former and Pravastatin for the latter. Among seniors, drugs for high blood pressure and heart disease are among the most widely prescribed, according to the cdc, as are cholesterol-lowering drugs, which have been another recent boon to drug companies, with $21.6 billion in US sales in 2006.

this, then, was my lineup when I signed on to Medicare at the beginning of 2006. Every day, I take four of the most common types of drugs used by people over 65. In addition, I take two kinds of expensive eye-drops for glaucoma, Cosopt and Xalatan. Without this cocktail, I would be blind and at an increased risk of having a stroke, developing esophageal cancer, and slitting my wrists. Now, my supply of these tiny kernels of survival would depend on Part D.

I had looked forward to going off private insurance and on Medicare: no more searching for in-network doctors, or getting precertified for routine procedures. Medicare is a far cry from Europe’s national health care systems—besides being primarily for old people, it has significant monthly premiums (for most, $96.40 in 2008), deductibles (including $1,024 for hospital stays), and copays. Yet it’s like those systems in that it’s basically a single-payer setup, in which the government pays providers to take care of patients.

But there’s a big difference between the original Medicare program and the new prescription drug plan, a difference that reflects the times in which each came to be. Original Medicare grew out of Harry Truman’s post-World War II calls for national health care. The program was debated for 20 years, and finally created (along with Medicaid for the poor) under Lyndon Johnson in 1965, against the wishes of the American Medical Association and much to the chagrin of conservatives, who ever since then have been looking for ways to dismantle what they see as a dangerous step toward socialized medicine.

Medicare, which in 1972 was expanded to cover disabled people under 65, did not include a prescription drug benefit—but in the ’60s and ’70s, drugs were cheaper and less crucial to treatment, even for seniors with chronic conditions. Since then, drug spending has risen steadily: Most years in the 1980s and 1990s saw double-digit increases, far outstripping inflation rates or even the rise in overall health care costs. Yet efforts to add any version of single-payer drug coverage to Medicare—most recently, as part of Hillary Clinton’s doomed 1993 Health Security Act—have consistently failed.

In fact, some have argued that Medicare not only can’t handle added benefits, but must essentially be destroyed in order to save it: Only some form of privatization, conservatives say, will prevent this foolhardy entitlement program from going bankrupt. In 1995, the Heritage Foundation launched a $30 million media campaign about Medicare reform. The foundation proposed a market-based system, modeled on the Federal Employees Health Benefits Program, in which the government would subsidize private insurance and managed-care companies in providing benefits.

While this public-private model has not yet succeeded in replacing Medicare, it did find expression in the new drug benefit. Part D is not in fact an entitlement program; it really isn’t even a benefit provided by the government. It’s a program subsidized (and nominally run) by the government in which people buy prescription drug insurance policies provided by private companies.

That public-private model didn’t mute the right’s opposition to Part D: After all, conservatives had proposed this notion in order to reduce existing benefits, not to add new ones. Some have never forgiven Bush for supporting Part D, and still aim to dismantle it. (In an especially cynical move, in 2005, the Republican Study Committee, a group of congressional budget slashers, proposed postponing implementation of the Medicare drug program in order to pay for Katrina relief.)

The pharmaceutical companies also flatly opposed Part D in the early stages of its development, which occurred during Bill Clinton’s final years in office. But the pharma giants later had a sort of epiphany, realizing that the industry’s real enemy wasn’t a Medicare drug plan per se; in fact, as long as it was executed on their terms, such a plan actually stood to increase drug sales. By the time Bush’s Part D proposal rolled around, explains Paul Precht, deputy policy director of the nonpartisan Medicare Rights Center, “the pharmaceutical industry said, ‘We won’t oppose it, but there has to be privatized delivery.'”

As Congress debated what was to become the Medicare Modernization Act of 2003, drug companies, insurance companies, hmos, industry trade associations, and advocacy groups spent more than $140 million on lobbying and deployed at least 952 lobbyists, according to a 2004 Public Citizen report. Their biggest priority: to prevent a system in which the government had the power to negotiate drug prices, as it does in purchases for the Department of Veterans Affairs, the Department of Defense, and the Public Health Service.

It worked. “Drug company lobbyists were unbelievably successful in getting a sentence put in the legislation saying the government cannot negotiate or set prices,” notes Dr. Sidney Wolfe, director of Public Citizen’s Health Research Group. “And once you had that, it became pure privatization, a free-enterprise system.”

Yet in this marketplace system, the government submits to terms that no private business would accept. Like any health plan, Medicare now negotiates what it will pay hospitals and doctors, Wolfe notes; why not do the same for drugs? “This is just chickenshit behavior on the part of the Congress. They just bowed over to the pharmaceutical industry.”

Under the 2003 law, prices and “formularies”—the lists of which drugs are covered according to different “tiers” of coverage—are set by the individual companies that offer Part D plans. Each company makes its own deals with drug manufacturers for discounts in the form of rebates (to the companies, not the consumers). There’s little real competition among these insurers, and to the extent they are able to squeeze discounts out of the manufacturers, they go straight to their bottom line—not to consumers. In an investigation last October, the House Committee on Oversight and Government Reform found that the discounts negotiated by private plans reduced overall drug spending by only 8 percent in 2007; in contrast, the Medicaid program, where the government buys drugs directly, cuts costs a full 26 percent via rebates.

In fact, one of the Medicare Modernization Act’s biggest handouts to the drug industry was its reclassification of 6.2 million low-income elderly and disabled people who had been receiving drug coverage through the Medicaid program. The new law forced these people into Part D; now the government subsidizes the same drugs at higher prices. According to the 2007 House report, that change alone stood to increase drug company profits by an estimated $2.8 billion in 2007.

people talk about the red tape of government bureaucracies, but dealing with true government-run programs like Social Security and original Medicare is child’s play compared to navigating the miasma created by the “marketplace” of Part D. On the government website that introduces the plan, the headline reads, “America, Pull up a Chair. We’ve Got Something Good to Talk About.” That’s an upbeat way of saying that most oldsters don’t have an ice cube’s chance in hell of understanding this thing on their own.

When I signed up for Part D, I was in my 60s with my faculties reasonably intact, computer literate, and lucky enough to have friends who were doctors and consumer advocates. I still didn’t have a clue how to choose from among the 52 Medicare prescription drug plans offered by about 20 different companies in the District of Columbia. Their monthly premiums ranged from about $15 to nearly $100, their yearly deductibles from $0 to $275. And that was the simple part. More important, and way more complicated, was the matter of whether each of my particular drugs was on their formulary lists, which would determine the size of my copayments. To really find out which was the best plan for me, I would have to look up each of my six maintenance drugs on various plans’ formularies, figure out the annual cost of my copayments, and add this number to the annual cost of the plan’s premiums and deductibles. In other words, I’d need a spreadsheet.

So I gave up. That is, I turned to aarp. Something has always annoyed me about the group, whose mailings depict old age as something enjoyed by good-looking people whose dentures sparkle as they dance the tango or race along the coast in a convertible, one hand on the wheel and the other holding a frosty can of Ensure. Absent are any shots of old folks eating ramen noodles so they can afford their blood pressure meds. But aarp‘s real loss of credibility came with its last-minute support for the flawed Medicare drug plan, which its ceo—who once ran a PR firm representing major health care industry clients—declared to be “not a perfect bill, but America cannot wait for perfect.”

With 39 million dues-paying members and a building that occupies almost an entire block in downtown Washington, you’d think aarp could have waited for something a little bit closer to perfect. But the organization also stood to make a bundle off a program run through private insurers. For years now, aarp has been as much a health plan as an advocacy group; according to a report by Physicians for a National Health Program, in 2002 $160 million—a quarter of aarp‘s annual income—came from insurance-related sources, most of it in the form of aarp-branded policies marketed by private companies. The group’s revenue from similar partnerships in the prescription drug program could reach into the billions over the coming decade, the report found.

But aarp has one thing going for it: human beings manning its telephones—pleasant and endlessly patient human beings, willing and in most cases able to answer every question and explain every minute point. I signed up for their midpriced Part D plan—and, it turns out, so did a lot of other people.  When the prescription drug benefit went into effect, there were about 90 companies offering some 3,000 plans. By the end of the open enrollment period for the second year of Part D, UnitedHealth—whose most popular plan is offered through aarp—had the largest market share, with 27.6 percent. The other market leader was Humana, with 20.6 percent; all others had 7 percent or less.

When the prescription drug benefit went into effect, there were about 90 companies offering some 3,000 plans. By the end of the open enrollment period for the second year of Part D, UnitedHealth—whose most popular plan is offered through aarp—had the largest market share, with 27.6 percent. The other market leader was Humana, with 20.6 percent; all others had 7 percent or less.

For me, aarp‘s MedicareRx Plan cost $26.40 a month last year, with no deductible. Fortunately, three of the six drugs I take are generics, which cost only $6 a month under the plan. Two are “preferred” brand-name drugs on aarp‘s formulary, which cost $28 a month. One of the two kinds of eyedrops I need is “non-preferred,” so it costs $69.10. My total monthly cost, for premium plus copays, was $169.50. It’s more than I paid in the past, but it could be worse—if, for example, I were poor, but not poor enough for Part D. To qualify for any subsidy of your Part D premiums and copayments, your income must be less than 150 percent of the federal poverty level, or $15,600 for an individual.

I’m also lucky that only one of my essential drugs is not on my insurer’s “preferred” formulary—though that could change at any time. The price I’m charged by my insurer is based on a “list price” developed by the manufacturer, explains the Medicare Rights Center’s Precht, and manufacturers can change this list price at any time without warning. By law, plans must report the net prices they pay (the list price minus any rebates) to Medicare, but not to consumers; since both insurers and drugmakers have a vested interest in maximizing their take from government coffers and old folks’ pocketbooks, this means zero transparency exactly where it is needed most.

Further, according to Precht, the plans are counting on the fact that most old people will not, or cannot, shop around for a new plan every time one of their drugs’ prices or their premiums go up. (The Center for Economic and Policy Research says premiums increased 25 percent this year alone.) “The senior market is viewed as sticky,” he says. “Older people tend to want to stick with their plans,” many of which “start off with a low premium and then the price goes up.”

For 2008, my own monthly premiums are $32.50—an annual increase of $73.20 since last year. My total copays have gone up about $14 a month. But all in all I’d be doing okay—if it weren’t for “the gap.”

The gap is also known as the doughnut hole, and it works like this. Whatever Medicare Part D plan you choose, you receive coverage up to the “initial coverage limit,” a threshold based on the full cost of the drugs you’ve received (not your copay amount). In 2007, the standard was $2,400; in 2008, it’s $2,510. After that you’ll have to pay full freight for your drugs until you reach yet another level of spending, at which point Part D’s “catastrophic” coverage kicks in. And guess what: According to the 2007 House oversight committee report, when beneficiaries are in the doughnut hole and paying full price, they don’t benefit from the rebates regularly offered by pharmaceutical companies to insurers; instead, the companies pocket the discounts. Last year, according to the report, Part D insurers stood to receive a billion dollars in rebates on drugs that seniors had actually paid for on their own.

Most of the people who fall into the doughnut hole—4.2 million in 2006, the last year for which numbers were available—probably have no bloody idea when the big plunge is coming. I certainly didn’t. But then it happened, last August: Suddenly, my three $6 generic drugs cost $28.03, $29.00, and a whopping $106.29 for the generic version of the antidepressant Wellbutrin. My $28 drugs were now $33 and $61, and even my expensive “non-preferred” drug went up a few dollars. And I still had to keep paying my plan premiums. My monthly costs more than doubled, from $169.50 to $357.76.

Like a lot of people who fall into the doughnut hole, I’m never going to get out. The year ends before I reach the required out-of-pocket cost, and then the whole cycle starts over again. I could switch to a plan that offers gap coverage—but those are expensive and generally limit their coverage to generics. In 2007, 92 percent of enrollees in stand-alone Part D drug plans had no coverage in the gap.

Fortunately, I can afford to pay $357.76 a month for four or five months to get the drugs I need. It pinches my budget, but won’t overwhelm it, especially as long as I keep working. But that’s not true for everyone.

What would I do if I couldn’t afford my drugs? Where would I cut back? The antidepressants are the most expensive, so I could stop taking those. I’d feel shitty, but since I’ve never actually been suicidal, at least it wouldn’t kill me. I could take my chances on giving up my acid-reflux drugs, since only a fairly small percentage of people with untreated Barrett’s syndrome actually develop esophageal cancer. I’d rather starve than give up my glaucoma meds. How many old people in the United States are facing these choices today? And now ask yourself: How many old people face similar dilemmas in France, or Japan, or Australia?

you start to wonder whether it’s worth joining Medicare Part D at all. According to my calculations, in 2007 I spent $2,975 on drugs and premiums. If I didn’t have a drug plan, I would have spent $3,976. So being on Medicare Part D saved me just $1,001.

I could have saved a lot more just by being Canadian. A 2004 analysis by the Health Reform Program at Boston University’s School of Public Health found that drugmakers’ US prices for brand-name drugs were 81 percent higher than the averages in Canada and six European countries. If the United States instituted the same policies (primarily, strict government price controls) that help force drug companies to sell their products to Canadians for 30 to 50 percent less, many American seniors could have no prescription plan at all, and still pay less than they do now. And the federal government could save itself the estimated $723 billion that Part D will cost during its first 10 years.

As it stands, investigators for Rep. Henry Waxman (D-Calif.) have found that in the six months after Part D went into effect, profits for the 10 largest drug companies increased a total of $8 billion—on average, 27 percent. The House oversight committee estimated insurance companies’ 2007 profits from Part D would be $1 billion. As for the efficiency of the marketplace, according to the committee, “the administrative expenses, sales costs, and profits of the privatized Part D program are almost six times higher than the administrative expenses of traditional Medicare.”

None of the health care advocates I have spoken with expect to see much improvement anytime soon. Democrats tried to pass a bill allowing the government to negotiate drug prices in Part D last year, but couldn’t pull together the 60 votes needed to move it through the Senate (and Bush had promised to veto it regardless). Another mild reform involves letting the federal government offer its own drug plan under Part D; the public option likely would be a little cheaper for seniors, and the competition could curb some of the private plans’ price increases. But unless the prices of the drugs themselves are lowered, advocates believe, the savings will not be significant. Narrowing the doughnut hole is another option: Edwin Park, senior fellow at the Center on Budget and Policy Priorities, says Congress could elect to start catastrophic coverage quicker, but that would cost money.

None of these measures addresses the core weakness of the program—its obligations to the insurance and drug industries. Medicare Part D is a small-scale model of just the kind of system some Democrats, including Barack Obama, now propose—a government-subsidized health insurance plan, one that preserves the profits of private middlemen at a high cost to citizens’ and government coffers.

For conservatives, meanwhile, the goal is to take Part D as a model for the rest of Medicare—and they’ve already made some inroads. The 2003 law that established Part D contains a “demonstration project” beginning in 2010 that will require Medicare to compete with private plans (which, via a complicated pricing formula, will be rigged to have lower rates) in six metro areas. This is meant to be the model, the seed that will grow into the Brave New World of privatized Medicare.

Back before the drug bill passed, the senior advocacy group Gray Panthers saw the writing on the wall and denounced the legislation as “bait in an insidious strategy to undermine traditional Medicare and convert it into a private industry using taxpayers’ subsidies to pay for it.” They were right, and the way things are going, I may yet live to see it happen—as long as I keep taking my drugs.