In attempting to persuade voters that Obama is not American enough to be president, the right has renewed charges that he is a socialist in sheep’s clothing. Their newest claim that an Obama presidency would usher in an era of “wealth redistribution” seems a thinly veiled attempt to associate Obama with history’s socialist revolutionaries and communist dictators.

In attempting to persuade voters that Obama is not American enough to be president, the right has renewed charges that he is a socialist in sheep’s clothing. Their newest claim that an Obama presidency would usher in an era of “wealth redistribution” seems a thinly veiled attempt to associate Obama with history’s socialist revolutionaries and communist dictators.

But before you start worrying that Obama will take your money and impose socialist redistribution mandates, it’s worth taking a moment to scrutinize the basis for the right’s hackneyed accusations.

According to an analysis by the technically non-partisan Tax Foundation, which has been called out in the past for propagating misleading information, Obama’s income-tax plan would “redistribute more than $131 billion per year from the top 1% of taxpayers to all other taxpayers.” They conclude by asking if such policies were enacted, what would be the “consequences for our democratic system”?—a not-so-subtle insinuation that an Obama presidency could be ruinous for America’s cherished democracy.

Similarly, an op-ed in this week’s Wall Street Journal asserts that IRS data due out in a few weeks will likely show that “the richest 1% of tax filers will have paid more than 40% of the income tax burden.” The WSJ argues that unfair tax increases on the wealthy will dampen economic growth as it leads to “reduced work and investment,” and the “redeployment of money into tax shelters” (something McCain adviser Phil Gramm may know something about).

Yet, upon closer inspection, these analyses prove deceptive. “Focusing on income taxes alone is cheating,” explains UT economics professor James K. Galbraith, a featured writer in our current issue and author of the upcoming book The Predator State. “The very rich shoulder a very small proportion of the payroll tax,” Galbraith told me, “and their share of sales taxes and property taxes is much smaller, as a share of income, than it is for poorer people.”

“Why are the very rich shouldering such a large part of the income tax burden?” Galbraith rhetorically asks. “Easy—they are very much richer than they ever were before. The income tax merely evens things out a bit.”

Galbraith also refutes the WSJ‘s argument that increasing taxes on the wealthiest Americans will hinder economic growth, insisting that “there is absolutely no serious evidence that higher tax rates on the wealthy has adverse effects on investment or work effort.”

As we face skyrocketing fuel costs, plunging housing prices, and a stuttering job market, it’s not the ordinary American’s who deserve to be called “whiners.” But, quips Galbraith as he considers those complaining about Obama’s so-called “wealth redistribution” plans, “the word certainly describes the McCain chorus at the Wall Street Journal.”

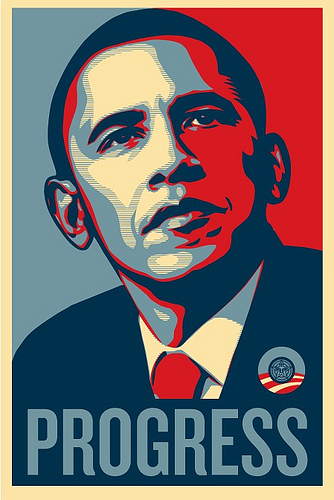

Photo used under Creative Commons license.