Jemal Countess/Getty

Update, June 1: In a 52-46 vote, the Senate passed a resolution to overturn Biden’s student debt cancellation plan. The bill now heads for the president’s desk. He has already vowed to veto it.

If you’re one of more than 43 million people with student loan debt in the United States, you may soon be forced to start repayments once again. On Wednesday, the House passed a deal to raise the debt ceiling, which includes a provision ending the pandemic-era pause on student loan payments. The agreement now heads to the Senate where lawmakers on both sides of the aisle hope to pass it by late Friday.

So what do borrowers need to know? If the deal passes in its current form, repayments and interest accrual will kick in at the end of August. That’s roughly the same time the Biden administration had previously said that the federal pause would finally end after more than three years, eight extensions, and two presidencies. But those hoping for another last-minute extension this time around are out of luck; the debt ceiling agreement specifically blocks President Biden from issuing one without congressional approval.

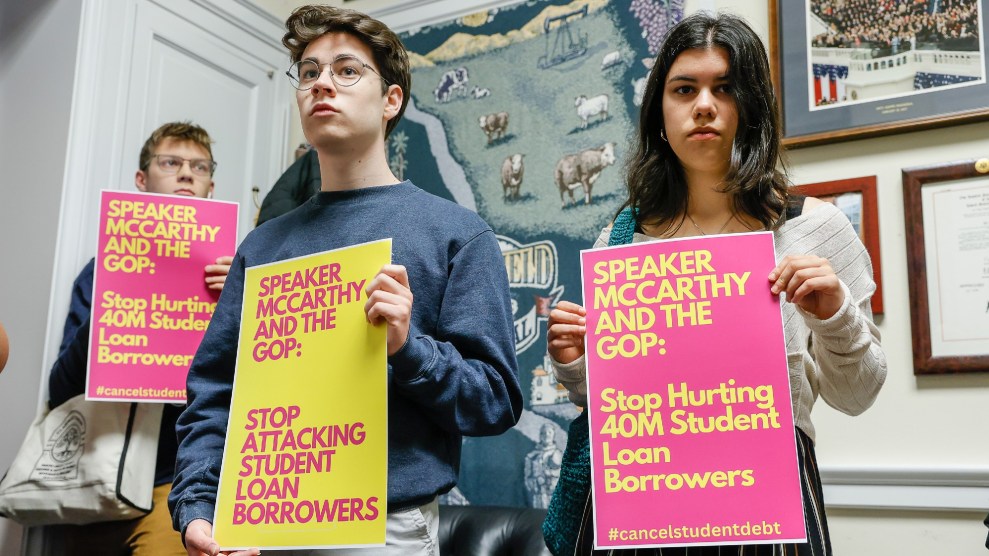

Biden’s plan to cancel student debt—something House Republicans sought to kill in an initial debt ceiling draft—was spared, and the proposal to eliminate $20,000 worth of debt for Pell Grant recipients and up to $10,000 for borrowers who earn less than $125,000 a year remains in the hands of the Supreme Court. Court observers, as my colleague Hannah Levintova reported, are pessimistic that student loan forgiveness will survive the high court’s conservative majority. And even if justices do allow Biden’s plan to continue, future legal challenges are expected. There is, however, a whole other Republican-led measure seeking to repeal the student loan forgiveness plan that just advanced in the Senate. But Biden has vowed to veto it.

If all this sounds confusing, rest assured, you’re not alone. Both the debt ceiling provision and the upcoming high-stakes Supreme Court ruling are all but certain to add to the general confusion over repayments. One thing that isn’t confusing, however, is the immense relief that would affect countless lives if student loan forgiveness actually wins.