Rudy Torres/Avalon/Zuma

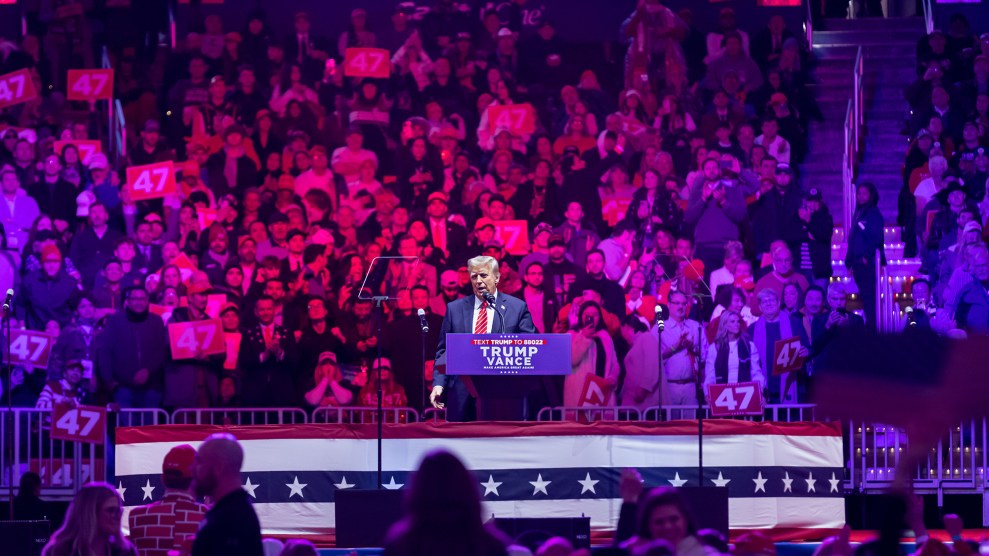

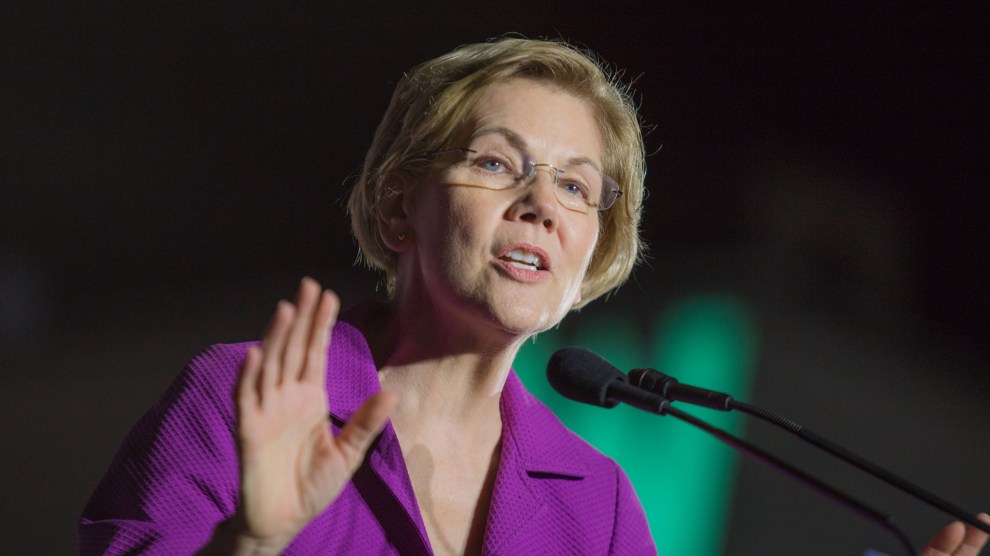

The wealth tax lives. On Tuesday, Sen. Elizabeth Warren (D- Mass.) said her “first order of business” in the Senate would be to introduce legislation to follow through on her signature campaign promise: a 2 percent tax on fortunes above $50 million. “It is time to make the ultra-rich pay their fair share,” she said.

The tax would, estimates indicate, only hit 75,000 households. With it, “we could provide universal child care and universal preschool and raise the wages of every child care worker and preschool teacher in America,” Warren said on MSNBC. “We could put money into K-12. We could make post-high school education—two-year-college, four-year-college, technical school—tuition free.”

My first order of business on the @SenateFinance Committee – the committee that leads tax and revenue policy in the Senate – will be to introduce legislation for a #WealthTax on fortunes above $50 million. It is time to make the ultra-rich pay their fair share. pic.twitter.com/IccP6do57y

— Elizabeth Warren (@SenWarren) February 2, 2021

Warren, who will join the Senate Finance Committee, did not introduce any specific legislation, but it will likely reflect the much-debated policy she touted on the campaign trail. The wealth tax takes a snapshot of assets—including homes and overseas holdings—to levy a tax (with the IRS taking the lead on assessing net worth), according to Warren’s memo. It only affects wealth above the $50 million threshold. If an individual held assets at $60 million, it would only tax 2 percent of $10 million. Warren’s plan also calls for beefing up the IRS to ward off tax evasion.

Think of it this way: Even if Jeff Bezos isn’t making an income as Amazon’s CEO, he’d still have to pay a tax on his roughly $200 billion fortune. One of the authors of Warren’s tax plan, Gabriel Zucman, noted another coincidence:

Remember when one of the main arguments some people made against a wealth tax was, "oh, but Jeff Bezos would work less hard"?https://t.co/8hRO6lAip6

— Gabriel Zucman (@gabriel_zucman) February 2, 2021