Marco Piraccini/Zuma

Over the past four decades, private equity has become a powerful, and malignant, force in our daily lives. In our May+June 2022 issue, Mother Jones investigates the vulture capitalists chewing up and spitting out American businesses, the politicians enabling them, and the everyday people fighting back. Find the full package here.

What do Beyoncé, Journey, the Chainsmokers, and Blondie all have in common? They all have songs owned by private equity!

PE is a multitrillion-dollar industry that has gobbled up everything from the hospital your mom works at to the local newspaper your grandpa used to read every Sunday, and yes, even your favorite songs.

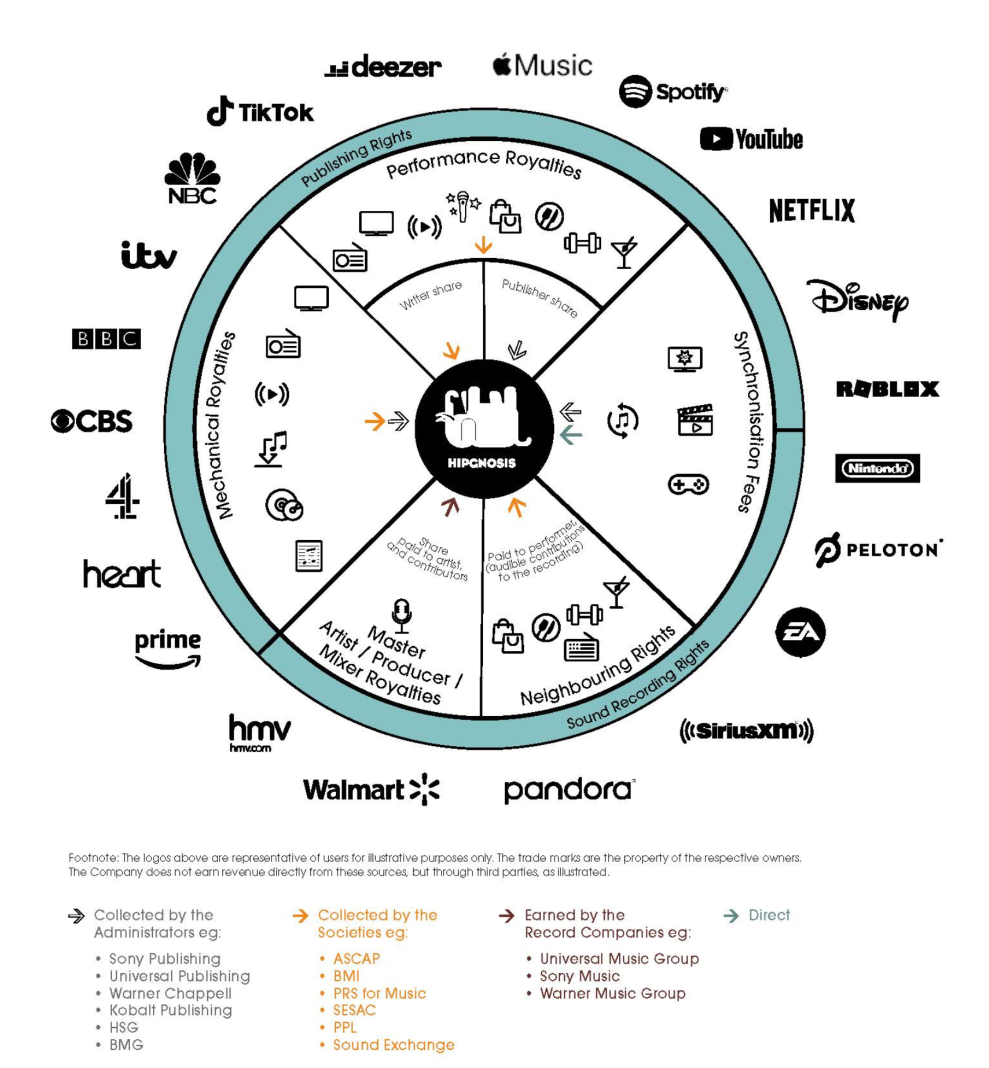

The way song rights work can be byzantine, especially in the streaming era. But taking a look at one firm’s holdings can explain the money machine at play. One of the larger music-focused firms is the UK-based Hipgnosis Songs Fund. Their business model, according to the firm’s founder, is that they buy the intellectual property rights to bulk sums of popular music, claiming 50 to 100 percent of royalties that comes from streaming, commercial, and artistic music placement. Hipgnosis claims to own the rights to over 60,000 songs, equating to over 2.2 billion dollars, according to a report from the Guardian. Among those thousands of songs, there are tons you’ll probably recognize: “Toxic” by Britney Spears, “Don’t Stop Believin'” by Journey, “Single Ladies” by Beyoncé, and “Runaway” by Kanye West. There’s even a handy chart on Hipgnosis’s site to illustrate just how they make this happen:

Now, private equity owning an artist’s music is not, necessarily, a bad thing. As the chart points out, they and their collaborators can still make money. While many of these deals are protected by airtight NDAs, the deals can be 10 to 20 times the catalogs’ annual income, according to the Guardian. And some artists are eager to make money off their music this way—particularly the songwriters, who receive an abysmal percentage of streaming royalties. But sometimes, private equity can get in the way of an artist’s life’s work. The most famous example is Taylor Swift. When mega-manager Scooter Braun sold Swift’s master recordings to Shamrock Holdings he essentially iced Swift out of owning her own work, choosing to do the deal with the firm over the artist.

And it’s just one tentacle of the giant capitalist squid that is private equity. For more, check out editorial fellow Arianna Coghill’s TikTok explainer:

@motherjonesmag My fellow #swifties will never forget 😤😤 #beyonce #justinbieber #taylorswift #music ♬ This Love (Taylor’s Version) – Taylor Swift