The Earned-Income Tax Credit is one of the largest social welfare programs run by the federal government. It’s available only to people who work—primarily those with children—and takes the form of a tax refund that generally amounts to a few thousand dollars each year.

Conventional wisdom has long held that the EITC motivates people to work, but a new study suggests this isn’t so. Dylan Matthews says today that this undermines conservative support for the program:

Conservatives and business interests have long grudgingly tolerated or outright supported modest expansions of the EITC because of its tie to work: It isn’t welfare, but an earned benefit that helps the economy by increasing labor force participation. If it doesn’t help labor force participation, that rationale goes away.

Let’s unpack this a bit. What it means is that the business community likes the EITC because they think it increases the size of the labor force. This in turn pushes wages down. In other words, part of the EITC is captured by corporations: they get to cut wages, which are are then made up by the EITC.

As you can imagine, this is a black mark against the EITC among liberals. Why should corporations end up getting a piece of a program meant to help the poor? If, instead, it turns out that the EITC has little impact on labor force participation, that’s a good thing. It means that the poor are getting 100 percent of the benefit.

Back in the days of old, this would probably be a net political negative: maintaining bipartisan support is a good thing even if it costs a bit in terms of help for the working poor. But these are not the olden days, and there hasn’t been bipartisan support for the EITC in ages. So I’d call this unalloyed good news if it’s true. It means the EITC’s benefits are going exactly where we want them, and we could even sever the connection to work if we wanted to. Republicans wouldn’t support this, but so what? They wouldn’t support it anyway.

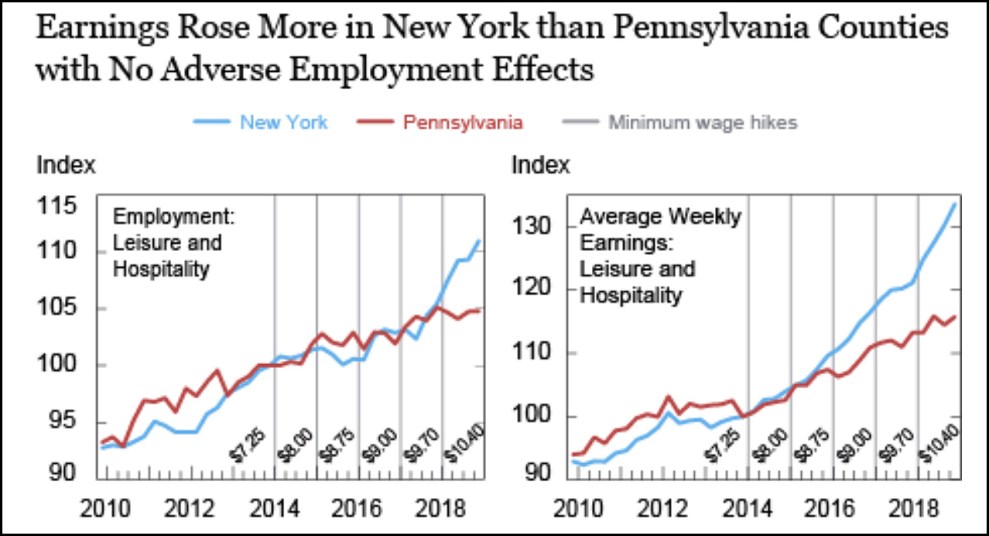

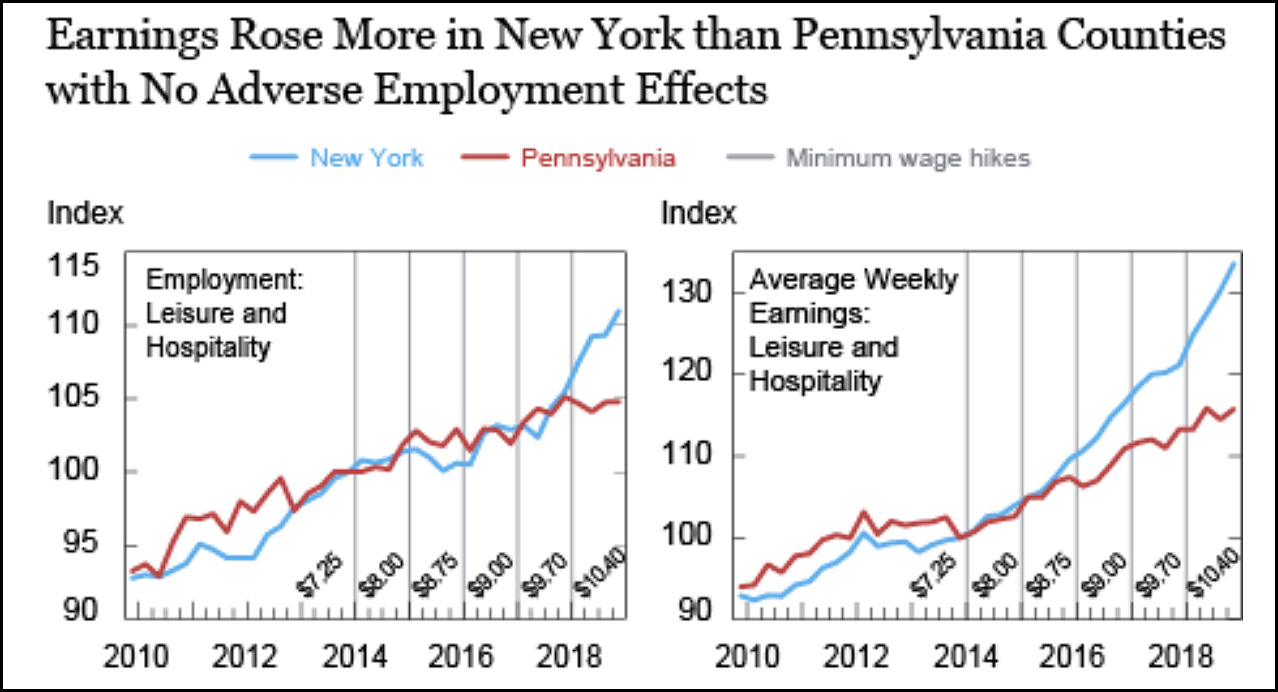

In other semi-related news, the New York Fed recently completed a detailed study of minimum wage hikes in New York state. There have been loads of similar studies before, but most of them have focused on fairly small changes in the minimum wage, which still leaves us in the dark about the effect of larger changes. This study, however, tracks a minimum wage increase of nearly 50 percent over the course of six years by comparing border counties in New York (which saw an increase) with those in Pennsylvania (which didn’t). Here’s the result:

As the authors says, New York’s minimum wage increase “appears to have had a positive effect on average wages but no discernible effect on employment.”

This is tentatively good news for the $15 minimum wage campaign, since it suggests that even sizeable increases in the minimum wage don’t reduce employment. Keep in mind, however, that it’s still tentative for at least two reasons. First, it’s just one study. Second, it took place entirely during an economic expansion. The effect of a big minimum wage increase might be quite different during a recession.

Bottom line: it appears that both the EITC and the $15 minimum wage are pretty good programs for helping the working poor. What’s more, both have different pluses and minuses and they complement each other pretty well. Given what we know, progressives ought to support them both.