David Lazarus complains this morning about sneaky fees:

Take a close look at your receipt the next time you buy some tunes at Amoeba Music in Hollywood. You’ll see a 35-cent charge tacked on for “wages & benefits.” That’s not a state or local tax. It’s the company simply reaching a little deeper into your pocket to cover its costs of doing business.

Chris Carmena, Amoeba’s general manager, told me the 35-cent charge helps defray expenses related to minimum-wage requirements, paid sick leave and workers’ healthcare. “It obviously doesn’t cover all of our costs,” he said, “but it helps.”

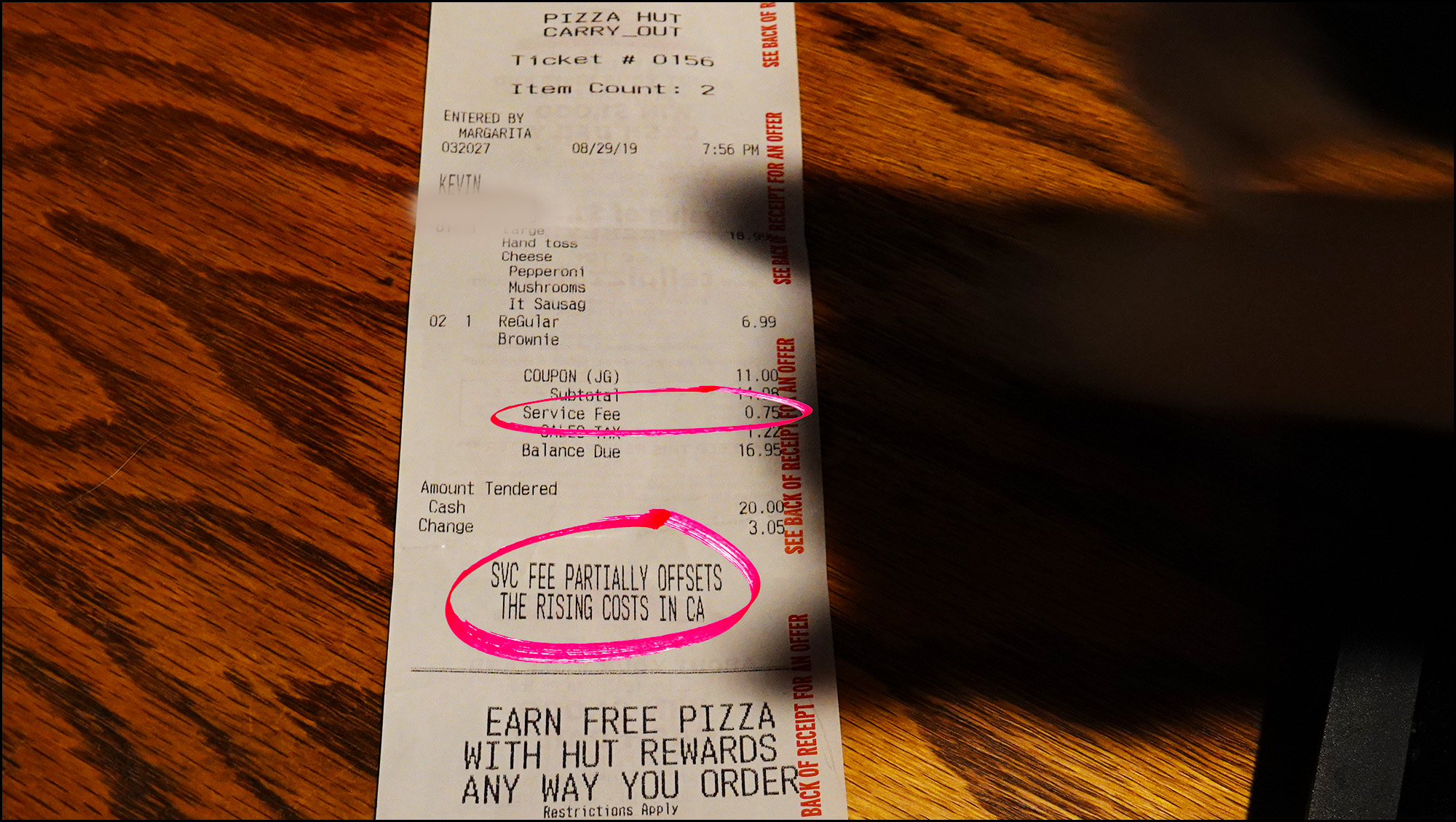

Funny he should mention that. Last night we got a large 3-topping pizza from Pizza Hut for only $7.99. What a deal! Except that it included a 75-cent fee to defray “the rising costs in California.”

Cat shadow, as usual, is shown for scale.

Kevin Drum

Well, I have no doubt that costs are rising in California, though no particular new reason comes to mind at the moment. And at the very, very least, Pizza Hut should give us some warning of this fee on their website.

Aside from random griping, though, my real reason for posting this is to find out if the Hut is doing this elsewhere. I’m sure that some of you are willing to admit to buying pizzas from Pizza Hut (ours was, ahem, just an experiment). Has anyone from other states seen a similar fee?

UPDATE: Apparently I’m behind the curve on this. Here’s a recent op-ed from the OC Register:

In 2015, the state mandated that employers give their workers three days a year of paid leave….Then in March 2016, on the Saturday before Easter, Gov. Jerry Brown cut a backroom deal with labor union leaders and state lawmakers to ratchet up the minimum wage in California to $15 an hour by 2023 for smaller employers, and by 2022 for larger ones.

….“Due to a myriad of legislative and court decisions, some restaurants in California have elected to add a surcharge to their receipts to defray increased costs incurred over the last several years,” begins an article on the association’s website titled, “Understanding and Guidance on Surcharges.” The tone is matter-of-fact. “The increased costs of operating a restaurant can be attributed to minimum wage increases, health care, paid sick leave, restrictive scheduling, cost of food and supplies and increased pay equity between traditionally tipped employees and heart of the house employees.”

The article offers advice on how to calculate taxes correctly and how to avoid getting sued by a city attorney, such as the one in San Diego who filed a slew of cases in 2017 charging some surcharging restaurants with false advertising and consumer fraud. Last November, a San Diego Superior Court judge ruled in one of these cases that “the surcharge is not unlawful as a matter of law.” Similar rulings followed in similar cases.

….Stephen Zolezzi, CEO of the Food and Beverage Association of San Diego, said in 2018 that surcharges allow the restaurant industry to send a message.

“Yes, it’s a political statement,” he said. “We’re trying to show people the consequences of legislation that adds to the cost of doing business.”

I’m still curious if this is becoming common in any other states. Or is it just California?