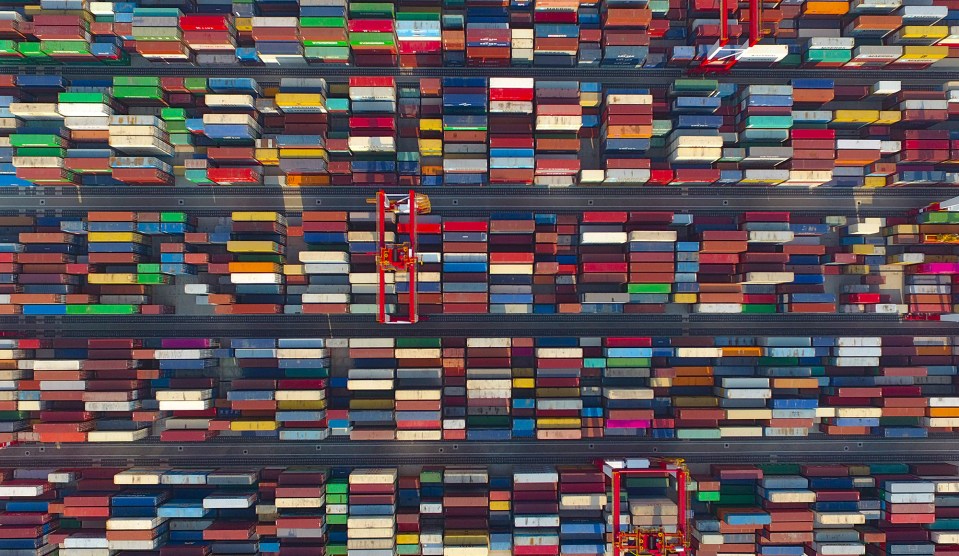

Ding Ting/Xinhua via ZUMA

It’s hard to keep track of all the China tariff action these days. Here’s a short primer.

Imports from China have been broken into lists, which are just what they sound like: lists of various kinds of products. Lists 1 and 2 account for about $50 billion worth of Chinese imports annually and were subjected to 25 percent tariffs last year. These were mostly industrial products, not consumer products.

List 3 included food and other consumer items in addition to industrial goods, clocking in at about $200 billion worth of Chinese imports. Trump imposed a 10 percent tariff on List 3 last year and upped it to 25 percent earlier this year.

List 4 is everything else and amounts to about $300 billion worth of imports. Trump imposed a 10 percent tariff on List 4 products earlier this month. On Friday, he announced that this would increase to 15 percent and the tariffs on the other lists would increase to 30 percent.

However, because Trump doesn’t want to interfere with Christmas, List 4 was split into List 4a and List 4b. The tariffs on List 4b, which includes lots of popular consumer items, won’t go into effect until mid-December.

Keep in mind that tariffs are imposed on the “customs value” of products. An iPhone that retails for $1,000, for example, has a customs value of around $400. A 15 percent tariff comes to $60, or roughly 6 percent of the retail value.

All told, we import about $550 billion in goods from China annually, and when List 4 takes full effect at the end of the year all of it will be subject to Trump tariffs. Products on Lists 1-3 will be subject to tariffs of 30 percent and products on List 4 will be subject to tariffs of 15 percent. Unless Trump changes his mind between now and December, that is.