Yesterday I read a whole spate of stories about the growing number of people who are 90 or more days delinquent on their auto loans. For example:

A record 7 million Americans are 90 days or more behind on their auto loan payments, the Federal Reserve Bank of New York reported Tuesday, even more than during the wake of the financial crisis. Economists warn that this is a red flag. Despite the strong economy and low unemployment rate, many Americans are struggling to pay their bills.

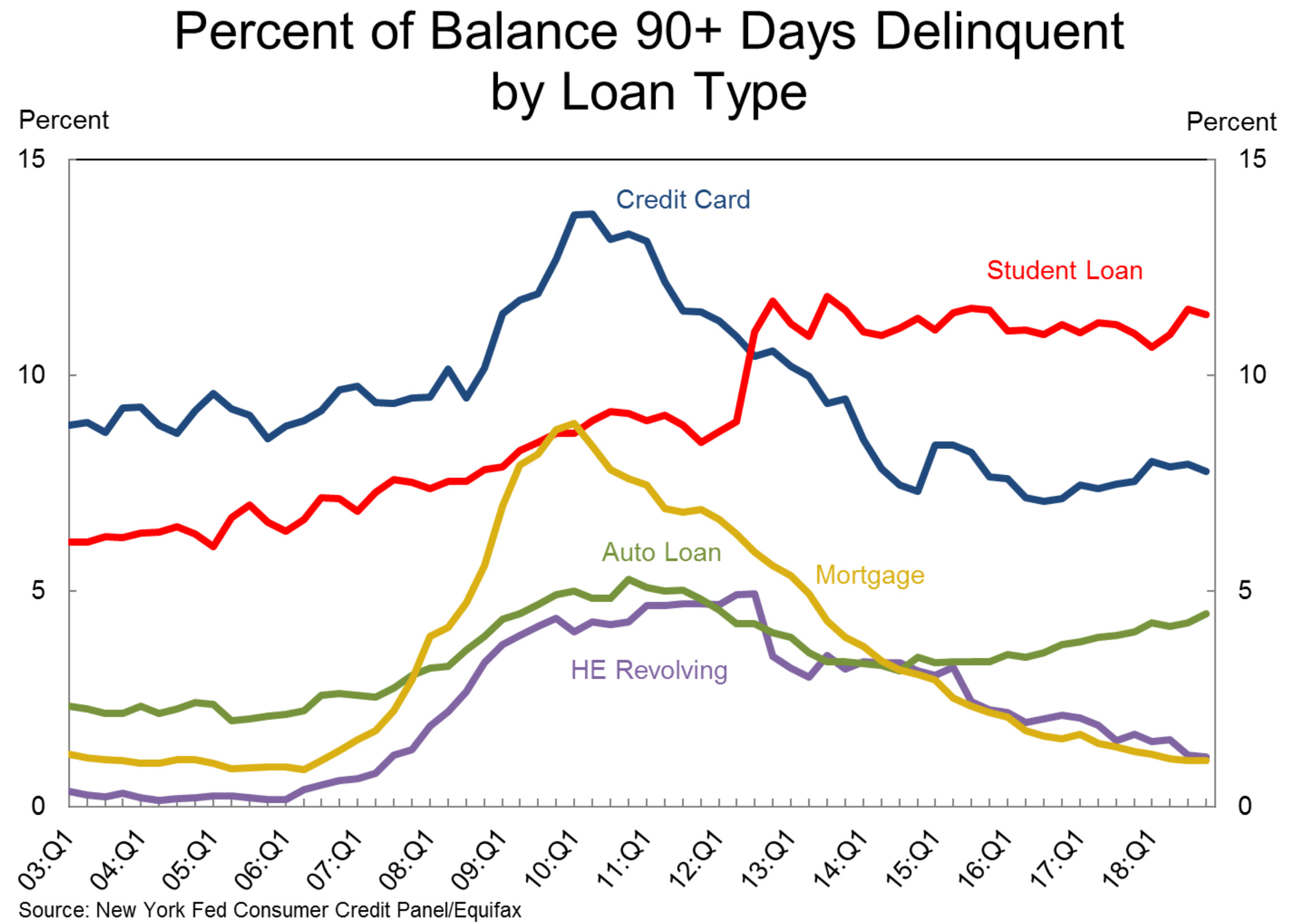

Today I finally got curious enough to look at the Fed report where this came from. It’s true, it turns out, that this is a record number in absolute terms, but that’s because the number of auto loans is twice as high as it was in 2010—and higher than it was even during the pre-2007 housing boom. More loans means more defaults, which makes absolute numbers sort of meaningless here. Instead, let’s look at a chart showing loan delinquencies in percentage terms:

Every type of loan delinquency is either flat or down with the single exception of auto loans. Overall, delinquencies have been declining since 2009 and are still declining. And even auto loans are getting worse at a pretty slow rate. But here’s an interesting additional chart:

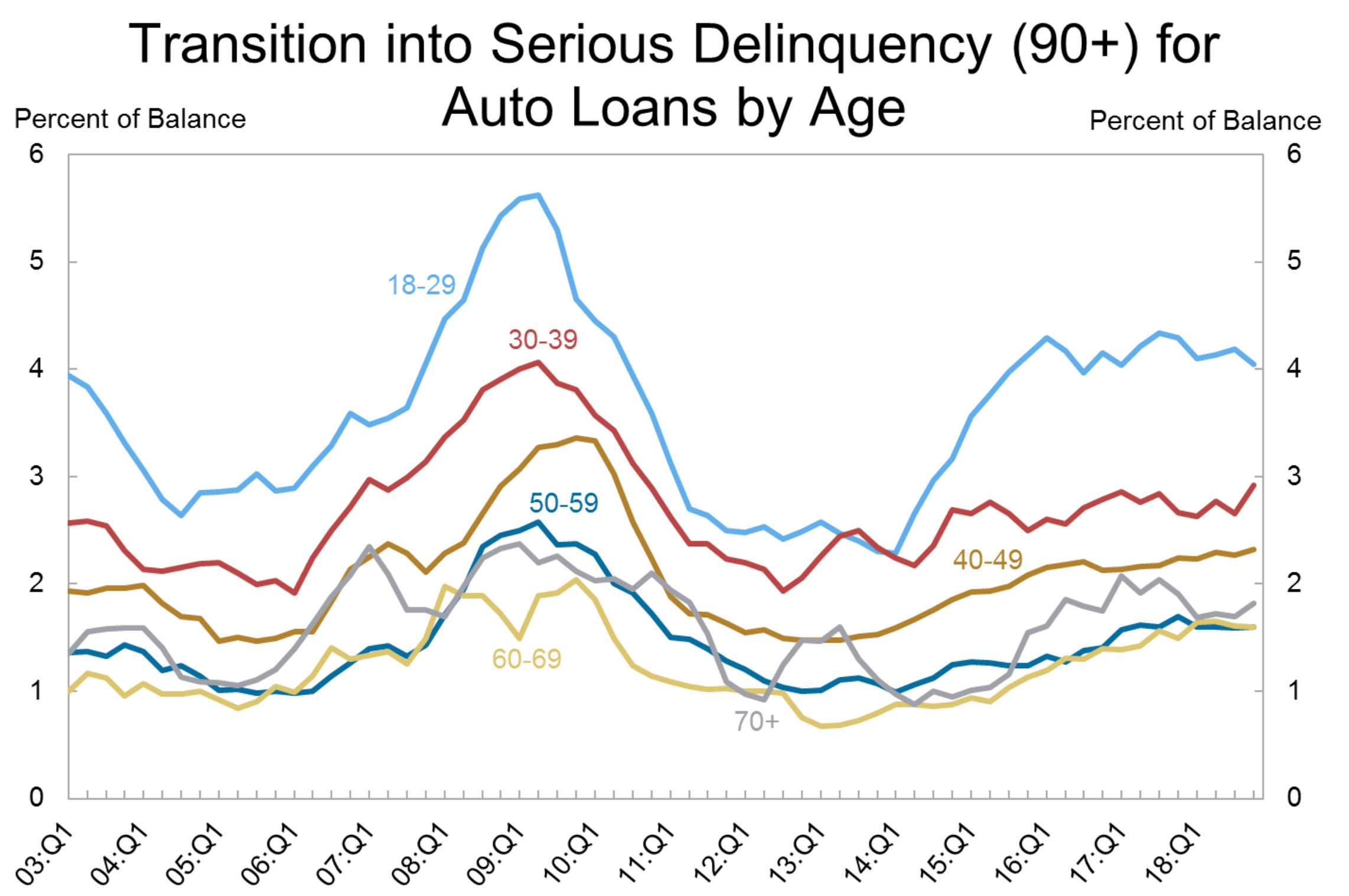

Over the past three years, the delinquency rate on auto loans has stayed steady for those under 40. The increase in delinquency is entirely due to the middle-aged and elderly. I’m not quite sure what to make of this, but it seems like it must mean something.

In any case, the takeaway here is that auto delinquencies are rising, and this might indeed foreshadow problems. But nothing special happened in the past quarter or even in the past year. It’s just been a slow and steady march upward since 2014.