The Europeans come to Washington with potential auto tariffs weighing heavily on their minds. Last week, Mr. Trump threatened “tremendous retribution” if his meeting with the EU officials doesn’t lead to what he considers to be a fair auto-trade deal. On Tuesday night, Mr. Trump suggested he was willing to make concessions if Europe would. He wrote on Twitter, “Both the U.S. and the E.U. drop all Tariffs, Barriers and Subsidies! That would finally be called Free Market and Fair Trade!”

I’m willing to bet that Trump has no clue what he’s talking about when he says he wants to drop “all” tariffs, barriers, and subsidies, but I guess that’s his problem. In any case, this got me curious about how high the overall tariff barriers really are between the US and the EU, but I had a hard time finding this. The best I could come up with was something from the World Bank called WITS: “The World Integrated Trade Solution (WITS) software provides access to international merchandise trade, tariff and non-tariff measures (NTM) data. Browse the Country profile section to obtain countries exports, imports and tariff statistics along with relevant development data.”

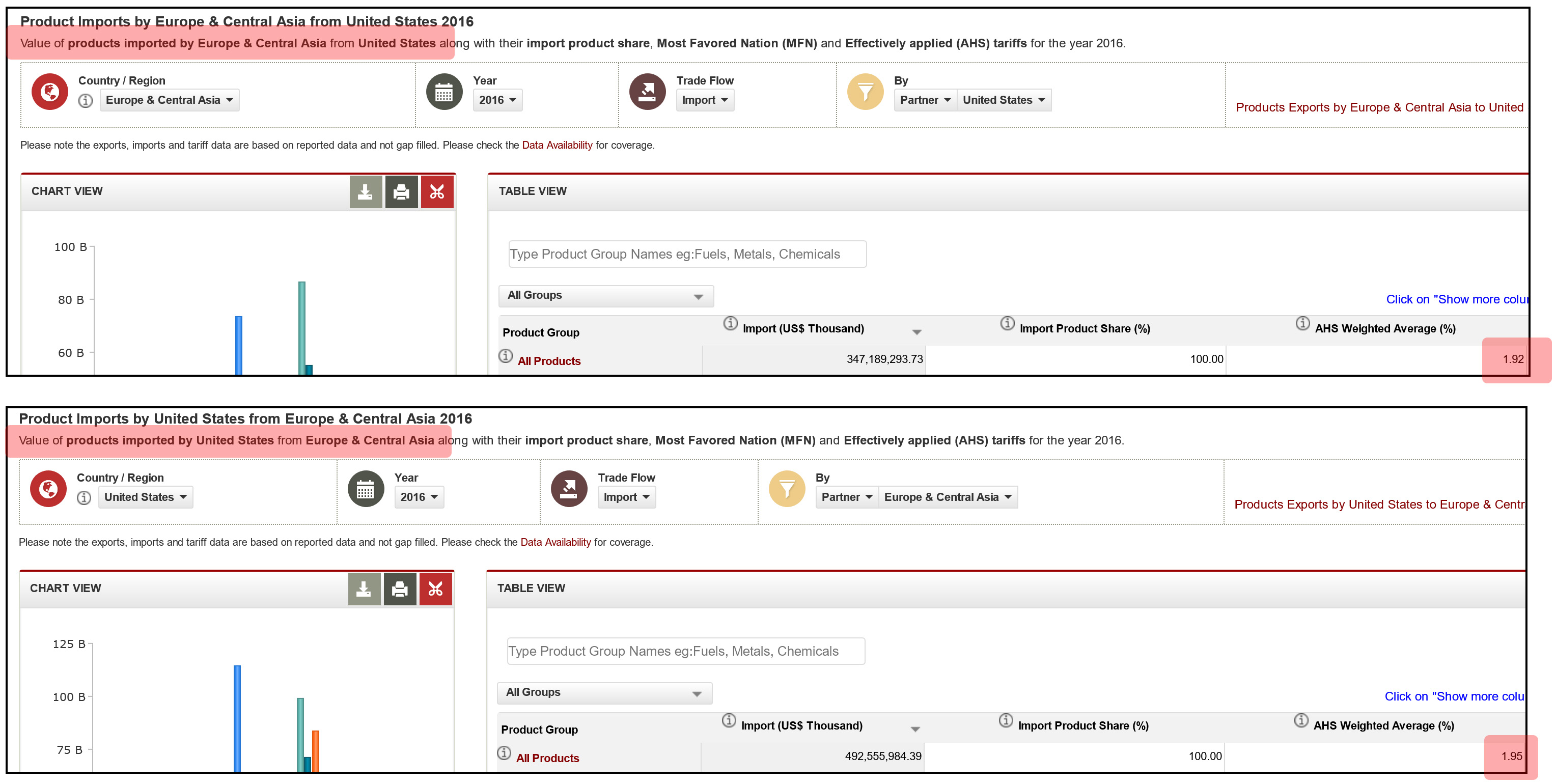

OK, fine. So I checked the US and Europe going in both directions and came up with this:

That’s a little hard to read, but it suggests that tariffs levied by the EU on imports from the US amount to 1.92 percent. Likewise, tariffs levied by the US on imports from the EU amount to 1.95 percent. For all practical purposes, they’re the same.

Of course, I’m not sure I have this right. Plus there are all sorts of non-tariff barriers that you ought to count, though you first have to figure out a way to express them in dollars.

Can anyone help out further with this? At first glance, the WITS data suggests that tariffs between the US and Europe are small and nearly identical. But I’m sure there are details I’m totally missing here. Who wants to help me out here?