A reader drew my attention to this Bloomberg story about the “retail apocalypse,” and after reading it I wanted to add a couple of points. Unfortunately, I went off to eat dinner, and when I got back to my desk I could remember only one of them. This morning I could still remember only one of them. So here it is:

Basically, retail’s problems aren’t new. The sector was doing fine until, suddenly, employee growth flatlined starting in 2000. (Yes, this is another example of the Great Inflection of 2000.) This flatline had almost nothing to do with e-commerce, which accounted for less than 2 percent of retail sales back in 2000. The more likely culprit is twofold. First, automation started taking away some jobs. Second, a wave of leveraged buyouts and private equity takeovers loaded up retailers with debt and forced them to focus on shedding staff as a way of cutting costs. This worked for a while, but as Bloomberg reports, it’s not working anymore. Thanks to retail’s weakness—which in 2017 is partly due to e-commerce—rolling over their debt is getting harder and harder. What we’ll see over the next few years is a “debt apocalypse”:

Until this year, struggling retailers have largely been able to avoid bankruptcy by refinancing to buy more time. But the market has shifted, with the negative view on retail pushing investors to reconsider lending to them. Toys “R” Us Inc. served as an early sign of what might lie ahead. It surprised investors in September by filing for bankruptcy—the third-largest retail bankruptcy in U.S. history—after struggling to refinance just $400 million of its $5 billion in debt. And its results were mostly stable, with profitability increasing amid a small drop in sales.

….Just $100 million of high-yield retail borrowings were set to mature this year, but that will increase to $1.9 billion in 2018….Even worse, this will hit as a record $1 trillion in high-yield debt for all industries comes due over the next five years, according to Moody’s. The surge in demand for refinancing is also likely to come just as credit markets tighten and become much less accommodating to distressed borrowers.

There’s a political side to this too:

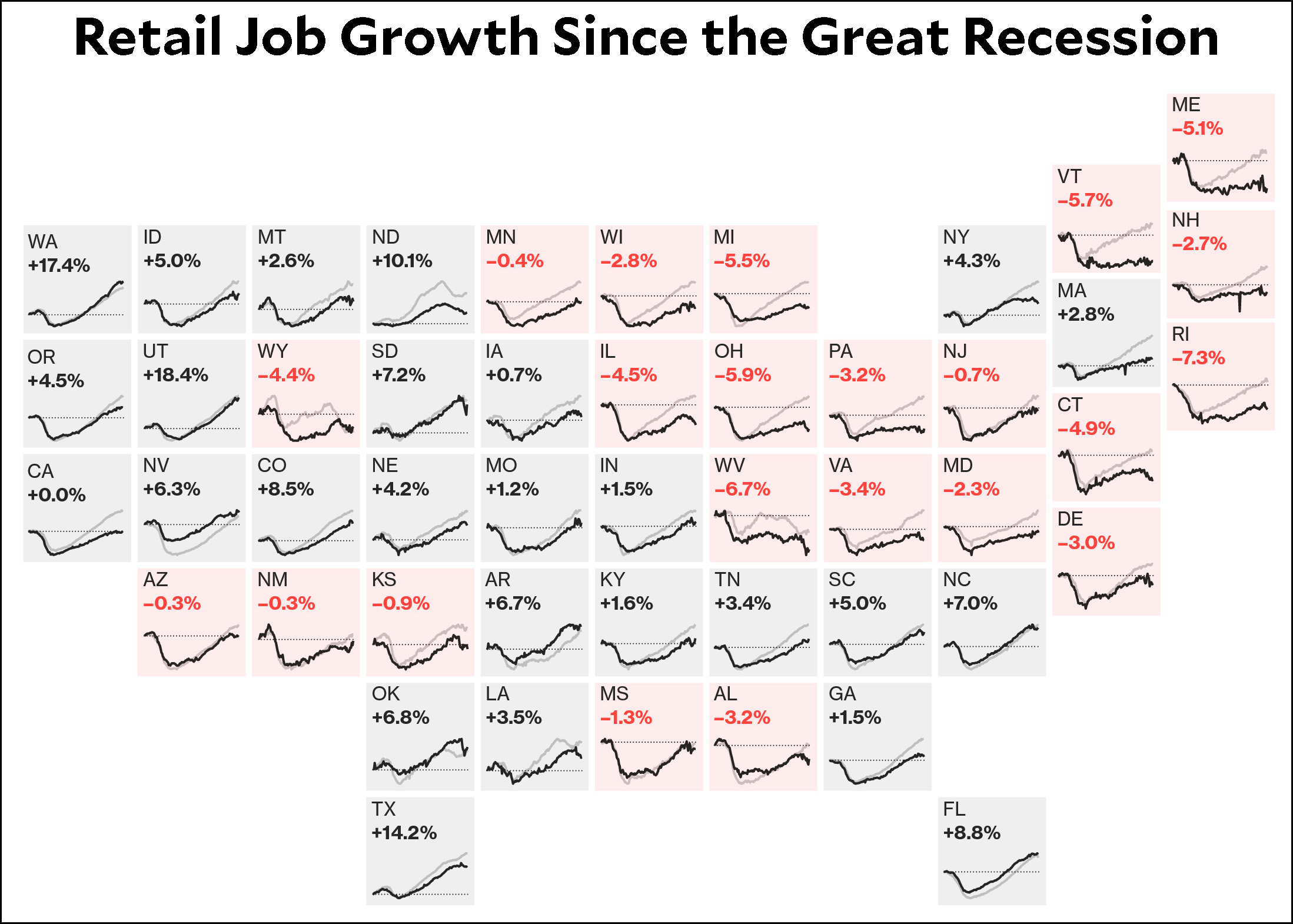

The spillover will likely flow far and wide across the U.S. economy. There will be displaced low-income workers, shrinking local tax bases and investor losses on stocks, bonds and real estate. If today is considered a retail apocalypse, then what’s coming next could truly be scary….States like Ohio, West Virginia, Michigan and Illinois have been among the hardest hit, with retail employment declining over the past decade, and now those woes are likely to spread. Many states, such as Nevada, Florida and Arkansas, have overly relied on retail for job growth, so they could feel more pain as the fallout deepens.

Here is Bloomberg’s map of where retail pain is the greatest:

If it’s true that “economic anxiety” in 2016 was mostly code for underlying racial resentment, in 2020 it’s likely to be all too real. But not because of coal mining jobs, which are minuscule: we’ve lost about 20,000 coal mining jobs since 2000. By comparison, the flatlining of retail has cost about 3 million jobs, and in 2017 retail employment started to actually decline:

Politicians take note. It’s a mug’s game to predict the political future, but this might well be a big issue in 2020.