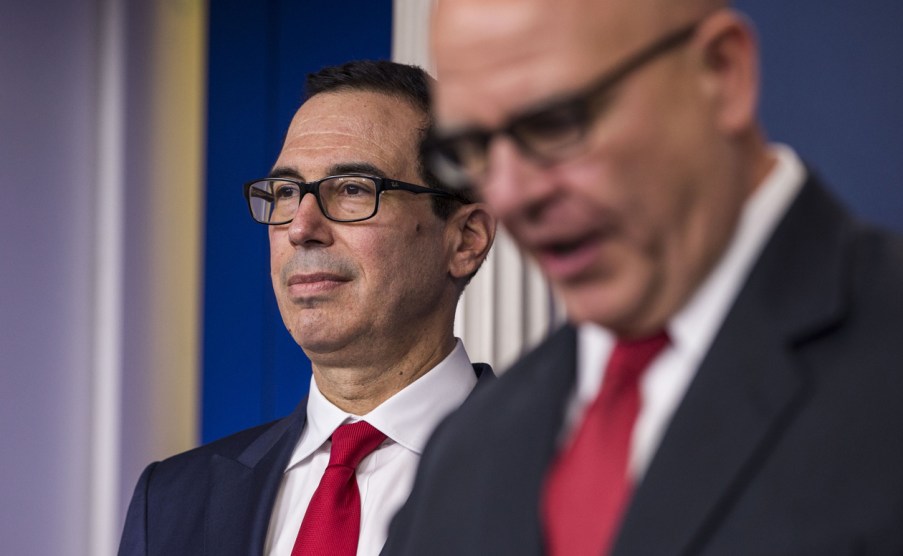

Alex Edelman via ZUMA

Here’s a headline in the Wall Street Journal today:

Steven Mnuchin, a Newcomer, Tilts at Washington’s Hardest Target: The Tax Code

I’d like to suggest a small rewrite:

Steven Mnuchin, a Newcomer, Takes a Swing at Washington’s Easiest Meatball: The Tax Code

Let’s get serious. Ronald Reagan passed three big tax bills and a bunch of smaller ones. George H.W. Bush passed a big tax bill. Bill Clinton passed a big tax bill. George W. Bush passed two big tax bills. Even Barack Obama sort of passed a tax bill.

Passing a tax bill is the easiest gimme in Washington. Passing a tax bill when Republicans control every branch of government is a hanging curve that a 10-year-old could hit out of the park. The fact that Mnuchin is having trouble with a tax bill is yet another sign of the fundamental incompetence of the Trump administration and the Republicans in Congress.

So why are people taking seriously the idea that Mnuchin is attempting a triple backflip with sprinkles on top? I think it’s because he’s persuaded everyone that Republicans are trying to pass tax reform, like the 1986 bill. That really was hard. But no one in Congress has ever been serious about tax reform. They just want to pass a huge rate cut, and they’re casting around for various ways to make the total revenue hit a little smaller. That means finding exemptions and tax credits here and there that have weak constituencies and can therefore be killed off without too much blowback. The state tax exemption, which mostly hits blue states, is a perfect example.

But this kind of aimless target seeking is in no way tax reform. It’s just an attempt to cut rates on zillionaires and big corporations without blowing up the deficit too badly. This lack of any real bearings is one reason why putting the bill together is so hard. Every loophole in the tax code has a constituency of some kind that will fight to keep it, and Republicans aren’t willing to fight back because they’ve never had any real commitment to eliminating them in the first place. This is why they fold at the first sign of resistance. In their hearts, they just want rate cuts, not a more efficient tax code. And needless to say, Donald Trump couldn’t care less either way.

Steve Mnuchin isn’t having a hard time because he’s a newcomer. It’s because nobody in the Republican Party has any real moorings anymore. They don’t believe in broadening the base. They don’t believe that tax cuts pay for themselves. They don’t believe that reducing top marginal rates supercharges the economy. They don’t believe that corporations are going to use foreign profits to boost US investments if they’re allowed to repatriate it at low rates. They don’t even believe that big deficits—aka “starving the beast”—will rein in spending. They want tax cuts because—well, because they’ve always wanted tax cuts. Wasn’t that Ronald Reagan’s big lesson to the party?

And so they’re having a tough time. They’re trying to pass a tax bill, but no one really understands why they want a tax bill in the first place. That’s hardly a recipe for success.