Nope, still not me.Getty Images

While Kevin’s on vacation, we’ve invited other Mother Jones writers to contribute posts.

Some of you probably saw my post about the frustrations I encountered trying to freeze my credit with the Big Three. From the feedback, it sounds like some of you aren’t experiencing problems but others haven’t been so lucky. In any case, I’ve got something new to pule about.

After freezing my credit with Equifax, Experian, TransUnion, and small fry Innovis, I figured I should review my various credit reports to make sure there weren’t any weird requests or new accounts in there—especially given that Equifax waited so long to tell the public that hackers may have accessed our social security and credit card numbers and other personal information crooks can use to hijack our identities.

This is supposed to be a freebie. The Fair Credit Reporting Act, originally enacted in 1970, was amended in 2003 to require that the credit-reporting agencies give consumers a chance to review their credit files free of charge and dispute erroneous information in those files that might affect a person’s credit score—and thus their ability to secure a loan at a reasonable price. Each agency, upon request, has to provide you with a free credit report every 12 months. There are numbers you can call, or you can supposedly access free reports from the Big Three via a special website, AnnualCreditReport.com.

But it seems like not all of the agencies want you to find that site. Equifax, to its credit, is pretty straightforward. Google “equifax free credit report” and here’s the first result you see:

Which takes you to this page:

Which takes you to this page:

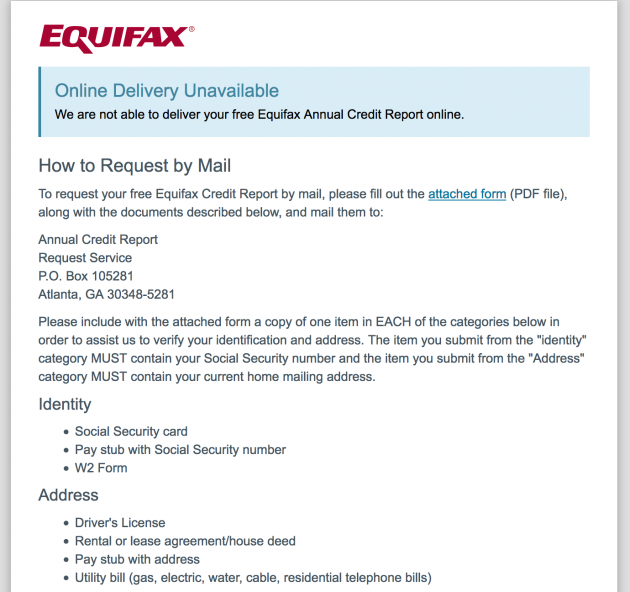

This is as it should be. The company points you unequivocally to AnnualCreditReport.com. But after going to that site, completing the process, and reviewing and saving PDFs of my credit reports for TransUnion and Experian, Equifax disappointed…

Swell. Having apparently reverted to the dark ages as a result of the Big Hack, Equifax now wants me to send them, by the highly secure medium of snail mail, things any identity thief would love to get his clammy little hands on. I don’t even have the words to… well, I do, but I won’t repeat them here, because your children could be reading over your shoulder.

Innovis, a newer, smaller player, doesn’t use AnnualCreditReport.com. It has you fill out a brief form online and promises to send a copy of your report by mail within a few days. Which is fine, so long as they come through. I’ll let you know if they don’t.

Experian and TransUnion will give you that free credit report if you actually make it to AnnualCreditReport.com. But both companies have come up with ways to turn this very reasonable corporate obligation into a revenue stream.

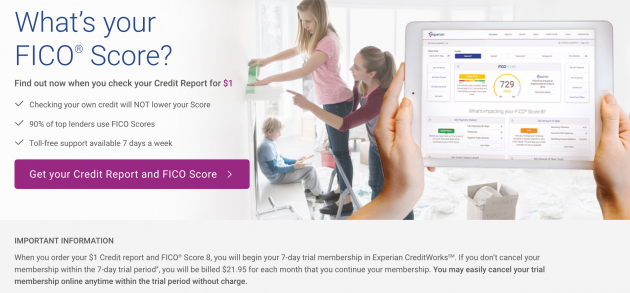

Try Googling “experian free credit report.” The first search results I saw were ads from Experian and FreeCreditReport.com—which is also Experian. I clicked on the first one, and this is where it took me:

They’re offering to give you your credit report and score for a buck. That’s almost free, right? Click on the purple button, and you’ll be sent through an enrollment process. But if you do that without reading the “Important Information” bit underneath, you may not realize you’re signing up for a seven-day trial membership in a $21.95/month service called CreditWorks Plus, which they will then bill you for unless you cancel within those seven days. This comes up again in the fine print during the enrollment process, but who reads fine print?

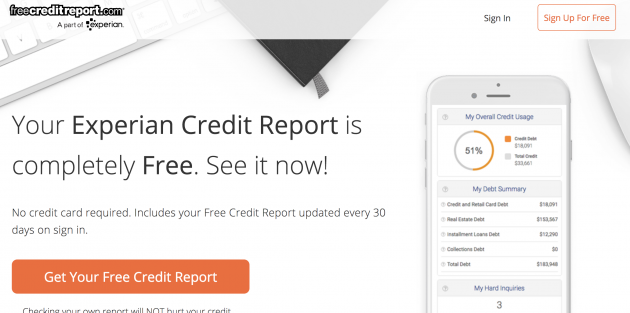

Clicking on the second ad gets you here:

Now it’s free! Clicking on that orange button takes you to a similar enrollment page where you have to give them lots of information (including your social) and agree to epic terms of service that go on for pages and pages. (I didn’t do this because, frankly, it creeped me out.) The service you’re signing up for here, “CreditWorks Basic,” is indeed free, an Experian spokeswoman confirmed via email. “However, we may conduct different offers as well as deploy different offers with partners.”

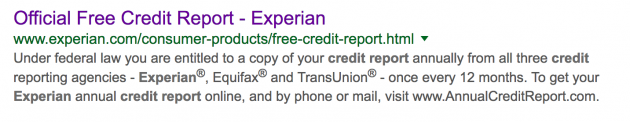

Let’s have a look at the first non-ad result that came up in my search:

That looks exactly like what we want, right? But the link takes you here:

That purple button again leads to the enrollment process for CreditWorks Basic. Enroll and you become a fresh sales lead for Experian and its affiliates—whose ultimate goal is to convert you into a paying customer.

Let’s step back to that $1 credit report offer. If you poke around on the website of the Better Business Bureau and consumer sites such as ConsumerAffairs.com, you’ll come across a ton of complaints from people who clicked on that big orange button without reading the “Important Information,” and who feel they were suckered. On July 14 of this year, “Terry of Clarkstown, MI” wrote: “Someone needs to do something about this company intentionally deceiving people. I too paid $1.00 for a credit report but instead they signed me up at $21.99 a month. I wasn’t even able to cancel my subscription without paying a $50 balance…” A couple of weeks later “Andy of San Mateo” chimed in: “I paid $1 dollar for a credit score report. I did not realize I signed up for a monthly service with recurring charges in the amount of $21. It is a very dishonest tactic…”

Asked about this common misunderstanding, a spokeswoman responded in an email that Experian discloses its trial offers “clearly and conspicuously” in several locations, and adds that it takes consumer concerns seriously. “As with any large-scale enterprise, there may be a small subset of consumers who are unsatisfied,” she wrote. “When brought to Experian’s attention, the company tries to resolve concerns to the customer’s satisfaction.”

Okay, but is Experian deliberately diverting people who are looking for the free credit report the law guarantees them—the one with no strings attached—to try and sell them paid services? (Not like this is illegal; it just smells a bit.) The spokeswoman didn’t dispute this. She simply noted that the services Experian is selling gives customers more than just a credit report.

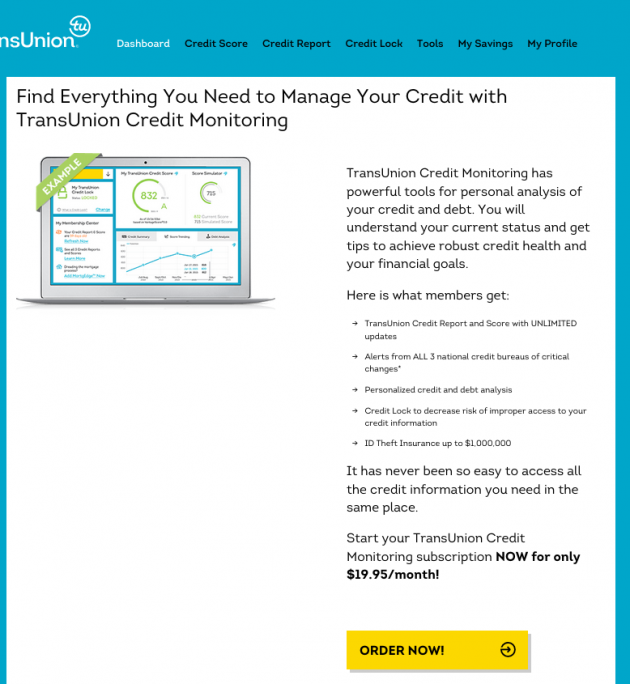

Now let’s look for our free TransUnion credit report. When I Googled “transunion free credit report,” the first result was this TransUnion ad:

Three free reports! That sounds good. We click, and…

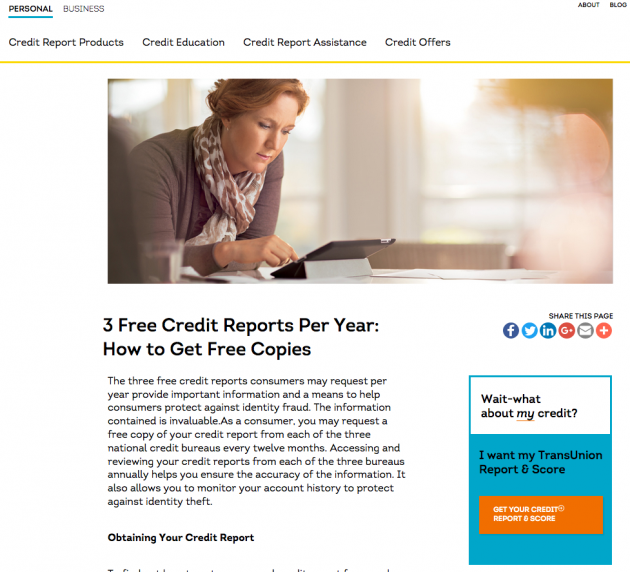

Three free reports! That sounds good. We click, and…

You don’t want a reading assignment, just that free report. So you click on the good ol’ orange button: “Get your credit report and score.” It directs you to a page where you can register or log in.

The TransUnion registration, which I had to do earlier to freeze my credit file, is a minor pain in the butt—they ask security questions that you’ll probably have to dig into your filing cabinet to answer, and you have to agree to an absurdly broad (and probably unenforceable) liability waiver written in all-caps legalese—but you do it anyway. You log in, and here’s what you see:

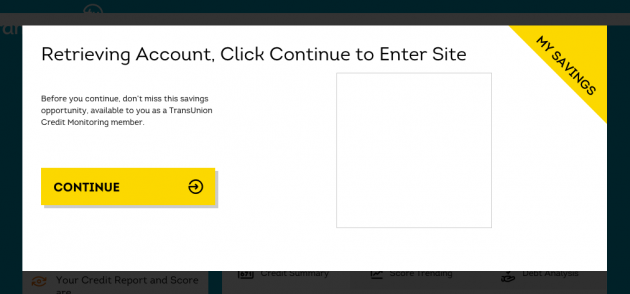

Um…okay. You click “continue,” and…

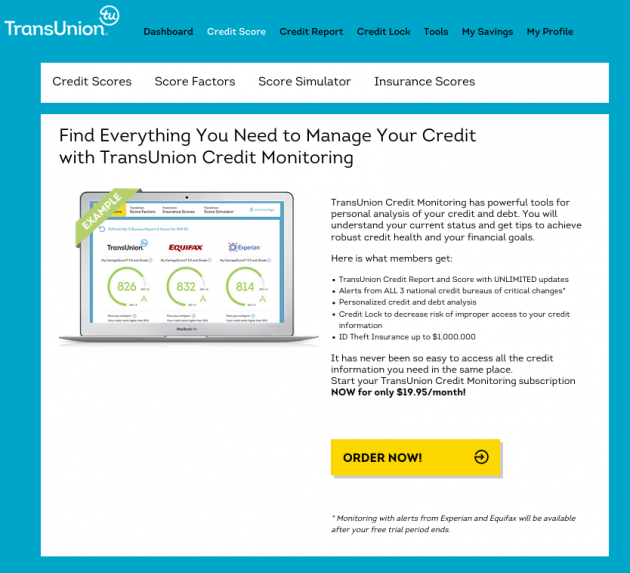

So they’re trying to sell you something, too. Everyone wants to sell, but you just want the free report the ad seemed to be promising. Confused, you lash out at the toolbar menu up top, and select “Credit Score.”

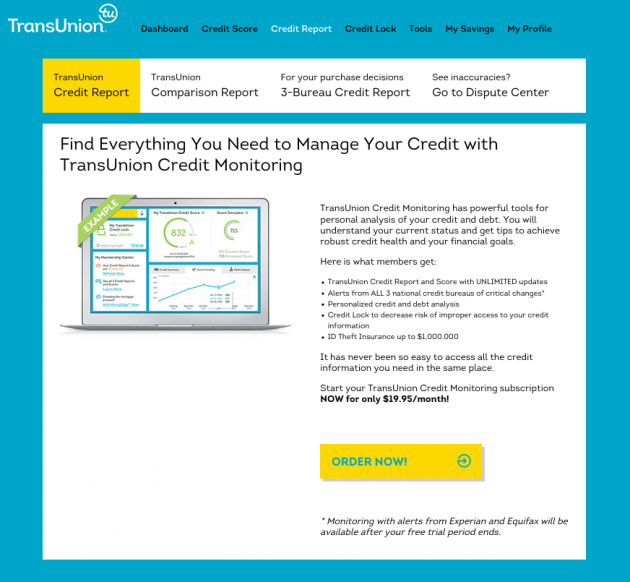

Hey, where have you seen that page before? You try another toolbar option, “Credit Report,” and…

The FREE ONE, MAN! How do we get the FREE ONE?

Oh. Back on that page with the orange button (there are actually three orange buttons; you can only see one of them in my screenshot), if you read down to the second section, it does mention that you can access your credit report at AnnualCreditReport.com. Of course, TransUnion didn’t bother to link up that URL, so you saps will just have to copy and paste it into your browsers. (Did TransUnion’s media representative respond to my inquiries about this wild goose chase? He did not.)

The upshot: If you really want the free one, click here. You only need to put in your information once and nobody will try and pull a fast one on you. Equifax will pull a slow one, but that’s another matter.