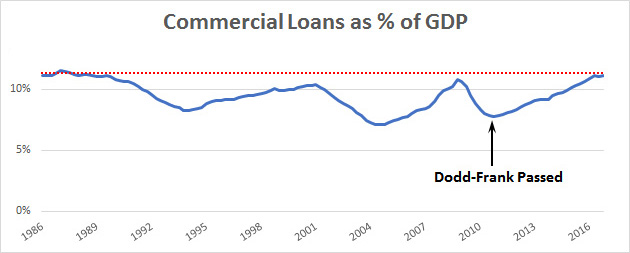

I know that nobody cares about this, but my post this morning about commercial lending got me curious. The proper way to judge whether banks are making loans is to look at total bank lending as a percent of GDP. So I did. And as long as I did the work, I might as well pretty it up and share it with you. Here it is for the past 30 years:

As you can see, bank lending generally declines during recessions and then goes back up. Right now, it stands at a little over 11 percent of GDP, which is as high as it’s ever been. To suggest, as President Trump did, that businesses are having a hard time getting loans because of Dodd-Frank is ridiculous.

That said, a brief warning. Corporations raise money in multiple ways. Bank lending is part of it. But there are also stock issues, bond sales, private equity, non-bank loans, and so forth. If you put all of this together, it would give you an idea of the overall ease or difficulty of raising money right now, and I have no idea what it would show if someone went through this exercise. In other words: commercial bank lending is pretty robust right now, but don’t draw any larger conclusions from this unless you have the data to back it up.