Carolyn Johnson reports that another cycle in the pharmaceutical outrage machine is building up:

Politicians are, once again, concerned that a drug company that plans to sell an old medicine for a very high price is taking advantage of the system. On Monday, Sen. Bernie Sanders (I-Vt.) and Rep. Elijah E. Cummings (D-Md.) sent a letter to the chief executive of Marathon Pharmaceuticals, arguing that the Illinois company is”abusing” government policies that encourage the development of treatments for extremely rare diseases, called orphan diseases.

“We urge you to significantly lower your price for this drug before it goes on the market next month,” they wrote. “Marathon’s apparent abuse of government-granted exclusivity periods and incentives to sell what should be a widely available drug for $89,000 a year is unconscionable.”

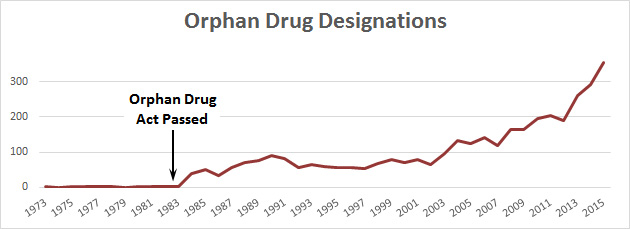

Unlike some of the other recent huge price increases that have been in the news, this one is for a so-called “orphan” drug that treats a rare disease. In this case, the rare disease is Duchenne muscular dystrophy, which afflicts about 15,000 people. That’s too few for a pharmaceutical company to spend time on, so in 1983 Congress passed the Orphan Drug Act, which provides subsidies and patent incentives for developing orphan drugs and bringing them to market. It’s worked fairly well:

The orphan drug at issue here is deflazacort, which has been available outside the US for a long time. However, nobody had bothered to conduct the clinical trials necessary for FDA approval in the US until Marathon did so. Having done that, Marathon now plans to charge $89,000 per year for a drug that formerly cost about $1,000 per year.

Is this outrageous? Sure. Is it also an effective way to bribe companies to bring otherwise unprofitable treatments to market? Sure. Did Marathon abuse the system, as Sanders and Cummings claim? Probably. The clinical trial of deflazacort was small and probably fairly cheap. Marathon could still make money with a lower price.

But here’s the thing: the Orphan Drug Act was passed by Congress, and so was the TREAT Act, which speeds up FDA approvals of orphan drugs. The policy goal is to provide pharmaceutical companies with enough incentive to bring orphan drugs to market, but not so much that they’re fleecing the public. If that balance is wrong, then Congress can change it. Just keep in mind that no system will ever be perfect. If we subsidize orphan drugs enough to make them profitable, there are always going to be cases where someone finds an unusually lucrative opportunity. If we lower the subsidies enough to eliminate these opportunities, we may kill off the orphan drug market altogether.

In other words: be careful. Maybe the Orphan Drug Act needs some updates, but don’t kill the goose that laid the golden egg.

UPDATE: So how much did it cost Marathon to conduct the studies needed for FDA approval? Derek Lowe points us to John Carroll, who asked a couple of experts for an estimate based on a Marathon slide that outlines their research program. One figured the total costs at $65-75 million, while the other came in at $10-15 million. That’s a pretty big difference, but probably not enough to change the math much:

If half of all US patients are put on Marathon’s steroid, that’s at least $405 million gross a year — $33.7 million a month — based on their lower $54,000 annual net price….Because the FDA gave them orphan status, Marathon has a 7-year exclusivity deal for deflazacort. Based on the company’s wholesale price of $89,000, that market is theoretically worth up to $12.6 billion in total through the full stretch.

That’s gross revenue, which is considerably higher than net profit. Still, it suggests that $10 million vs. $65 million isn’t a very big deal. Even a tenth of Carroll’s lifetime estimate would make deflazacort a huge moneymaker for Marathon.

But if this is anything close to accurate, I have a question: if deflazacort is such a slam-dunk winner, why didn’t some big drug company do this years ago?