The Wall Street Journal writes today about Japan’s stagnant economy and persistent deflation:

During Japan’s go-go 1980s, Hiromi Shibata once blew a month’s salary on a cashmere coat, wore it a few times, then retired it. Today, her daughter’s idea of a shopping spree is scrounging through her mom’s closet in Shizuoka, a provincial capital.

….The U.S. appears to be leading other parts of the globe out of an extended era where central banks relied heavily on low and negative interest rates and stimulus to jump-start growth and keep prices from falling….Japan remains definitively stuck, despite a long and aggressive experiment with ultralow rates. A quarter-century after its property bubble burst, a penny-pinching generation has come of age knowing only economic malaise, stagnant wages and deflation—a condition where prices fall instead of rise.

….Since then, annual growth has averaged less than 1% amid periodic recessions. Prices began falling in the late 1990s….Many economists believed the Bank of Japan’s 2013 stimulus would be enough to jolt the nation out of its downward spiral of weak growth and falling prices….Some economists contend the government should try even more fiscal stimulus and monetary easing. Others argue the stimulus has already saddled Japan with so much debt—now 230% of gross domestic product—that it could end in an economic collapse.

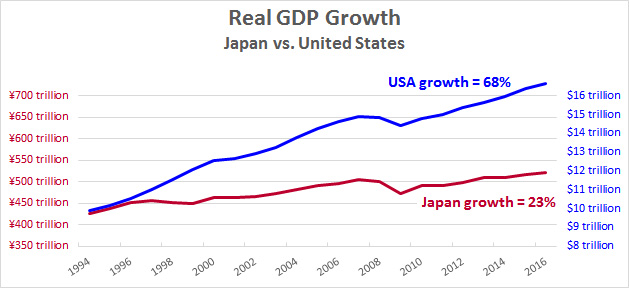

It’s true that Japan has suffered through two decades of low growth:

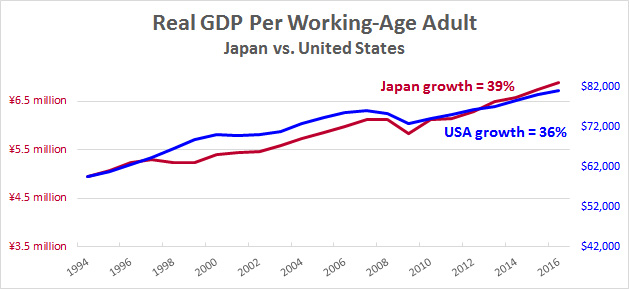

But there’s way more to this story. Obviously, the bigger your population, the bigger your GDP. The fact that the Russia has a bigger GDP than Switzerland doesn’t mean it has a better economy. It just means it’s bigger. The key metric to judge whether an economy is in good shape is GDP per working-age adult, since that tells you how productive your workers are. So let’s look at that:

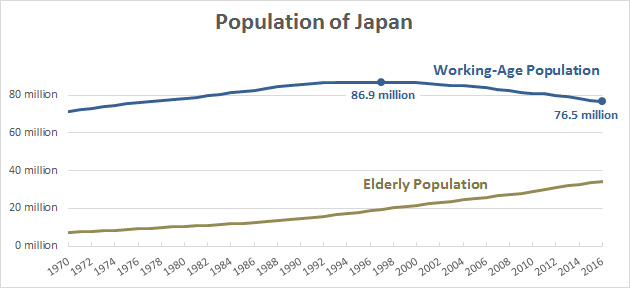

Despite its persistently low inflation, Japan’s economy is doing fine. Their GDP per working-age adult is actually higher than ours. So why are they growing so much more slowly than us? It’s just simple demographics:

Japan is aging fast. Its working-age population peaked in 1997 and has been declining ever since. Fewer workers means a lower GDP even if those workers are as productive as anyone in the world. Now put all this together, and here’s what you get:

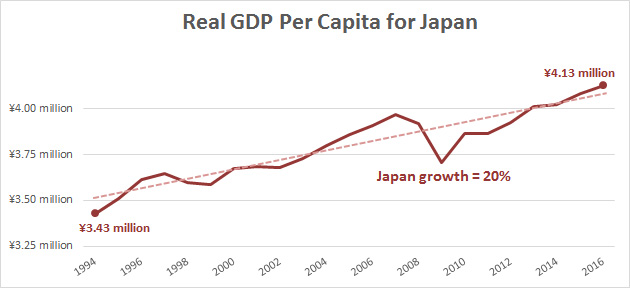

This is GDP per capita. That is, the amount of stuff that Japan produces for each person in the country. Over the past two decades it’s grown 20 percent. And aside from the Great Recession, that growth has been pretty steady. It’s not declining. It’s not stagnating.

Under the circumstances, Japan is doing fine. Each of their workers is as productive as ours, and their productivity has actually grown a little faster than ours. But there’s only so much you can do when your population is declining. Given the demographic realities, Japan is probably doing about as well as they could.

There are two things I take away from this. First, there’s not much the Bank of Japan can do to stimulate their economy. It’s already running pretty well. Second, despite this, Japan is suffering from persistent deflation. Why? If their economy is productive and growing, deflation shouldn’t be any more of a problem for them than it is for us. Somehow, though, the very fact of a declining working-age population—and, since 2011, a declining overall population—seems to be driving deflation. This is very mysterious, especially since Japan’s deflation has persisted even in the face of massive BOJ efforts that, according to conventional economics, should have restored normal levels of inflation.

So why didn’t it? Is it really a consequence of demographic decline? Or is it something else?