How much would a 20 percent tariff on Mexican imports cost us? I think it’s pointless to delve very deeply into this until President Trump and congressional Republicans produce a serious plan of some kind. Relying on random tweets and leaks from GOP gatherings will just drive us all crazy, as we try to analyze every dumb idea that gets run up the flagpole. Hell, even Paul Krugman says he’s a little confused about some of this stuff, and his Nobel Prize was for international trade.

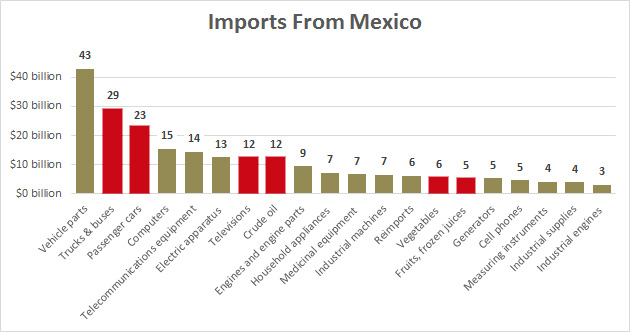

However, there is one bit of raw data that you might as well get familiar with, since it’s not going to change. Here are our top 20 imports from Mexico:

I’ve highlighted a few of the categories that get the most attention: cars, televisions, crude oil, and produce. Generally speaking, if we tax these things at X percent, their price in the US is going to increase X percent. It won’t be quite that much, since trade will adjust based on the taxes, and in the long run the dollar will rise. Probably. And this all assumes there’s no retaliation from Mexico, which there probably would be.

Still, in the short and medium term, a 20 percent tax will increase the price of Mexican goods by 20 percent. That means a Ford Focus will cost 20 percent more, flat-screen televisions will cost 20 percent more, and avocados will cost 20 percent more. The problem, of course, is that Ford can’t increase the price of a Focus by 20 percent. Nobody would buy them. So they’ll just have to keep prices low and take it in the shorts.

Bottom line: in some cases, prices will go up, which will be bad for US consumers. In other cases, importers who are stuck with Mexican factories will have to accept lower profits, which is bad for US companies. In yet other cases, imports will just cease and plants will be shut down, which will be bad for Mexico.

So who will this be good for? That’s a very good question. In the case of cars and TVs, probably Japan and South Korea. In the case of produce, maybe Chile. In the case of crude oil, maybe Iran.

Of course, if we decide to put a tax on all imports from everywhere—not just Mexico—then consumer prices of just about everything will go up with no release valve. This would violate every trade treaty we’re part of, which means that the entire world would probably retaliate. In the end, prices would go up and American factories would either keep production unchanged or even cut back some. This would be pretty disastrous for the working class folks who voted for Trump.

But that’s what everyone is talking about.