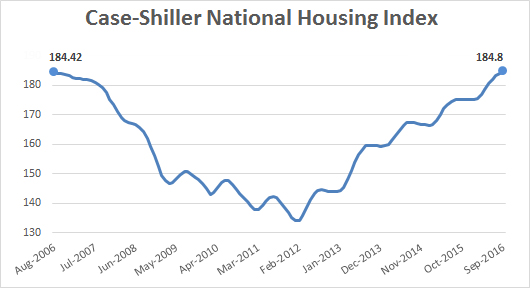

The Wall Street Journal points out today that housing prices are now as high as they were at the peak of the bubble years:

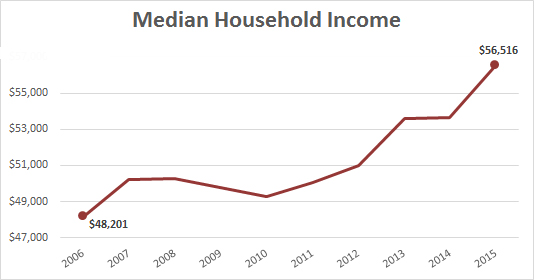

But that’s OK. It’s been over a decade now and incomes have gone up enough to compensate. We can afford housing at 2006 prices, right? Um…

Well, incomes are a little higher, but not by a lot. On the bright side, at least we have an incoming president who—

Aw crap. We’re so screwed.

UPDATE: As too many people have pointed out in comments and on Twitter, I messed this up, comparing the Case-Shiller index in nominal dollars to household income in real dollars. Sorry! It’s fixed now. In nominal terms, household incomes have gone up about 17 percent since 2006, so houses are still more affordable than they were at the top of the bubble.

But not by a whole lot—and housing prices are continuing to rise. I’d still keep a close eye on this.