A couple of days ago I wrote about the minimum wage, and how it’s gone down over the years. How much has it gone down? Well, that depends on what measure of inflation you use.

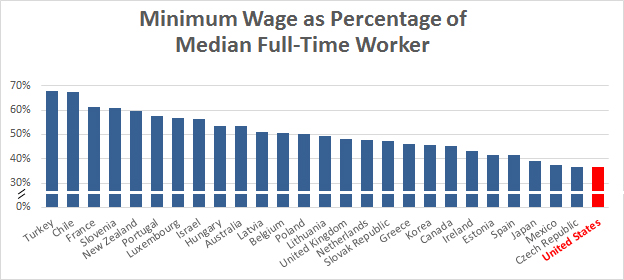

But there’s another way of looking at it that doesn’t rely on a computed inflation rate at all: just compare it to the median wage. Via the OECD, here’s how we compare to other rich countries:

In countries like France, Australia, and Britain, the minimum wage is equivalent to about half or more of the median wage. In the US, it’s equivalent to only 37 percent of the median wage. That’s the lowest in the OECD dataset.

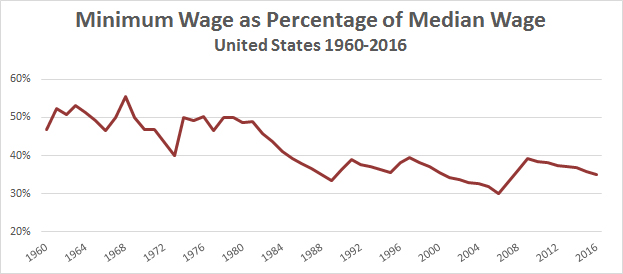

But it hasn’t always been this way. Here’s what the minimum wage in the US looks like over the past half century:

I had to massage the data a bit to get a wage series back to 1960, so this might be off slightly. But not by more than a couple of percentage points or so. The basic story is simple: Up until the Reagan era, the federal minimum wage was around 50 percent of the median full-time wage—or higher. Then it dropped for eight years running and has never recovered.

So what does this say about where the minimum wage ought to be? If we raised it to $10.50, we’d be back to 50 percent of the median wage. That would put us in the middle of the international pack, which seems perfectly reasonable. If we raised it to $15, we’d be at 72 percent of the median wage, far higher than any of our peer countries.

Obviously you can decide for yourself where we ought to be. But looked at this way, I’d be pretty happy with a minimum wage of $10-11, but pretty skeptical of $15. There’s really not much precedent for a minimum wage that high, and I’m not thrilled with experimenting that far away from international norms.1 What’s more, although I think the minimum wage serves a purpose, my preference is to combine a moderate but reasonable minimum wage with, say, a moderate but reasonable increase in the Earned Income Tax Credit.2 They serve different purposes and benefit different groups of people, and the combination would almost certainly benefit the working poor more than just one or the other.

1As we liberals point out endlessly, the bulk of the evidence suggests that moderate increases in the minimum wage don’t have much effect on employment. And that’s true. But the flip side is also true: large increases in the minimum wage probably do have an effect on employment. My guess is that a $15 minimum wage would have fairly significant disemployment effects.

2And an expansion of Medicaid. One thing that makes it hard to compare our minimum wage with other countries is that other countries have safety net features that we don’t have. For example, universal health care, which reduces medical costs for the working poor to nearly zero. I would much rather have a $10-11 minimum wage + EITC increase + Medicaid expansion than a $15 minimum wage.