Finally we have a real difference between Hillary and Bernie. Hillary supports Philadelphia’s proposed tax on sugary drinks of 3 cents per ounce. Bernie doesn’t. “A tax on soda and juice drinks would disproportionately increase taxes on low-income families in Philadelphia,” he said on Thursday.

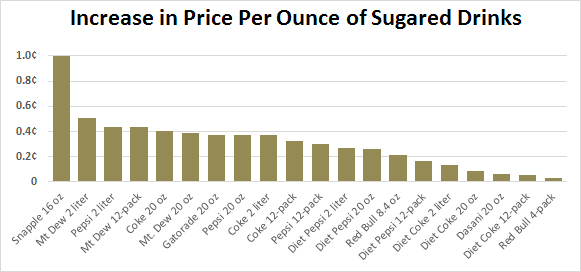

Clearly this requires data. First off: how much of this tax would be passed on to consumers? The conventional wisdom is that most of it would, but a recent study out of Cornell suggests the real pass-through is much lower. The authors looked at prices of sugary drinks in Berkeley, which passed a 1-cent soda tax in 2014, both before and after the tax was implemented. Then they compared this to the before-and-after price of the same drinks in San Francisco, which voted in favor of a soda tax but not by the supermajority it required. The net difference is shown in the chart below:

The Snapple outlier is unexplained. Apparently 100 percent of the tax got passed through to Snapple addicts. But for most sugary drinks, only a fraction of the tax was passed through. Overall, after doing a bit of fancy math, the authors conclude that an average of 22 percent of the tax was passed through for Coke and Pepsi products.

So how would this affect Philadelphia? A Gallup poll confirms Bernie’s general concern: low-income consumers are more partial to sugary drinks than high-income consumers, who prefer diet drinks. A recent NIS study concluded the same, and put some numbers to it. Using their data, I figure that a low-income family of three buys about 3,000 ounces more sugary soda per year than a higher income family. If 22 percent of the 3-cent tax is passed through, that’s 0.66 cents per ounce, or about $20 per year for the entire family.

So yes, this is a regressive tax. On the other hand, it’s also a pretty small tax, and the potential benefits are large if it cuts down on consumption of sugary soda and thus reduces the incidence of diabetes—a disease that’s especially widespread among low-income families. But does it? Since we have virtually no real-world experience with this, nobody knows for sure.

So make up your own mind. It’s possible to calculate a ballpark estimate of how much a soda tax would amount to, and although it’s regressive, it’s pretty modestly regressive. But we have no idea whether it would accomplish anything. We can only try and find out.