I hope you’ll pardon a bit of real-time navel-gazing. It won’t take long. A couple of weeks ago Bernie Sanders released an outline of his single-payer health plan, and I pronounced it “pretty good.” A week later, Emory’s Kenneth Thorpe took a detailed look at Sanders’ plan and basically concluded that it was fantasy. Why the huge difference between us?

It has little to do with the details of the Sanders plan. We’re both looking primarily at the financing. Here was my reasoning:

- Total health care outlays in the United States come to about $3 trillion.

- The federal government already spends $1 trillion.

- Sanders would spend $1.4 trillion more. That comes to $2.4 trillion, which means Sanders is figuring his plan will save about $600 billion, or 20 percent of total outlays.

- I doubt that. I’ll buy the idea that a single-payer plan can cut costs, but not that much. I might find $1.7 or $1.8 trillion in extra revenue credible, which means that Sanders is probably lowballing by $300 billion or so—which, by the standards of most campaign promises, is actually

not that bad. I’d be delighted if a single Republican were that honest about the revenue effects of whatever tax plan they’re hawking at the moment.

not that bad. I’d be delighted if a single Republican were that honest about the revenue effects of whatever tax plan they’re hawking at the moment.

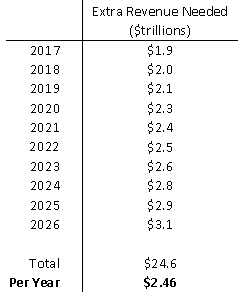

But Thorpe says Sanders is off by a whopping $1.1 trillion. Yikes! Where does that come from? There are several places where Thorpe suggests the Sanders plan will cost more than Sanders thinks, but the main difference is shown in the table on the right. Thorpe, it turns out, thinks the Sanders plan would cost an additional $1.9 trillion in the first year. So he and I are roughly on the same page.

But I stopped there. I basically assumed that both costs and revenues would increase each year at about the same rate, and that was that. Thorpe, however, figures costs will increase substantially each year but tax revenues will increase hardly at all. So that means an increasing gap between revenue and spending, which averages out to $1.1 trillion over ten years.

Other details aside, then, this is the big difference. If Sanders’ new taxes fall further and further behind each year as health care costs rise, then he’s got a big funding gap that he would have to make up with higher tax rates. But if he can keep cost growth down to about the same level as his tax revenue growth, his plan is in decent shape.

So which is it? Beats me. This is the kind of thing where the devil really is in the details, and even a small difference in assumptions can add up to a lot over ten years. Still, I was curious to see why Thorpe and I seemed to diverge so strongly, and this is it. Take it for what it’s worth.