These mortgages, which are given to borrowers that can’t fully document their income, helped fuel a tidal wave of defaults during the housing crisis and subsequently fell out of favor.

Now, big money managers including Neuberger Berman, Pacific Investment Management Co. and an affiliate of Blackstone Group LP are lobbying lenders to make more of these “Alt-A” loans….Many of these loans come with interest rates as high as 8%, compared with an average of about 3.8% for a typical 30-year fixed-rate mortgage.

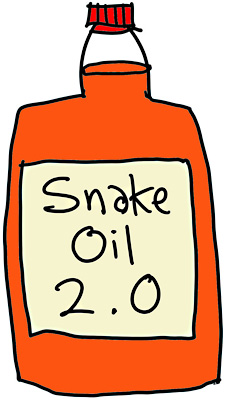

….There has also been a rebranding effort: Most lenders prefer to call these products “nonqualified mortgages” due to the stigma attached to the Alt-A category. By backing these loans, money managers said they would reach an underserved corner of the housing market: Borrowers who have good credit but might be self-employed or report income sporadically.

Naturally, everything is different this time around. Everyone is being careful. It’s just a small piece of the market. Borrowers have to produce some documentation. So don’t worry: things are going to be fine. Wall Street knows what it’s doing. No need to concern your pretty little heads about this.