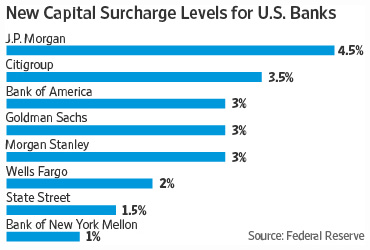

Seven years after the great banking meltdown of 2008, and five years after the passage of Dodd-Frank, the Fed has finally announced new capital requirements for large, systemically important banks that could devastate the financial system if they failed. These new requirements can be met only with common  equity, the safest form of capital, and are in addition to the 7 percent common equity level already required of all banks:

equity, the safest form of capital, and are in addition to the 7 percent common equity level already required of all banks:

J.P. Morgan would face a capital “surcharge” of 4.5% of its risk-weighted assets under the final rule. The other seven firms must maintain an additional capital buffer of between 1% and 3.5%….The size of each bank’s additional capital requirement is tailored to the firm’s relative riskiness, as measured by a formula created by international regulators and the Fed. A bank’s surcharge can grow or shrink depending on changes such as size, complexity and entanglements with other big firms.

….“A key purpose of the capital surcharge is to require the firms themselves to bear the costs that their failure would impose on others,” Fed Chairwoman Janet Yellen said in a written statement prepared for this afternoon’s open meeting. “They must either hold substantially more capital, reducing the likelihood that they will fail, or else they must shrink their systemic footprint, reducing the harm that their failure would do to our financial system.”

Leverage, leverage, leverage. That’s the big lesson we should have learned from the Great Meltdown. And the cleanest and easiest way to reduce leverage is to increase capital requirements. This is a good move in the right direction, though it probably doesn’t go far enough.

It also applies only to ordinary banks, not to the shadow banking sector—which, in retrospect, appears to have been at least as big a contributor to the financial collapse as conventional banks. But that’s a tougher nut to crack. It will probably be a while before we see how the Fed plans to handle that.