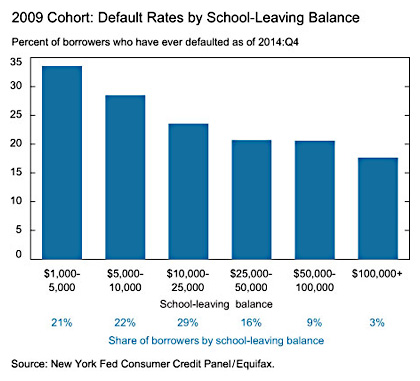

Alex Tabarrok passes along the chart on the right, which shows the default rate on student loans. What it shows is surprising at first glance: the highest default rates are among students with the lowest debt, not the highest.

Alex Tabarrok passes along the chart on the right, which shows the default rate on student loans. What it shows is surprising at first glance: the highest default rates are among students with the lowest debt, not the highest.

But on second glance, this isn’t surprising at all. I’d suggest several good reasons to expect exactly this result:

- The very lowest debt levels are associated with students who drop out after only a year or so. They have the worst of all worlds: only a high school diploma and a low-paying job, but student debt that’s fairly crushing for someone earning a low income.

- The next tier of debt is likely associated with students at for-profit trade schools. These schools are notorious for high dropout rates and weak job prospects even for graduates.

- The middle tier of debt levels is probably associated with graduates of community colleges and state universities. Graduates of these schools, in general, get lower-paying jobs than graduates of Harvard or Cal.

- Conversely, high debt levels are associated with elite universities. Harvard and Cal probably have pretty high proportions of students who earn good incomes after graduation.

- The highest debt levels are associated with advanced degrees. The $50,000+ debt levels probably belong mostly to doctors, lawyers, PhDs, and so forth, who command the highest pay upon graduation.

A commenter suggests yet another reason for high default levels at low levels of debt: it’s an artifact of “students” who are already deep in debt and are just looking for a way out: “The word is out if you have bad credit and are desperate for funds just go to a community college where tuition is low and borrow the maximum….Want the defaults to go down — stop lending to students that have a significant number of remedial courses their 1st and 2nd terms at a college where tuition is already low.”

If you’re likely to complete college, student loans are a good investment. But if you’re right on the cusp, you should think twice. There’s a good chance you’ll just end up dropping out and you’ll end up with a pile of student loans to pay back. If you’re in that position, think hard about attending a community college and keeping student loans to the minimum you can manage.

And try majoring in some field related to health care. Occupations in health care appear to have a pretty bright future.