How should we respond to sustained economic weakness? Brad DeLong has a lengthy post today comparing two approaches. To oversimplify, we have Larry Summers on one side, who believes the answer is higher government spending on infrastructure. On the other side is Olivier Blanchard, the IMF’s chief economist, who thinks the answer is higher inflation.

In a nutshell, the argument for higher inflation is simple. Right now, with interest rates at slightly above zero and inflation running a little less than 2 percent, real interest rates are about -1 percent. But that’s too high. Given the weakness of the economy, the market-clearing real interest rate is probably around -3 percent. If inflation were running at 4-5 percent, that’s what we’d have, and the economy would recover more quickly.

There are two arguments opposed to this. The first is that central banks have demonstrated that 2 percent inflation is sustainable. But what about 5 percent? Maybe not. If central banks are willing to let inflation get that high, markets might conclude that they’ll respond with even higher inflation if political considerations demand it. Inflationary expectations will go up, the central bank will respond, and soon we’ll be in an inflationary spiral, just like the 1970s.

The second argument is the one Summers makes: sustained low interest rates are almost certain to lead to asset bubbles. So even if higher inflation works in the short run, it’s a recipe for disaster in the long run.

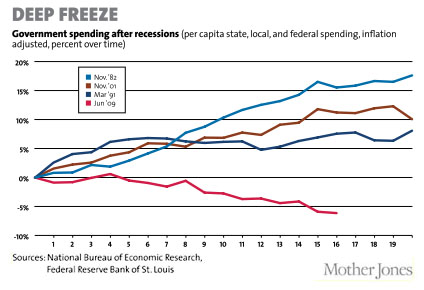

DeLong draws several conclusions from this. He agrees that higher government spending is a good idea—and so do I. The drop in government spending since 2010 has been unprecedented in recent history (see chart below). He’s ambivalent about a higher inflation target, since he agrees that at some level it risks turning into a spiral. (But he’s not sure what that level is.) And finally, he thinks the real demand-side problem is in residential construction, which  has plummeted since the housing bubble burst. This could be addressed with policy changes at the FHFA, which might be a better alternative than higher inflation anyway. I have two observations about all this:

has plummeted since the housing bubble burst. This could be addressed with policy changes at the FHFA, which might be a better alternative than higher inflation anyway. I have two observations about all this:

- Central bankers seem to think that over the past 30 years they’ve demonstrated credibility in restraining inflation, something they’re loath to give up. That’s why they hate the idea of raising their inflation targets above 2 percent. But it strikes me that they may be wrong: what they’ve really done is demonstrate credibility in following the Taylor Rule, which provides a formula-based target for short-term interest rates. But right now, the Taylor Rule suggests that interest rates should be below zero.1 A higher inflation target that’s in service of rigorously following the Taylor Rule might increase the monetary credibility of central banks, not decrease it. (Or, possibly, have no effect at all on their credibility.)

- The Summers view that sustained low interest rates lead to bubbles may be correct. But this is only true if there just flatly aren’t enough good real-world investment opportunities available, which would leave investors with no place to put their money except in risky asset plays. DeLong seems to agree with this. When Ryan Avent asks, “Are we really arguing that there aren’t enough good private investment opportunities in America?” DeLong answers, “Yes. We are.”

DeLong has much more to say about all this, and I’m dangerously oversimplifying here. But I’m doing it to make a point. First, I think central banks have a lot of leeway to pursue higher inflation as long as they’re clear about what they’re doing and can credibly say that they’re merely following the same monetary rules they’ve been following for the past three decades. Second, it’s surprising that we haven’t paid more attention to the suggestion that asset bubbles are the result of a (permanent?) condition in which there simply aren’t enough good private investment opportunities. This deserves way more discussion, not just a footnote in a broader essay. If it’s true, surely this is the economic challenge of our day. No matter what else we do, we’re in big trouble if markets simply don’t believe there are enough factories to expand or new companies to invest in. If investors have essentially given up on the real economy, no amount of fiscal or monetary policy will save us.

So why isn’t this getting more discussion?

1Actually, this depends on which version of the Taylor Rule you use. But let’s leave that for another day. For now, it’s enough to say that there’s a conventional version of the Taylor Rule which says real interest rates should be well below zero.