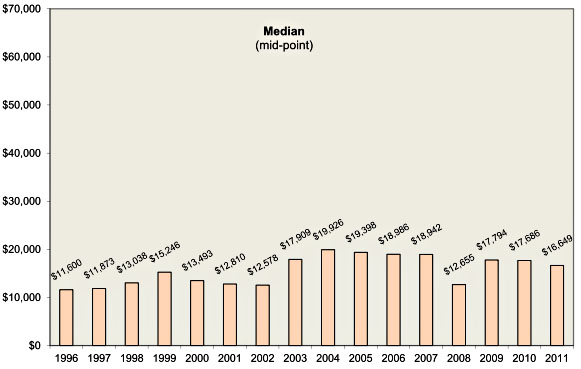

The Great Recession took a big toll on 401(k) retirement plans. The chart below, from the Employee Benefit Research Institute, shows the general volatility of 401(k) accounts: they go up smartly during booms (1996-99, 2002-07) and plummet during busts (2000-02, 2007-08). The average account took a 30 percent hit when the housing bubble burst in 2008.

In general, average 401(k) account balances have grown fairly steadily over the past two decades. But 401(k)s have two big problems. The first is volatility. If you were 55 when the Great Recession hit, you’ve made up most of the losses from 2008 and your account balance is probably close to where it was in the mid-aughts. But if you turned 65 in 2008 and were planning to retire that year, you were screwed.

Second, account balances just aren’t very big. The chart below understates retirement readiness since it shows averages for all workers. The actual median account balance for workers in their sixties is in the neighborhood of $50,000 or so. But even that isn’t much: it provides an annual annuity of only a few thousand dollars. That’s nice to have, but it’s hardly a windfall.

Of course, one other thing to keep in mind is that less than half the population has a pension of any kind, and that’s always been true. Over the past three decades, defined-contribution plans like 401(k)s have grown while defined-benefit plans have mostly disappeared. But over that entire period, less than half of all private sector workers have had either kind of pension. For the rest, the big debate over pensions is strictly academic. They rely almost exclusively on Social Security and always have.

This is just one part of the retirement puzzle, of course. More on the bigger picture tomorrow.