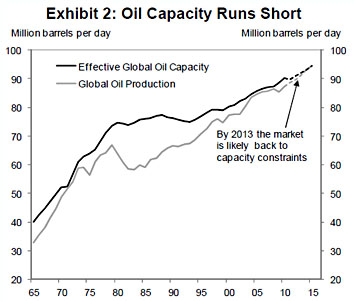

Feeling a little bullish about the economy? Settle down! I don’t know if this forecast is new, or if it’s the same one I wrote about last year, but the oil analysts at Goldman  Sachs think we’re very close to reaching our maximum oil pumping capacity again after a few years of looseness caused by the recession. Via Jared Bernstein, Goldman’s chart is on the right. So what does it mean when oil demand starts to bump up against supply? This:

Sachs think we’re very close to reaching our maximum oil pumping capacity again after a few years of looseness caused by the recession. Via Jared Bernstein, Goldman’s chart is on the right. So what does it mean when oil demand starts to bump up against supply? This:

High prices, as bad as they are for an economy addicted to cheap oil, aren’t the worst prospect facing us. The real problem is spare capacity….Twenty years ago, OPEC had spare production capacity of about 15 million bpd. A decade ago that had dropped to 5.5 million bpd. [Today], spare capacity has dropped almost to zero.

….In other words, it’s likely that we’re now in a permanent state of near zero spare capacity, which in turn will lead to an increasingly unstable world. As we enter an era in which even Saudi Arabia has no spare capacity to smooth out supply disruptions elsewhere in the world, any blip in supply, whether from political unrest, terrorism, or merely unforeseen natural events, will cause prices to carom wildly. A world with $100 per barrel oil is bad enough, but a world in which a single pipeline meltdown could cause prices to skyrocket to $300 per barrel for a few months and then back down is far worse.

More here. This was all written back in 2005, when $100 oil seemed shockingly high. Today it’s the new normal. What’s worse, though, is that when the global economy expands, we hit our maximum pumping capacity and prices start to oscillate quickly upwards. Result: a global recession, which reduces oil consumption a bit. A few years later, we repeat the process. More on that here.

Plus, as Jared points out, we also have Europe to worry about, as well as persistently low labor force participation at home. 2012 may be a good year compared to 2011, but that’s grading on a curve. Thanks to a combination of really hard problems and really stupid politicians, our recovery is likely to remain sluggish for a long time.