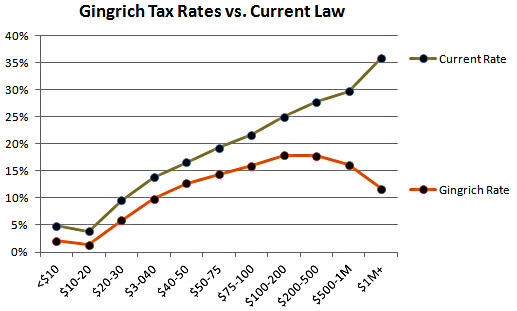

Via Matt Yglesias, I see that the Tax Policy Center has completed a preliminary analysis of Newt Gingrich’s tax plan. You will be entirely non-shocked to learn that it’s pretty much the same as every other Republican tax plan: it offers only modest cuts for poor and middle-class taxpayers but gigantic cuts for the well-off and the rich. In order to make sure that not a single person would even theoretically pay higher taxes under his plan, Newt uses the dodge pioneered by Rick Perry that allows taxpayers to choose between the current tax code and the Gingrich plan. However, he goes Perry one better by being even more brazenly pro-millionaire with an effective rate of 11.2% for anyone earning more than a million dollars per year.1 Take that, cowboy!

According to TPC, the Gingrich plan would lower federal tax revenue by $1.28 trillion in 2015 compared with current law, roughly a 35 percent cut in total projected revenue. I assume that Gingrich’s plan to make up for this loss involves some handwaving about economic growth, but I don’t have the energy to try and find the official explanation.

1The “current rate” numbers are based on the assumption that the Bush tax cuts expire as scheduled. They look a little different if you assume that the Bush cuts are extended. But as I said about the Perry Plan, why would anyone bother to extend the Bush tax cuts if you’re going to pass a shiny new plan that just replaces the current code anyway?