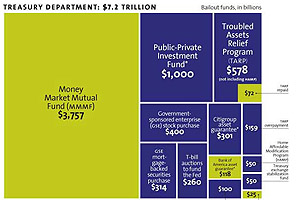

Now that Bloomberg has peeled another layer off the Federal Reserve onion, we know a bit more about just how much money they spent rescuing the banking system in 2008. Matt Yglesias sums up his reaction, and I think he gets it exactly right:

NOT SCANDALOUS—Lending vast sums in a banking panic.

DUBIOUS—These weren’t penalty rates.

DEFENSIBLE—Erring on the side of activism.

THE REAL SCANDAL—Abandoning activism for the rest of us: If I had fully understood what the Fed was doing in the fall of 2008 and the winter of 2008-2009, the truth is that I would have defended it all…The real scandal has only emerged with clarity in the subsequent years. Having ensured the basic stability of the banking system, monetary policymakers in America proceeded to forget all about their go-getter attitude and ability to reach deep into the practical and legal toolkit in order to get what they want. We’re heading into the winter of 2011, with three years of mass unemployment under our belt and no end in sight. That’s not happening because the Fed was too generous with the free money for banks at the height of the crisis. It’s because once the acute phase of the banking crisis ended, suddenly we returned to small thinking and small-c conservatism. But it can’t be both. If in a time of crisis, the right thing to do is

to get “crazy” then there’s plenty more crazy stuff the Fed could be doing to boost overall spending in the American economy. Or if the right thing to do is to stay orthodox and ignore the human consequences, then there was no reason not to stay orthodox three years ago and refuse to lend at anything other than a penalty rate.

Yes, we aimed a big bazooka full of money at the banksters in 2008. That’s galling, and there’s a good case to be made that we should have done it differently. Maybe more executives should have been fired, maybe the Department of Justice should have tossed more Wall Street traders in jail, and maybe a couple of big money center banks should have been placed in temporary receivership. But even conceding all that, the Fed and Congress (kicking and screaming, but eventually doing the right thing) saved the banking system, and that had to be done. There’s a certain amount of unfairness that’s inherent in any banking rescue, and I can live with that when the alternative is a second Great Depression.

But hoo boy, what a contrast with how the rest of us were treated. Things like principal write-downs, second waves of stimulus, aid to states, and mortgage cramdown all got a bit of idle chatter but were then left to die. For some reason, it would have been unfair to hand out money to profligate homeowners, state and local workers, and the millions who have been unemployed for more than a year.

And yes, in some cosmic sense, perhaps it would have been unfair. Massive financial crashes always produce some inherent unfairness. For some reason, though, we were willing to overlook that unfairness when it was Wall Street that came begging but became obsessed with it when all the rest of us came begging.

This is how 2008 radicalized me. It’s one thing to know that the rich and powerful basically control things. That’s the nature of being rich and powerful, after all. But in 2008 and the years since, they’ve really rubbed our noses in it. It’s frankly hard to think of America as much of a true democracy these days.

Front page image: Jacob Anikulapo/Flickr