I think Christina Romer is pulling a fast one in her op-ed defending President Obama’s jobs plan. She takes on several arguments against his proposal, and this is one of them:

WE NEED A HOUSING PLAN, NOT MORE FISCAL STIMULUS The bubble and bust in house prices has left households burdened with too much debt. Until we deal with this problem — perhaps by providing principal relief to the 11 million households whose mortgages are larger than the current value of their homes — we’ll never get the economy going.

The premise of this argument is probably true….[But] recent research shows that government spending on infrastructure or other investments raises demand even in an economy beset by over-indebted consumers….In the recovery from the Great Depression, economic growth, which raised incomes and asset prices, played a big role in lowering debt burdens. I strongly suspect that fiscal stimulus will be more cost effective at speeding deleveraging and recovery than government-paid policies aimed directly at reducing debt.

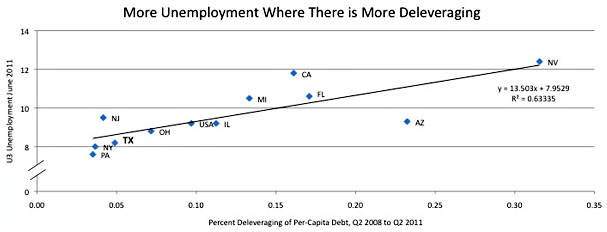

Hmmm. Romer seems to be attacking a straw man. No one — at least no one arguing that we need a better housing plan — is claiming that fiscal stimulus won’t spur economic growth, or that economic growth won’t lower debt burdens. Of course they will! The argument is that fiscal stimulus isn’t enough by itself, or, alternately, that it might not give us the biggest bang for our buck. Among state economies, there’s a very strong correlation between deleveraging and unemployment, which suggests pretty strongly that programs aimed at targeting underwater mortgages would be extremely helpful.

But Romer’s only real response is that she “strongly suspects” that fiscal stimulus is the best way of addressing this. As it happens, I’m willing to give a “strongly suspects” from Christina Romer a lot of weight. Still, the role of housing in driving the recession and its continuing role in keeping demand depressed is pretty clear cut, and this suggests that any effective jobs plan should include both fiscal stimulus and an aggressive mortgage forgiveness program. It’s possible (likely, in fact) that an aggressive housing plan is politically infeasible, but still, from an economist I’d like to hear an economic argument either for or against. I don’t think we have one here.