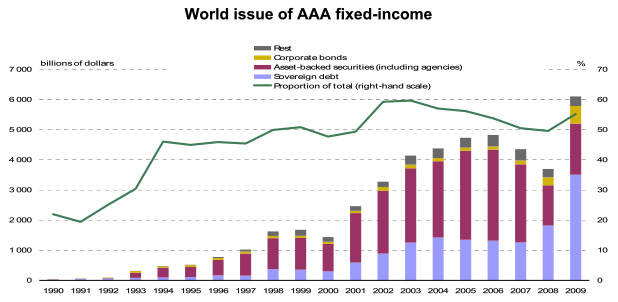

Felix Salmon posts this chart from a recent Basel report and repeats the familiar observation that “it wasn’t an excess of greed and speculation which led to the financial crisis, but rather an excess of overcaution, with an attendant surge in demand for triple-A-rated bonds.” True enough: everyone wanted super safe investments, so Wall Street cranked out boatloads of allegedly super safe investments. As the Basel report states, “Between 1990 and 2006, the year in which the series of ABS issues peaked, assets with the highest credit rating rose from a little over 20 per cent of total rated fixed-income issues to almost 55 per cent.” (That’s the heavy green line in the chart.)

But I think this misses the point a bit. The problem is that the Basel report cherry-picks its timeframe. Try this instead: “Between 1994 and 2006, assets with the highest credit rating rose from about 47 per cent of total rated fixed-income issues to almost 55 per cent.” That doesn’t seem quite so scary. But surely that’s a better timeframe to use since global issuance of fixed income securities was pretty negligible before that.

What is scary in this chart is the huge growth of debt in general over the past two decades, and in particular the boom in ABS debt during the aughts, which tripled between 2000 and 2006. These are the CDOs and structured products that fueled the housing boom, and there’s not much question that most of them should never have been allowed to join the AAA hit parade. They’re largely gone now, but unfortunately, Felix points out what’s next:

Finally, look at the way that the maroon bars — structured products, basically — have given way to a scarily large purple bar at the far right of the chart. That’s sovereign debt, and it tells you all you need to know about where the next crisis is likely to come from.

The share of debt rated AAA may be only modestly higher now than it was in the late 90s, but it still strains credibility to believe that half the debt in the world is truly AAA — i.e., essentially completely free of credit risk. The world just isn’t that safe a place.