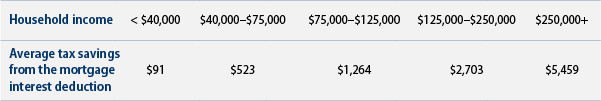

Seth Hanlon says that the home mortgage deduction is more valuable for high earners than for low earners. Here’s the data:

This seems to suggest that eliminating the mortgage interest deduction would raise effective marginal rates more on rich people than on middle earners, so it would be a progressive thing to do. But I have a couple of questions about this:

- Above the $40,000 line, the mortgage interest deduction seems to amount to about 1% of income for everyone. But a tax increase of one percentage point is a bigger deal for a median earner than it is for a high earner. So it’s not clear just how progressive it would be to get rid of this deduction.

- This data is solely for owner-occupied housing. But renters benefit too, since landlords can deduct mortgage interest just like homeowners. This reduces their average costs and therefore (on average) reduces rent levels. You need to account for this to see how much benefit there is for workers who earn less than $40,000.

I’m probably in favor of phasing out the mortgage interest deduction regardless since I think we’re well past the time when the federal government has any legitimate interest in spurring homeownership. Still, I’m not sure it would be all that progressive a move.