Yesterday I pondered the question of why most Americans, who aren’t rich themselves, are generally unsympathetic to increased taxes on the rich. Today, Robert Waldmann takes me to the woodshed:

The answer is that Americans are sympathetic to higher taxes on the rich, as has been demonstrated by every poll on the question in the past two decades….Kevin Drum and Felix Salmon ignore not only massive evidence but also my many posts pointing to that massive evidence. My feelings are hurt. Not to boast, but just to boast, I have actually corresponded by e-mail with Drum and by some kind of instant messenger with Salmon.

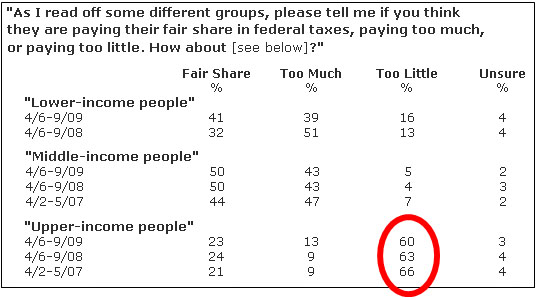

Italics mine. In my defense, I thought about mentioning this in my post yesterday. But then, for some reason, I didn’t. I’m not sure why, to tell the truth. In any case, here is Robert’s most frequently cited evidence from Gallup:

I’ve condensed the full report, but basically it shows that large majorities have felt that upper-income taxes are too low since at least 1992 — though that majority has dropped considerably during that time (from 77% in 1992 to 60% in 2009). It’s also worth noting that essentially nobody thinks that they, personally, are paying too little federal income tax.

Still, there you have it. Soaking the rich isn’t the electoral loser I made it out to be. So then the question becomes: why is Congress unable to reform the estate tax, which affects only the very tippy top of the super rich? Why are negotiations over the carried interest loophole, which affects only zillionaire hedge fund managers, retreating from 100% repeal to 75% repeal to 65% repeal? The answer, of course, lies primarily in the ideology of the Republican Party, aided and abetted by the ideology of “centrist” Democrats, which is strong enough to overcome public sentiment.

So then, how about this question instead: Americans apparently are sympathetic to higher taxes on the rich, but equally apparently, they don’t really care very much about it. They don’t care enough, anyway, to sway their elected representatives much. How come?