The Financial Times got a look at a draft study from the International Energy Agency today and reports that “The world economy spends more than $550bn in energy subsidies a year, about 75 per cent more than previously thought.” Matt Yglesias comments on the notion that removing these subsidies would move us closer to a free market in energy:

The last point really is telling and important here. I can’t think of a single significant “free market” institution in America that spends nearly as much time and energy on this set of market distortions than they do bashing enviornmentalist proposals. Operationally, conservatism in the United States just isn’t about small government or free markets.

That’s true enough. However, the FT piece also includes this line:

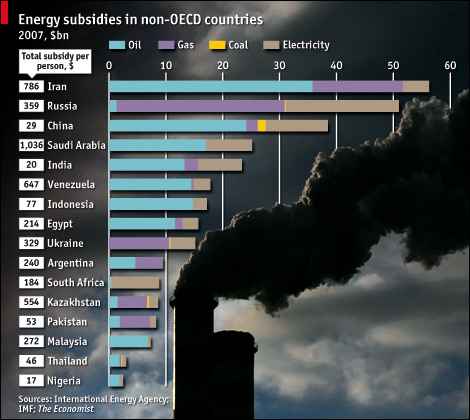

Iran, Russia, Saudi Arabia, India and China top the ranking, according to the report.

It turns out the IEA study is about developing economies. There aren’t any details about what’s in the report, but it looks like they’re mostly tallying consumer subsidies for things like heating oil and gasoline, not corporate  welfare for Exxon Mobil. It doesn’t really have much to do with the United States, and it’s not really surprising that American think tanks spend more time on American legislation (which they can influence) than on petrol subsidies in Iran (which they can’t).

welfare for Exxon Mobil. It doesn’t really have much to do with the United States, and it’s not really surprising that American think tanks spend more time on American legislation (which they can influence) than on petrol subsidies in Iran (which they can’t).

That said, there are plenty of examples of corporate welfare for energy production in the United States, one of which has been in the news quite a bit lately: the statutory $75 million limit on liability for oil spills. This creates a significant distortion in the free market for energy, but it hasn’t exactly lit the conservative world on fire. Over at the Heritage Foundation, for example, the best Nicolas Loris could say a couple of weeks ago was that raising or eliminating the cap “is a matter needing careful thought.” Indeed.

This is especially noteworthy in light of today’s news that climate legislation is likely to be watered down into mere energy legislation. The whole idea behind a comprehensive climate bill is that it provides some scope for political dealmaking: enviros get their cap-and-trade plan while a few conservatives hold their noses and vote for it because they get some goodies in return (nuclear power, offshore drilling, etc.). Market-distorting subsidies are, generally speaking, the price for conservative support on any bill, and now it’s starting to look like they’re going to get more of them without really paying any price at all. Hooray for free market capitalism!