Tonight we have good news and bad news on the bank front. The bad news is that big banks are still playing games with their reported leverage levels. In fact, as the Wall Street Journal reports, the gameplaying is getting worse:

Tonight we have good news and bad news on the bank front. The bad news is that big banks are still playing games with their reported leverage levels. In fact, as the Wall Street Journal reports, the gameplaying is getting worse:

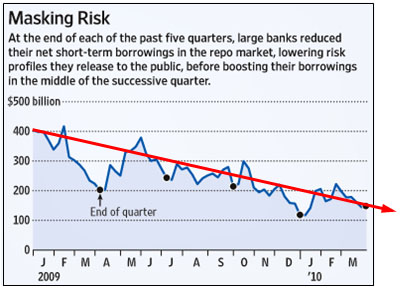

Major banks have masked their risk levels in the past five quarters by temporarily lowering their debt just before reporting it to the public, according to data from the Federal Reserve Bank of New York.

A group of 18 banks — which includes Goldman Sachs Group Inc., Morgan Stanley, J.P. Morgan Chase & Co., Bank of America Corp. and Citigroup Inc. — understated the debt levels used to fund securities trades by lowering them an average of 42% at the end of each of the past five quarterly periods, the data show.

….”You want your leverage to look better at quarter-end than it actually was during the quarter, to suggest that you’re taking less risk,” says William Tanona, a former Goldman analyst who now heads U.S. financials research at Collins Stewart, a U.K. investment bank.

And the good news? The absolute level of short-term borrowing is going down over time. This might just be an artifact of the current low-interest-rate environment and the general deleveraging of the financial sector following the 2008 crash, but it’s welcome regardless.