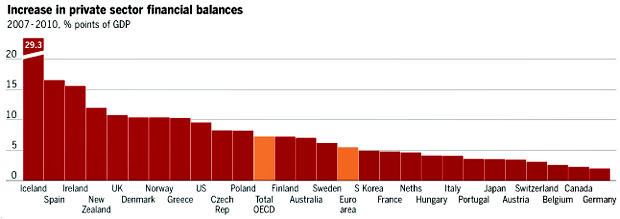

Paul Krugman says that Martin Wolf is depressing reading today. I should say so. First, he recapitulates the basics: a huge credit bubble has produced way too much debt in the world’s rich countries, which means that private actors are busily deleveraging as fast as they can. That is, they’re spending a lot less than they make and saving the excess. So now what?

We can identify two alternatives: success and failure.

By “success”, I mean reignition of the credit engine in high-income deficit countries. So private sector spending surges anew, fiscal deficits shrink and the economy appears to being going back to normal, at last. By “failure” I mean that the deleveraging continues, private spending fails to pick up with any real vigour and fiscal deficits remain far bigger, for far longer, than almost anybody now dares to imagine. This would be post-bubble Japan on a far wider scale.

Unhappily, the result of what I call success would probably be a still bigger financial crisis in future, while the results of what I call failure would be that the fiscal rope would run out, even though reaching the end might take longer than worrywarts fear.

….I can envisage two ways by which the world might grow out of its debt overhangs without such a collapse: a surge in private and public investment in the deficit [i.e., rich] countries or a surge in demand from the emerging countries. Under the former, higher future income would make today’s borrowing sustainable. Under the latter, the savings generated by the deleveraging private sectors of deficit countries would flow naturally into increased investment in emerging countries.

As Wolf points out, though, nobody is seriously interested in either of these two solutions. The first requires continued high federal deficits combined with a surge in private investment. The second requires huge capital flows into emerging countries to spur investment and consumption there. Both of these are political poison.

So what’s the bright side? That Wolf is wrong, I suppose. Like Krugman, though, I suspect that at most he’s a little pessimistic. The next few years aren’t going to be pretty, and the political will in the United States to tackle real problems of this magnitude just isn’t there. Democrats are too scared, Republicans care only about the electoral blood they smell in the water, and the public just wants to lash out at whoever caused this. Meanwhile, Wall Street is rocking along as if nothing had ever happened. This, not the loss of the public option or a minor compromise on the excise tax, is the real price we’re paying for a broken political system.