Ventura County Fire Department/ZUMA

This story was originally published by Slate and is reproduced here as part of the Climate Desk collaboration.

If you’re one of the millions of Americans worried about your pocketbooks and the general cost of living, you might have picked up on some good news recently: Inflation has really been cooling off this summer, as long-sticky (and long-lamented) food and energy prices continue to moderate. Some economic indicators remain stubborn, however—and they aren’t likely to abate anytime in the near future, no matter how long the Federal Reserve keeps interest rates high, what tweaks President Joe Biden makes to his trade policy, whether corporations decide themselves to slash prices on certain products, and whether COVID-battered supply chains finally get some long-needed fixes.

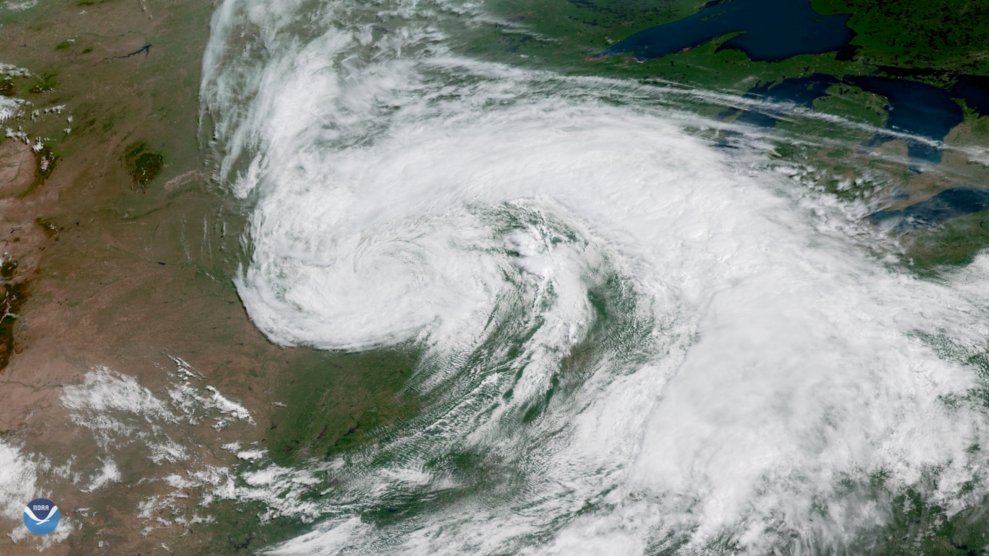

Other, grimmer recent headlines help to explain why. Hard rains from a tropical disruption in the Gulf have been battering Florida’s southern regions for days, leading to a rare flash-flood emergency. Another batch of storms is swirling near Texas at the moment and could form into a tropical depression, according to forecasts from the National Hurricane Center. Even if both states end up missing bigger storms now, it’s likely only a matter of time before they’re threatened again: The National Oceanic and Atmospheric Administration predicts that the United States will see its worst hurricane season in decades this summer.

Meanwhile, the heat waves that have enveloped Phoenix are intensifying to the point that some analysts are deeming its latest conditions “a Hurricane Katrina of heat.” Spanning outward, the Midwest and Northeast are projected to get their own extreme heat warnings as early as next week, with energy demand set to skyrocket as people turn on their air conditioners. The country has already seen 11 “billion-dollar disasters” this year, including the tornadoes that slammed Iowa just weeks ago. Meanwhile, the already strapped FEMA faces a budgetary crisis, and sales of catastrophe bonds are at an all-time high.

Now, let’s look back at the inflation readings. One of the categories remaining stubbornly high while other indicators shrink? Shelter and housing, natch, as rents and insurance stay hot—and still-elevated interest rates make construction and mortgage costs even more prohibitive. On the energy front, motor fuel may be cheapening, but fuel and electricity for home use are still pricey. Auto insurance remains a driving outlier, as I noted back in April, not least because of insurers hiking premiums for cars in especially disaster-vulnerable regions—like the South, the Southwest, and the coasts.

Look at what else is happening in those very regions when it comes to home insurance: Providers are either retreating from or dramatically heightening their prices in states like California, Texas, Florida, and New Jersey, thanks to their unique susceptibility to climate change. These states have seen supercharged extreme weather events like floods, rain bombs, heat waves, and droughts. National lawmakers fear that the insurance crises there may ultimately wreak havoc on the broader real estate sector—but that’s not the only worst-case scenario they have to worry about.

Agricultural yields for important commodities produced in those states (fruits, nuts, corn, sugar, veggies, wheat) are withering, thanks to punishing heat and soil-nutrition depletion. The supply chains through which these products usually travel are thrown off course at varying points, by storms that disrupt land and sea transportation. Preparation for these varying externalities requires supply-chain middlemen and product sellers to anticipate consequential cost increases down the line—and implement them sooner than later, in order to cover their margins.

You may have noticed some clear standouts among the contributors to May’s inflation: juices and frozen drinks (19.5 percent), along with sugar and related substitutes (6.4 percent). It’s probably not a coincidence that Florida, a significant producer of both oranges and sugar, has seen extensive damage to those exports thanks to extreme weather patterns caused by climate change as well as invasive crop diseases. Economists expect that orange juice prices will stay elevated during this hot, rainy summer.

(Incidentally, climate effects may also be influencing the current trajectory and spread of bird flu across American livestock—and you already know what that means for meat and milk prices.)

It goes beyond groceries, though. It applies to every basic building block of modern life: labor, immigration, travel, and materials for homebuilding, transportation, power generation, and necessary appliances. Climate effects have been disrupting and raising the prices of timber, copper, and rubber; even chocolate prices were skyrocketing not long ago, thanks to climate change impacts on African cocoa bean crops. The outdoor workers supplying such necessities are experiencing adverse health impacts from the brutal weather, and the recent record-breaking influxes of migrants from vulnerable countries—which, overall, have been good for the U.S. economy—are in part a response to climate damages in their home nations.

The climate price hikes show up in other ways as well. There’s a lot of housing near the coasts, in the Gulf regions and Northeast specifically; Americans love their beaches and their big houses. Turns out, even with generous (very generous) monetary backstops from the federal government, it’s expensive to build such elaborate manors and keep having to rebuild them when increasingly intense and frequent storms hit—which is why private insurers don’t want to keep having to deal with that anymore, and the costs are handed off to taxpayers.

When all the economic indicators that take highest priority in Americans’ heads are in such volatile motion thanks to climate change, it may be time to reconsider how traditional economics work and how we perceive their effects. It’s no longer a time when extreme weather was rarer and more predictable; its force and reasoning aren’t beyond our capacity to aptly monitor, but they’re certainly more difficult to track. You can’t stretch out the easiest economic model to fix that. And you can’t keep ignoring the clear links between our current weather hellscape, climate change, and our everyday goods.

Thankfully, some actors are finally, belatedly taking a new approach. The reinsurance company Swiss Re has acknowledged that its industry fails to aptly factor disaster and climate risks into its calculations, and is working to overhaul its equations. Advances in artificial intelligence, energy-intensive though they may be, are helping to improve extreme-weather predictions and risk forecasts. At the state level, insurers are pushing back against local policies that bafflingly forbid them from pricing climate risks into their models, and Florida has new legislation requiring more transparency in the housing market around regional flooding histories. New York legislators are attempting to ban insurers from backstopping the very fossil-fuel industry that’s contributed to so much of their ongoing crisis.

After all, we’re no longer in a world where climate change affects the economy, or where voters prioritizing economic or inflationary concerns are responding to something distinct from climate change—we’re in a world where climate change is the economy.