Julie Bennett/AP

This story was originally published by Grist and is reproduced here as part of the Climate Desk collaboration.

When cities need to raise money for roads and water lines, they have a few options. They can raise taxes, for instance, or charge fees for city services. If that isn’t enough, though, they can also issue bonds, borrowing on a $4 trillion credit market to pay for new construction projects they can’t afford otherwise. These municipal bonds function like loans that banks and investors make to local governments, and they’re an essential tool for filling out city budgets.

“This is how your sewage gets funded, this is how your water gets funded, this is how public schools and public services are funded,” said Matthew Wynter, a research professor of finance at Stony Brook University.

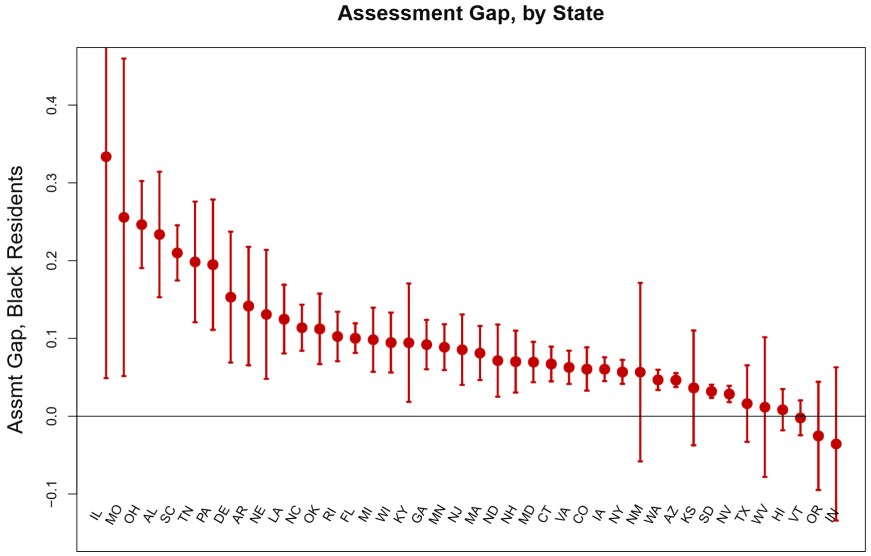

But a growing body of research shows that this credit market is also helping perpetuate systemic racism. When Black towns and cities try to borrow money on the bond market, they pay higher interest rates than their white counterparts. A paper published last week in the science journal PLOS One finds that this “Black tax” amounts to as much as $900 million per year in the United States. These higher borrowing costs can prevent these towns from pursuing much-needed infrastructure upgrades, or push them toward default and bankruptcy if they fall behind on interest payments.

While racial bias is accounted for in the municipal markets, climate change isn’t, according to the new research.

Erika Smull, lead author of the paper and a research analyst at Breckinridge, an investment management company, said that both the racial bias she found and climate change represents, “two huge systemic risks to not just the [municipal] market, but kind of everything about the United States.”

The inequality in the bond market perpetuates a cycle of debt and disinvestment in Black communities, but it also has huge implications for environmental justice and climate resilience. If local leaders can’t raise money to protect water lines and prepare for floods, their constituents will end up reliant on decaying and vulnerable public infrastructure.

“Race should certainly not affect the pricing of municipal bonds,” Smull told Grist.

A growing body of research published in recent years has illuminated the role that municipal bonds have played in deepening racial inequality. Destin Jenkins, a historian of capitalism at Stanford University, has written that segregated white suburbs benefited from high credit ratings which entrenched municipal wealth in the period after World War II. Conversely, he argues, investors punished Black towns for their shoddy infrastructure and lack of access to capital.

When bond rating agencies like Moody’s assessed the creditworthiness of cities, they would penalize Black towns for racial inequality that persisted from slavery. “Bond rating analysts participated” in the process of segregation, Jenkins writes, “by insisting that their ratings were reflections of objective economic conditions.”

Even towns with a low percentage of Black residents suffered from what one political scientist called the “black tax”, wherein areas with a higher percentage of Black residents are unfairly penalized for nothing else but their demographics.

Wynter, along with two colleagues, Ashleigh Eldemire and Kimberly F. Luchtenberg, co-authored a paper that delved into the issue of municipal bonds and racial discrimination. They found that even after controlling for all other variables, municipalities that were more racially diverse were offered municipal bonds with higher bond insurance rates and a lower credit rating, which led to higher interest rates and put the cities in a worse financial position.

“It’s much harder for municipalities that are racially diverse, to raise funding or to raise capital, especially when it’s expected that minorities might be the beneficiaries of those services,” said Wynter. “So we know that racial discrimination can affect the way that a municipality is able to access the credit market.”

One important point Wynter spoke to when discussing why racial discrimination persists in a relatively mundane part of the financial markets was geography. Because in-state bond investments are exempt from both state and federal taxes, many investors have pre-existing prejudices against communities of color within their own state’s bond market.

“The counties, the cities, and counties, and municipalities with high percentages of Black residents pay more, even though there’s nothing to really kind of show that they are riskier,” said Wynter.

Smull also emphasized the role of implicit bias that people working to issue and rate bonds have could play a role in disparities between the types of municipal bonds offered to white and Black cities and towns.

“They’re unaware that they hold that bias,” said Smull “And they just associate a city that is predominantly Black with images that have been curated in their mind over time.”

Most of these images, said Smull, are the types of negative stereotypes that have been persistent in the American imagination. This includes the idea that it might be a risk to invest in a town with a higher percentage of Black residents, this is despite the fact that the credit risk might be the same for a white and Black town but their rating could be lower.

David Dubrow, an attorney with Arent Fox Schiff and an expert on municipal finance, says this racial inequality on the bond market can trap Black cities in a cycle of disinvestment.

“What we’re talking about is a reinforcing cycle of penalizing poor communities that are already poor,” he told Grist. “The impact on the community is higher taxes and less money for social services, because [the city is] spending more on paying interest on borrowing money.”

The difference of a few percentage points in the interest rate of a bond can add up over the course of decades, placing a huge financial burden on cities. In a recent article, Dubrow’s firm estimated that because Milwaukee has a lower credit rating than other cities of its size, the city would pay an extra $477 million to borrow money on a 30-year bond. More than 40 percent of Milwaukee’s residents are Black.

Catherine Coleman Flowers is familiar with the lack of services that can follow decades of divestment and lack of access to resources. Flowers, who authored the book Waste: One Woman’s Fight Against America’s Dirty Secret, has spent a lot of her time working on sewage access in rural parts of Alabama, specifically in Lowndes County where for decades residents were unable to access sewage and often had to rely on “straight pipes” from their homes to dispel sewage, often only a few yards away from the entrance to those homes. Sewage and waste disposal is one of the main services that municipalities can provide but without adequate access to funding, they cannot maintain the upkeep needed to continue to provide basic services, or in some cases provide them in the first place.

Flowers, who has helped raise awareness of substandard waste and sewage services, says that these problems arise when cities lack the resources to invest in new infrastructure. The racial tilt of the municipal bond market is a key factor that contributes to this lack of resources.

“A lot of the poor communities remain poor because the formula is written in such a way that it doesn’t allow them to even get in the game,” said Flowers.

In many cases, when they can’t raise taxes or garner more money through bonds, cities are forced to resort to harsh and punitive measures to maintain their revenue and avoid default. The city government of Baltimore, for example, has imposed strict punishments on water customers in order to maintain revenue for the municipal water system. According to one estimate, the city shut off water deliveries to 42,000 customers in 2016 alone.

In the worst cases, a downward financial spiral can push cities toward bankruptcy. Earlier this year, for instance, the water utility for the city of Prichard, Alabama descended into crisis. The Prichard Water and Sewer Board provides drinking and sewer water to about 20,000 people in a predominantly Black suburb of Mobile, but the utility had long been facing financial headwinds. Thanks to leaks and holes in decades-old service lines, the utility loses more than half of all the water it purchases, which has left it unable to make ends meet.

Prichard’s median household income is less than half of the national average, and the board couldn’t raise rates on already struggling customers. Instead, it patched the financial hole by issuing a $55 million municipal bond to a bank called Synovus Bank, borrowing money to pay for infrastructure upgrades, but in December and January, the board missed two payments on the bond. One board member warned that the utility could default. A few months later, in June, Synovus sued the board and demanded it resume payments, accusing the utility of financial mismanagement.

Many local officials in Black towns and cities are wary of ending up in a situation like the Prichard water board, and they avoid the bond market out of a concern that they’ll end up with debt they can’t sustain.

“I would say that debt service is an issue, because once you have that debt on your books, you know, you’ve got to pay it,” said Darryl Greene, the treasurer for the city of Inkster, Michigan, a suburb of Detroit. “If you don’t have the necessary revenue stream to cover all of your major expenses in addition to covering the debt, you’re going to struggle.”

Inkster has a population of about 25,000, and about 67 percent of residents are Black. A decade ago, in the aftermath of the Great Recession, the state of Michigan declared that the city was experiencing “severe financial stress” in the face of declining revenue, but its budget has recovered somewhat since then.

Greene says the city has had success using bonds for small construction projects, but he believes that increasing tax revenue is a more sustainable way for the city to grow than tapping the bond market. A neighboring city called Highland Park, also majority Black, has been teetering on the brink of bankruptcy for most of this year as it struggles to keep up with rising water costs and payments to bondholders.

Flowers says that climate change will compound the impacts of discrimination in the municipal bond market. As worsening droughts and floods cause more damage to roads, water pipes, and sewer systems, towns will need even more money to maintain public services. If Black cities and towns can’t access the capital they need on the bond market, their infrastructure will decay even further.

“It limits their ability to cope with climate change because they don’t have the resources,” said Flowers. “You have to have the resources to build resilience, and you have to have the resources to build the type of storm drainage systems that will allow communities not to flood each and every time.”

Sondra Collins, a senior economist at the University Research Center for the State of Mississippi, said that given the persistence of racial discrimination in the municipal bond market, the best thing to achieve equity is to rethink the system as a whole. Dubrow’s firm has suggested that Congress could offer more direct grants for infrastructure improvements, or that the U.S. Treasury could backstop local bonds, which might assuage investor fears of default.

“I think it’s gonna take an overhaul,” said Collins. “You have to have a bunch of different people at the table with different experiences, different backgrounds. You’ve got to help think through all the options, all the ways that a rule might unintentionally hurt some groups.”