<a href="http://www.shutterstock.com/pic-87322042/stock-photo-cayman-brac-quiet.html?src=csl_recent_image-1">lweissman</a>/Shutterstock

Offshore tax havens—like the ones Mitt Romney has relied on—screw the federal treasury out of some $150 billion a year, but as Congress and the president haggle over where to scrimp and save, there’s been nary a mention of this potential deficit-busting gold mine. Today, the consumer group USPIRG released a report detailing what we could do with all that cash.

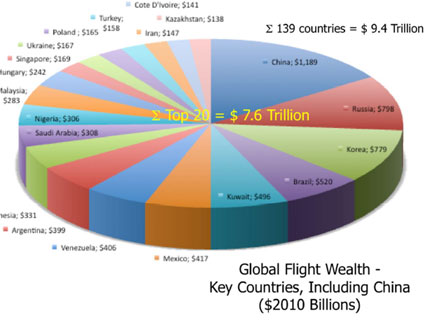

At least 83 of the top 100 publicly traded corporations in America shield large chunks of their income from taxes by keeping it overseas, according to the Government Accountability Office. In fact, according to the USPIRG report, 30 of the nation’s biggest, richest companies actually profited off the tax code between 2008 and 2010, by avoiding taxes and getting tax refunds from the government. USPIRG notes that one of the techniques Google used to save $3.1 billion over that time period is called “double Irish,” and involves two Irish subsidiaries and one in the tax haven Bermuda.

Minus all that revenue, Congress is looking to American taxpayers to pick up the deficit tab by raising Medicare co-payments and cutting food stamps and such.

Sen. Carl Levin (D-Mich.), chairman of the Senate Permanent Subcommittee on Investigations, weighed in on the report, saying, “Closing corporate tax loopholes should be part of the conversation about how to avoid the fiscal cliff… Congress has to choose whether it will protect offshore corporate loopholes that enable many multinationals to pay little or no tax, or close them to address our deficit problem and to fund national defense, education, health care, and other critical needs.”

The $150 billion could either wipe out the fiscal cliff spending cuts for 2013, according to the report, or generate over a third of the debt reduction goal of $4 trillion over 10 years. Here are some of the other fun things the report says $150 billion could buy us:

Job creation: Loan guarantees for half a million small businesses.

Student aid: Pell grants for 10 million students every year for four years.

Green energy: Thirty years of tax incentives for the production of renewable energy production.

21st century transpo: The construction of 15 commuter rail lines, 50 light rail transit lines, and over 800 bus rapid transit lines.

Healthcare: Three times the current funding for domestic violence and sexual abuse programs over 50 years.