Atrios says that 401(k) retirement plans have been a disaster:

The current system has failed, and the exciting plan to “fix” the failed system is run the same experiment, with minor tweaks, over for another 40 years and see how that works. Of course if you just grab your trusty envelope back and do The Math, the pittance people will save in these exciting new plans will be just that, a pittance.

This is a common view on the left, usually delivered with no evidence because it’s considered so obvious that no evidence is needed. On the occasions when there is evidence, it’s usually something about the stock market being in bad shape circa 2010.

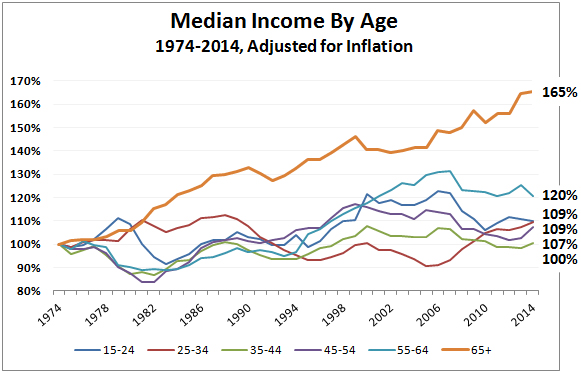

So let’s take a look at the evidence. I’ve put all of this up before, but not in one place. So let’s collect it. Here’s chart #1:

Retirement-age folks have done better than any other age group since 1974, and way better since 2000. So far so good. Here’s chart #2:

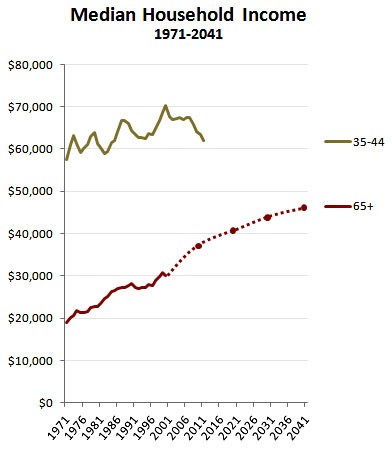

This is Social Security’s projection of median elderly income over the next 25 years. It looks pretty good too. There’s no evident crisis in these numbers. And this is not from some think tank with an axe to grind. It’s from the Social Security Administration’s MINT projection, which is probably the most comprehensive look we have at all sources of income among retired folks. Here’s chart #3:

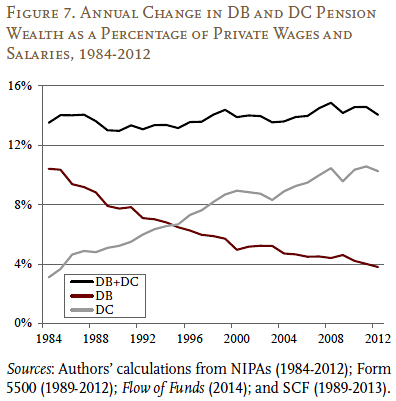

This comes from the Center for Retirement Research, a decidedly liberal outfit. They’ve been a longtime proponent of the view that 401(k) plans are worse than old-style defined benefit pensions, but last year they revisited this question using better data. What they found is that for the past 30 years, pension wealth has stayed steady even as 401(k) plans have become more popular and DB plans have gone the way of the dodo (except in the public sector, where they’re still common). In other words 401(k)s aren’t a failure.

My final bit of data, sadly, doesn’t lend itself to chart format, so we shall have to use words instead. In 2006, Congress passed the Pension Protection Act, something that most critics of 401(k) plans seem to ignore—or perhaps are blissfully unaware of. In the past 10 years, it’s accomplished the following:

- Allowed companies to automatically enroll workers (subject to an opt-out), thus increasing the number of people with 401(k)s.

- Made 401(k)s more accessible to small businesses.

- Increased 401(k) participation considerably among young workers and low-income workers, who need them the most.

- Encouraged the use of lifecycle funds, the best type for retirement plans.

Put all these things together, and there’s very little evidence for any kind of broad retirement crisis. Retirement readiness in America seems to be about the same as it’s always been.

Does that mean everything is hunky-dory? Of course not. 401(k) fees are still too high, something that I’d dearly love to see Hillary Clinton address with new federal regulation. It’s probably also true that old-style pensions were a little more generous for low-income workers than 401(k)s, though the evidence on this score is fuzzy. What’s more, although retirement readiness is no worse than it’s been in the past, it’s not really any better either. In particular, folks at the bottom of the income ladder still don’t participate much in 401(k) programs and rely entirely on Social Security, which is pretty stingy for low earners.

My answer to this is Kevin’s One-Third-One-Third plan. That is, Social Security payments for the bottom third should be increased by a third. This would make a huge difference to the lowest-income workers, but at a pretty reasonable price. My back-of-the-envelope chicken scratchings suggest it would cost about $20-30 billion. That’s politically within reason.

There’s one other change I’d like to see, but I’ll leave that for another time. In a nutshell, there really doesn’t appear to be any kind of broad-based retirement crisis. 401(k) plans have performed decently and are likely to perform even better in the future. Our biggest retirement problem is with the lowest-income workers, and that could be fixed at a pretty modest cost if we could only muster the political will to do it.

UPDATE: I really wanted my plan to be called “One-Third-One-Third-One-Third,” but I couldn’t think of a third “One-Third.” However, @Noman suggested raising the Social Security earnings cap to pay for my plan, and it turns out that an increase in the cap of one-third would raise roughly $30 billion. Isn’t it great when a plan comes together?

So now it’s the One-Third-One-Third-One-Third plan: payments to the bottom third should be boosted one-third by raising the earnings cap one-third. Take that, Herman Cain.